This post was written exclusively for Investing.com

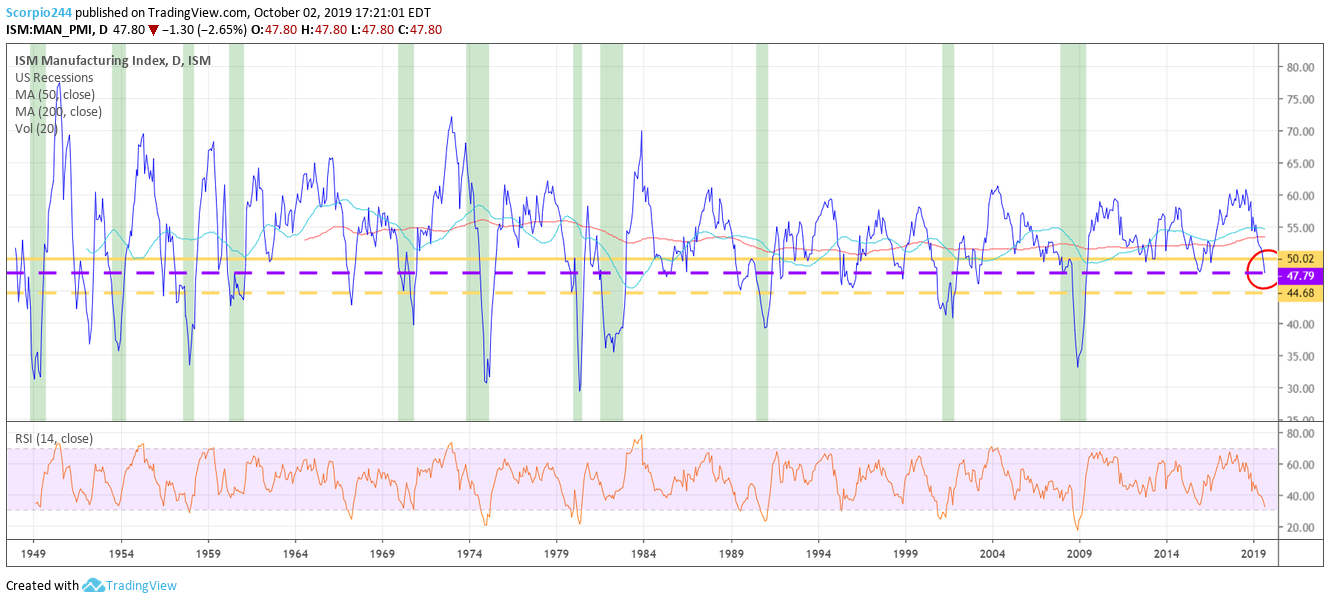

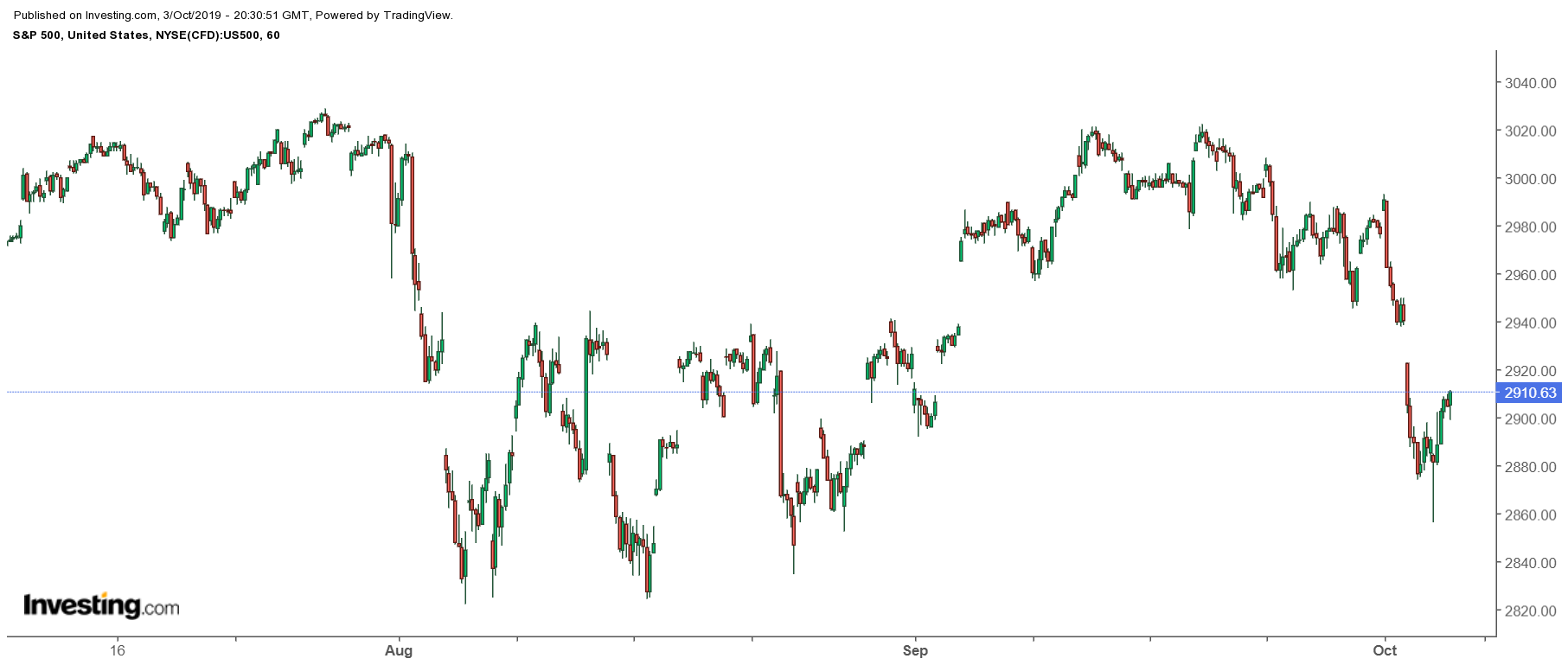

The latest ISM Manufacturing report sent shivers down the spines of investors when it came in at 47.8 versus analysts' expectations of 50.4 on the morning of Oct. 1. It resulted in a steep decline in the S&P 500 since its release. The weaker-than-expected report has brought recession fears bubbling to the surface once again. However, the current ISM reading does not necessarily indicate a recession is on the way.

The ISM report itself isn’t the greatest indicator of future recessions, at least not based on the latest data. When digging through the actual ISM report, it notes that the weaker-than-expected ISM reading corresponds to a 1.5% increase in third quarter GDP on an annualized basis. Also, when looking at past data it took even lower readings to indicate that a recession was near. Does it indicate a slower economy? Yes. Does the reading indicate a recession? No, not at this point.

ISM PMI Needs to Fall More

It may be premature for those leaning toward a recessionary outlook to claim victory. Previous ISM reports, going back to the year 1948, show that the latest reading falls short of a recessionary forecast. In recent periods, the ISM reading fell to roughly 48 in December 2016, before rebounding, it even fell to 46 in March of 2003, without a recession. In the past the ISM reading has had to fall much lower, to levels of roughly 43 to 44 or lower to signal a recession. Currently, a recession may still not be in the cards for 2019 or 2020.

Even when that reading has fallen below 43 it has not always signaled a recession. The ISM PMI although a useful tool in gauging the health of the manufacturing part of the U.S. economy, is not always a perfect indicator. The reading fell to roughly 42 in April 1967 and 40 in 1952 without triggering a recession.

Diverging Indicators

Even more interesting is the fact that the IHS Market PMI reading, which came out on the same day as the PMI reading, was ahead of expectations. The largely unnoticed PMI reading came in at 51.1, which was higher than expectations of 51, and better than last month’s reading of 50.3.

What may be of more interest is that the Markit PMI may have already troughed and is now showing signs of a potential recovery. The reading had been hovering around 50 since mid-May. A divergent viewpoint from the ISM PMI results.

Market Jitters

Still the equity market is worried, and that has resulted in the S&P 500 falling by as much as 4.5% since the ISM report came out on Oct.1. Since peaking on Sept. 19, the index has fallen by roughly 4% to 2,910 as of Oct. 3, from approximately 3,022. Additionally, yields on the 10-year Treasury have fallen sharply to 1.54% from 1.78%.

Still Waiting

It’s been a year since recession worries first percolated, and still it is yet to be seen if a recession will actually occur. At this point it may be best to say the data is inconclusive or better yet, not supportive of a recession. After all, the ISM PMI corresponds to a positive annualized growth rate for the third quarter GDP. Meanwhile, manufacturing only represents a small portion of the U.S. economy. In total 2018 manufacturing was about $2.2 trillion of the $18.7 trillion U.S. economy, or roughly 11.7%.

Should a recession come, it will put to rest the longest period of economic expansion in U.S. history. It isn’t to say a recession couldn’t be on the way, but at the same time the latest data doesn’t suggest that one is coming either.

Like everything else in life, only time will tell.