For most investors, when the term ‘high yield’ is referenced regarding corporate debt, instinctually, ‘high risk’ is what comes to mind. In the current market environment of elevated interest rates and economic uncertainty, this article highlights the differentiated performances within the high yield debt credit tranche and profiles the WisdomTree US High Yield Corporate Bond ETF (WFHY).

Current State of US High Yield Corporate Bonds

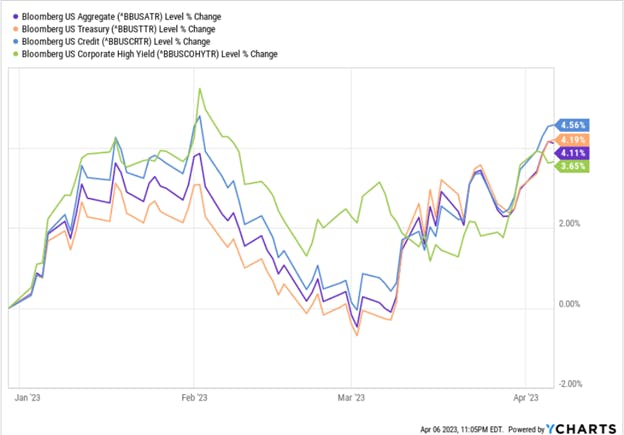

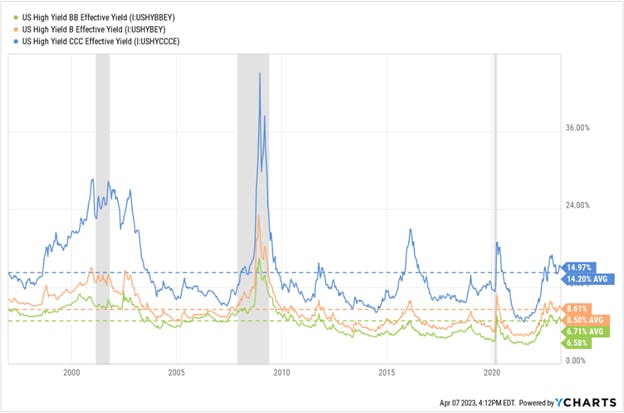

Against the backdrop of a rising interest environment with an uncertain macroeconomic outlook, the US High Yield Corporate Bond asset class, year to date, has underperformed its immediate peers within the US fixed Income spectrum from a total return perspective. However, the current effective yield generation for individual high yield bond tranches (i.e., BB-rated, or lower) is above their historical averages.

For high yield bonds, credit cycles tend to drive performance more than any other single factor, so a fulsome understanding of the prevailing economic landscape and its impact on the ability of companies to service their debt is crucial. In the current market environment where elevated inflation remains a concern for the Federal Reserve and a recurring series of bank failures have occurred - there is increasing uncertainty regarding the state of the economy.

High Yield Bonds: Looking Below the Surface

High yield bonds tend to be susceptible to recessionary environments as economic downturns typically result in lower economic activity and make it more difficult for high yield issuers to service their debt. However, all high yield debt is not the same. As mentioned earlier, because high yield is associated with high risk in the minds of many investors, the asset class is often viewed in a homogenous fashion. As demonstrated in the preceding chart, the 14.97% effective yield of US High Yield CCC-rated bonds is what naturally catches the attention of many – due to its exceptional nature. But there are other tranches of the high yield bond segment, namely BB-rated and B-rated, that provided a relatively more normalized return profile. This is best illustrated when looking at the total return performance of each high yield bond tranche over a long time horizon.

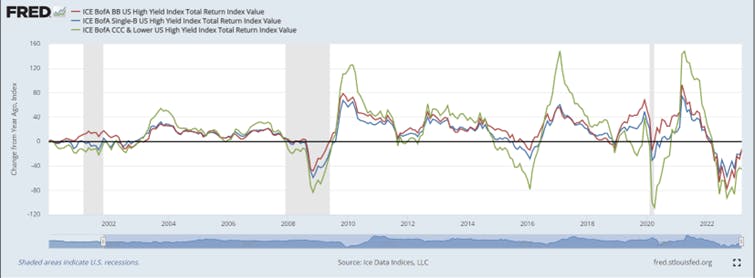

The following chart illustrates the 20-year, year-over-year total return performance of the BB-rated, B-rated, and CCC & lower-rated tranches of the ICE (NYSE:ICE) BofA US High Yield Master II Index, which tracks the performance of US dollar denominated below investment grade rated corporate debt publicly issued in the US domestic market.

As illustrated through the data, the CCC & lower rated tranche has a significantly more volatile investment experience over time, relative to its other high yield counterparts. Highlighting this nuance when discussing the high yield bond asset class is important, as these underlying components contribute to and drive the overall performance of high yield bond investments. As such, investors need to be cognizant of how the credit quality of a fund’s underlying holdings can impact top-line performance.

US High Yield Corporate Bonds: Focusing on Quality

Given the importance of credit quality exposure with US high yield corporate bonds, having an investment process that can identify quality debt issuance is crucial. WisdomTree’s approach to identifying qualified holdings within their US High Yield Corporate Bond Fund (Ticker: WFHY) is indicative of the intentionality behind the fund’s investment strategy.

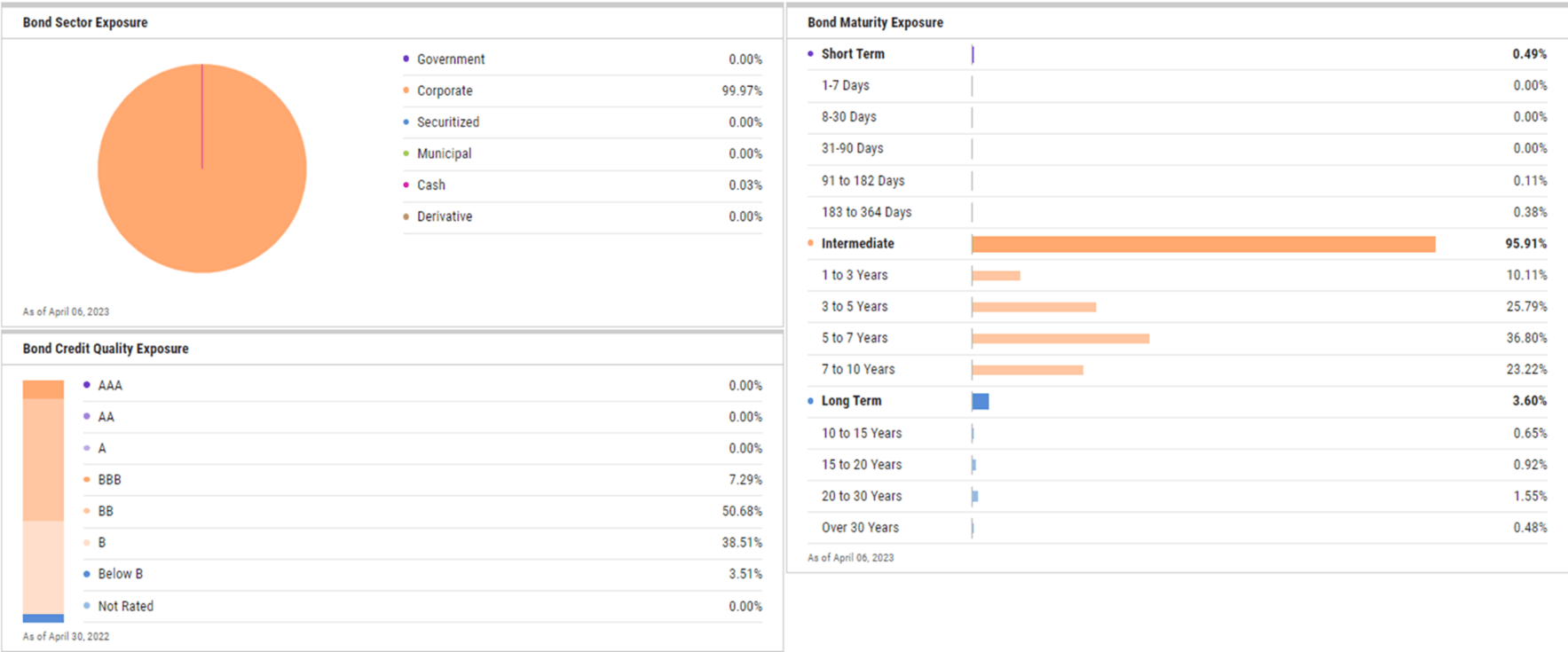

The WisdomTree US High Yield Corporate Bond Fund investment strategy is designed to capture the performance of selected issuers in the US non-investment-grade corporate bond market that are deemed to have solid fundamental and income characteristics. To achieve said objective, the ETF employs a multi-step process, which screens based on fundamentals to identify bonds with favorable characteristics and then tilts to those individual securities which offer positive income characteristics. As a result, the credit quality exposure of the fund has primarily been within the BB-rated tranche, with bond maturity being predominately in the intermediate range.

Source: YCHARTS. April 10, 2023.

For investors looking to gain exposure to the US High Yield Corporate bond asset class, the underlying credit exposure of an investment solution is an extremely important consideration. In the case of WisdomTree’s WFHY, the nature of the investment process helps minimize the fund’s exposure to the high yield bond assets shown to be most volatile.

This content was originally published by our partners at ETF Central.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI