Meta Platforms surges in afterhours after delivering blowout Q2 results

In the investment landscape of 2023, a seismic shift is underway. After decades of index-tracking dominance, active ETFs are experiencing a resurgence, riding a wave of increasing popularity among investors seeking strategies that can potentially outpace standard benchmarks.

This renewed interest has sparked a flurry of launches from various ETF providers, all aiming to carve out their slice of the market pie. Leading the charge are two formidable offerings from JPMorgan (NYSE:JPM): the JPMorgan Equity Premium Income ETF (JEPI) and the JPMorgan Ultra-Short Income ETF (JPST), each boasting an impressive $28 and $26 billion in assets under management (AUM) respectively.

The success of JEPI and JPST highlights a growing appetite for tactical investment strategies that can adapt to the ever-changing market conditions. It is against a similar backdrop that the MeetKevin Pricing Power ETF (PP) is gaining attention.

With impressive gains that are beating major index benchmarks in 2023, PP’s strategy warrants a closer look. In this article, we will delve into the details of this ETF, examining its strategy and the inherent risks, and shedding light on what sets it apart in the rapidly evolving world of active ETF investing.

Who is MeetKevin, and what is PP?

MeetKevin is the YouTube username of Kevin Paffrath, a former real estate agent and current online financial influencer, or "finfluencer" with some 1.87 million subscribers. Kevin is also a licensed financial advisor, and after the launch of PP an ETF manager as well.

Advised by Toroso Investments, LLC, PP was launched on NYSE ARCA on November 28th, 2022. It's a great example of how ETF white label services like parent company Tidal Financial Group have increasingly democratized and simplified breaking into the ETF industry for would-be entrepreneurs.

As its name suggests, PP is a thematic ETF that focuses on stocks that are "innovative companies" that possess "pricing power". This is primarily measured by a company's "price elasticity", which PP defines as "the ability to potentially increase prices for products and services without a corresponding drop in demand".

PP is as actively managed as ETFs get – there's little in the way of a strict rules-based methodology disclosed in its prospectus for how securities are selected and managed. Instead, we get some general guidelines for how PP will choose and weight its stocks.

The investment strategy of PP primarily hinges on a proprietary screening methodology by the Sub-Adviser, Plato’s Philosophy LLC, which Kevin is the CEO of. This screening process zeroes in on "innovative companies" seen as having more significant pricing power in comparison to their peers.

By analyzing a blend of self-reported data such as press releases and third-party data like news articles, the ETF identifies companies that are excelling in areas such as pricing power, the development of new products or services, consumer engagement, technological innovation, and the creation of physical or digital infrastructure for new technologies.

In addition, PP places emphasis on the company's track record in disrupting mature industries like automobiles or operating within disruptive sectors such as social media and blockchain. The ETF also tends to favor companies that are founder-led, spend more on research and development, and have a high level of customer satisfaction.

Following this initial selection, a bottoms-up analysis is performed on each identified Innovative Company. This involves examining various financial metrics like price over earnings-to-growth ratio (PEG), revenue, and margin growth, selecting companies that seem to have above-average growth potential. The metrics may vary slightly depending on industry-specific aspects.

PP's portfolio can include small, medium, and large capitalization companies and generally consists of around 25 to 60 securities. Being classified as a "non-diversified" investment company under the Investment Company Act of 1940, it may also invest a higher percentage of its assets in fewer issuers, which could result in concentration in a few holdings or sectors.

As seen with some other actively managed ETFs, PP is also able to implement a "macro-hedging" strategy which allows the fund to hold up to 30% of its net assets in certain ETFs. This is done to hedge against anticipated market risks such as geopolitical disruptions, Federal Reserve monetary decisions, or extreme weather events.

PP performance and risks

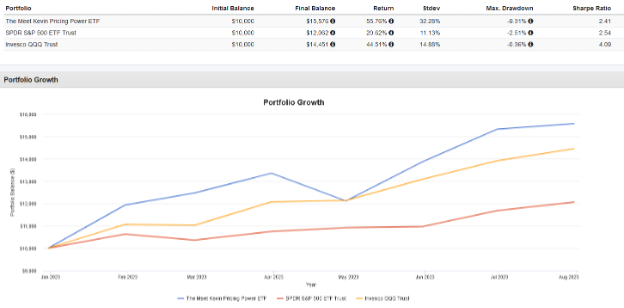

The backtest below is honestly too short to draw conclusions, but so far in 2023, PP is beating both the S&P 500 Index and the Nasdaq 100 Index, as represented by the SPDR S&P 500 ETF Trust (SPY (NYSE:SPY)) and Invesco QQQ Trust (QQQ) respectively.

However, it did so with a substantially higher max drawdown and greater standard deviation, which I think points to the volatility and possible downside risk inherent to such a concentrated ETF.

Case in point, as of August 1st, 2023, 22.55% of PP is held in Tesla (NASDAQ:TSLA), with Enphase Energy and Apple (NASDAQ:AAPL) coming in second and third place respectively at 12.31% and 11.03%. In total, the top three holdings of PP account for 45.89% of the ETF's total weight.

Such concentration, while potentially leading to higher gains, exposes the portfolio to significant risk associated with specific companies or sectors. This structure, inherent to some actively managed ETFs like PP with limited diversification, poses challenges for investors looking for a stable, long-term buy and hold strategy. The risks become even more pronounced after a large run-up, as a downturn in one or more of the top holdings could result in substantial losses.

This concentration dilemma is part of the longstanding broader skepticism surrounding actively managed funds. The latest SPIVA report illustrates this trend, showing that an overwhelming 94.3% of U.S. large-cap ETFs underperformed the S&P 500 over the last 15 years. While active management can create opportunities for outperformance, it often falls short over the long term, primarily due to higher fees and the risks associated with stock picking.

Speaking of higher fees – PP doesn’t come cheap. Currently, the ETF charges a 0.77% expense ratio. With just $43.81 million in AUM, the ETF has to charge a high fee in order to break even and potentially turn a profit. This expense ratio can eat into long-term returns, especially when you consider that large-cap thematic tech growth ETFs like the iShares Exponential Technologies ETF (XT) can be had for 0.46%.

This content was originally published by our partners at ETF Central.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI