-

Q2 2023 Performance: The company missed market expectations for earnings per share (EPS) on both a normalized and GAAP basis by -$0.15.

-

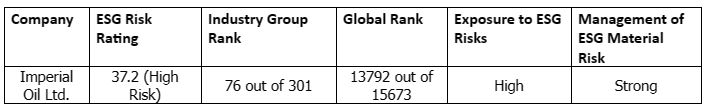

Environmental Responsibility: Involvement in the Pathways carbon sequestration project to decarbonize oil sands production.

-

Renewable Diesel Initiatives: Aligns with increasing demand for cleaner energy alternatives and may positively impact the company's ESG profile, attracting environmentally conscious customers and investors.

Imperial Oil Limited (NYSE: TSX:IMO) experienced a mixed performance in the second quarter of 2023, with both positive and negative indicators. While the company missed market expectations for earnings per share (EPS) on both a normalized and GAAP basis, it exceeded revenue expectations. Looking ahead, Imperial Oil anticipates improved production volumes, benefits from the favorable commodity price environment, and progress in renewable diesel initiatives.

Financial Performance Overview

In terms of financial performance, Imperial Oil reported a normalized EPS of $0.87, missing market expectations by -$0.15. The GAAP EPS also fell short of estimates by -$0.15, standing at $0.87. However, the company achieved revenue of $8.93 billion, surpassing market expectations by $28.52 million.

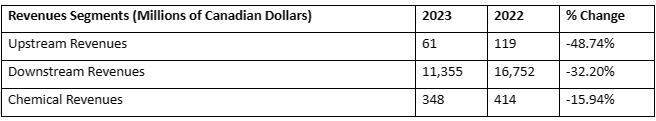

Segment Performance

The company's performance was driven by its business segments. In the upstream segment, lower bitumen and synthetic crude oil realizations, as well as planned turnaround activities and production timing, impacted revenues. However, favorable foreign exchange impacts and reduced operating expenses partially offset these factors. Downstream revenues declined due to weaker market conditions and planned turnaround activities, but favorable foreign exchange impacts partially mitigated the decrease. Chemical revenues also declined, potentially due to factors specific to the chemical sector, raw material costs, demand shifts, and market competition.

Refining Operations and Commitment to Environmental Responsibility

Imperial Oil's strong refining operations and the ability to capture and leverage the current strong refining cracks in the market are crucial for its financial success. The company's unique portfolio of refineries positioned across different regions allows it to fully extract value and respond to market demands. Maximizing the utilization of these assets, along with cost reduction efforts at the Kearl oil sands facility, aims to enhance profitability and shareholder value. The company's involvement in the Pathways carbon sequestration project, aimed at decarbonizing a significant portion of its oil sands production, demonstrates its commitment to reducing greenhouse gas intensity. Progress at the Cold Lake facility, along with technological advancements, regulatory developments, and market trends, will provide insights into Imperial Oil's environmental responsibility and potential risks and opportunities.

Outlook and Growth Potential

Imperial Oil anticipates stronger production volumes in the second half of the year as major planned maintenance activities in the upstream and downstream segments are completed. The company's confidence in its production guidance signals potential growth in revenues and earnings. Furthermore, the favorable commodity price environment, particularly for diesel and crude oil, could enhance profitability and cash flow.

Renewable Diesel and ESG Impacts

Imperial Oil's renewable diesel initiatives, including incorporating renewable diesel at the Kearl mining facility and the progress in the Strathcona Renewable Diesel Project, align with the increasing demand for cleaner energy alternatives. These efforts could positively impact the company's environmental, social, and governance (ESG) profile, attracting environmentally conscious customers and investors.

Conclusion

Imperial Oil Limited's Q2 performance showed mixed results, with earnings missing but revenue exceeding expectations. Challenges in upstream and downstream sectors persist, but strong refining operations and sustainability efforts provide hope. Monitoring refining profitability and cost reductions at Kearl are crucial. These factors are pivotal in underpinning its ability to navigate challenges. Given uncertainties, we recommend to hold on before buying any stock here urging caution amid evolving energy sector dynamics.

Disclosure: We don’t hold any position in the stock.

Source: https://www.imperialoil.ca/-/media/imperial/files/annual-and-quarterly-reports/q2-2023-interim-report-10q_eng.pdf

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.