Purchasing a home is one of the greatest financial decisions a person will have to make in their lifetime, and while the willingness to buy a home is one part of the equation, housing availability is a factor that determines whether one becomes a homeowner at all. In this article, we will look at the home construction sector and how limited existing inventory has put a renewed emphasis on new home construction and how this can be capitalized on by interested investors.

Housing Market Standstill

Presently, the US Pending Home Sales Index, which tracks the transactions of home sale contracts not yet completed in the US, remains very weak and is down approximately 20% over the last year.

As observed from the chart, the current level of the index is nearing the trough point that occurred during the pandemic. The significance of this current reporting is noteworthy, since pending home sales would tend to become existing home sales in a few months, thus the pending home sales index can be used as a leading indicator for housing market activity in the US. Based on the incoming data, housing sales activity has been severely muted.

Rising rates are an impediment

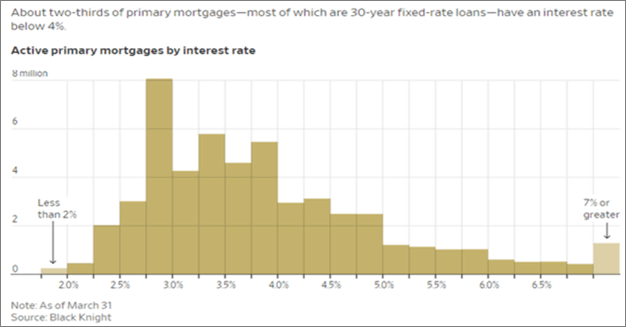

One of the main reasons for the housing market standstill: a lack of supply due to the spike in mortgage rates. Presently, two-thirds of mortgages have an interest rate below 4% and most of the buyers from the last few years could not afford the house they are living in if they had to buy them at current rates/prices.

The current rising rate market environment has become an impediment, as the lack of affordability has crushed demand not only from new buyers but also sellers. Simply put, with rates being elevated – homeowners aren’t willing to sell their current home to prospective buyers, as the cost of acquiring a new home is exorbitant; ultimately limiting overall housing availability.

Limited supply, potential opportunity

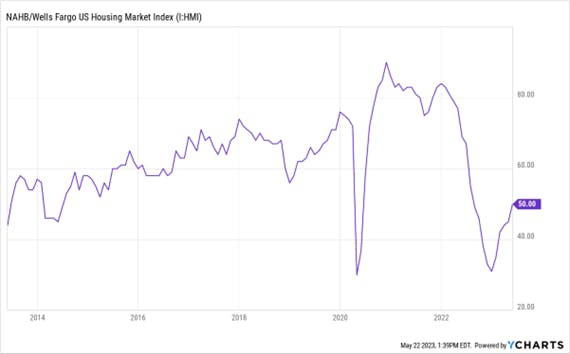

As noted in the National Association of Home Builders (NAHB) recent report, limited inventory has put a renewed emphasis on new construction, resulting in a solid gain for builder confidence in May 2023 even as the industry continues to face several challenges, including building material supply chain disruptions and tightening credit conditions for construction loans.

The report further states that builder confidence in the market for newly built single-family homes in May 2023 rose five points to 50, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This marks the fifth straight month that builder confidence has increased and is the first time that sentiment levels have reached the midpoint mark of 50 since July 2022.

Investing in Homebuilders

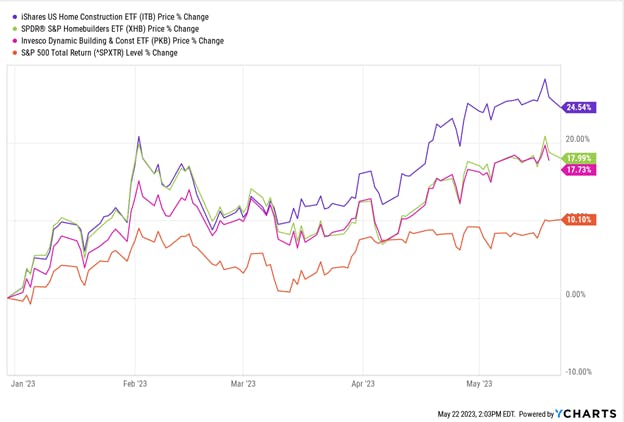

The change in sentiment occurring with homebuilders has been reflected in the performance of thematic homebuilder ETFs in recent months, as the iShares US Home Construction ETF (ITB), SPDR® S&P Homebuilder ETF (XHB), and Invesco Dynamic Building & Construction ETF (PKB) have all exhibited double-digit returns year to date.

As NAHB Chairman Alicia Huey stated, “New home construction is taking on an increased role in the marketplace because many homeowners with loans well below current mortgage rates are electing to stay put, and this is keeping the supply of existing homes at a very low level,”.

For investors interested in gaining exposure to the homebuilders sector, now would be a truly opportune time to examine how said allocation would fit within one’s portfolio and how best to capitalize on the market dynamics that are propelling the sector forward.

This content was originally published by our partners at ETF Central.