“The Only Chart That Matters” Stock Market (and Sentiment Results)…

Markets are clearly concerned about the U.S. budget deficit and war spending. Since the war began, the Biden administration and the U.S. Congress have directed $76.8 billion in assistance to Ukraine. The Administration is now drafting a bill for another $100 billion for Israel and the Ukraine.

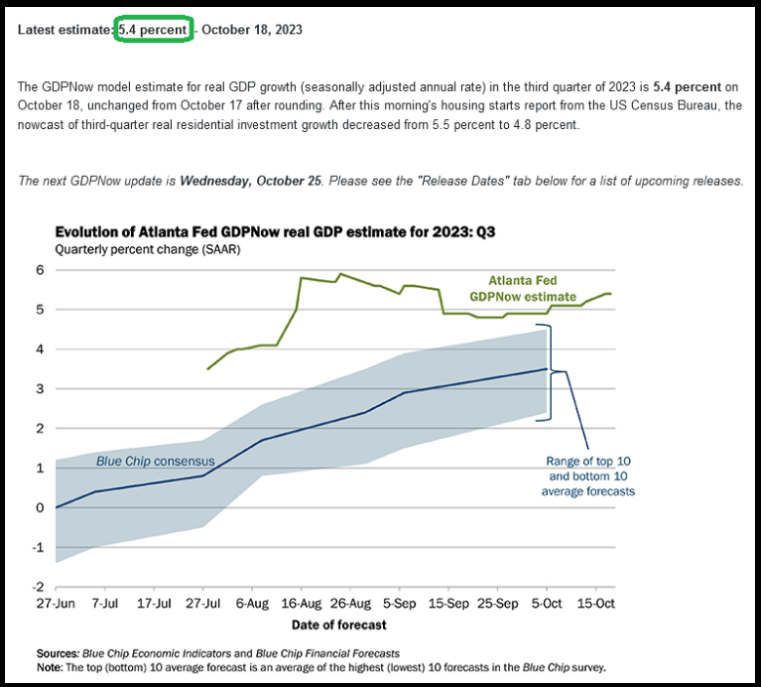

Whether you view these expenses as discretionary or non-discretionary (from a humanitarian and security standpoint), the markets do not like it (from a financial standpoint) and the ten year yield keeps testing a run to 5%. In isolation, 5%+ yields on the 10-yr are not abnormal and do not imply “end of times.” However, nominal growth needs to continue in order to support these yields or problems will surface.

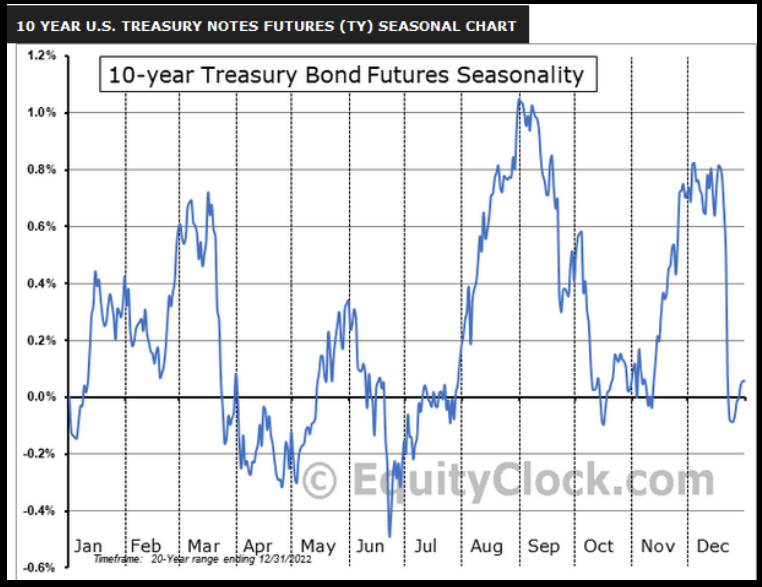

The issue right now is the amount of debt outstanding in the system. I have covered in recent podcast|videocast(s) that either natural pension demand will step in to lock up ~5% long term yields (matching their long-dated liabilities) and re-balancing into year-end, OR unnatural intervention will be required (BoJ, Fed, ECB).

Fox Business

I covered this specific topic (and methods) with Charles Payne on Fox Business this Monday. Thanks to Charles, Kayla Arestivo, Nicholas Palazzo and Jayme Cohen for having me on the show:

CNBC

On Friday I joined Ade Nurul Safrina on CNBC “Closing Bell” Indonesia to discuss inflation numbers, jobs numbers and outlook. Thanks to Safrina and Fitria Anggrayni for having me on:

Sentiment and Positioning

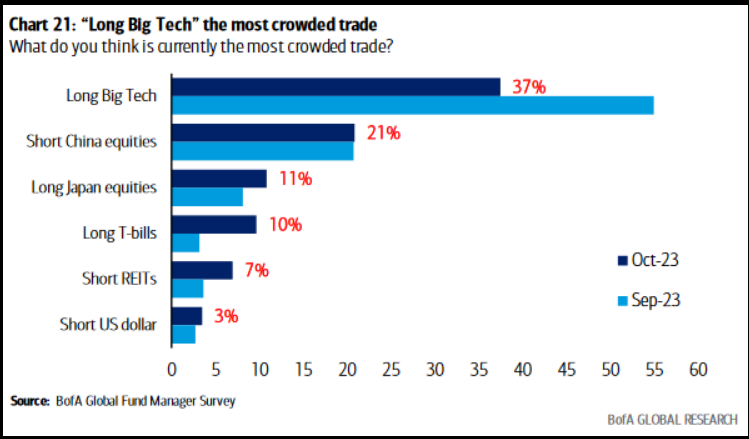

This Tuesday, Bank of America (NYSE:BAC) published its monthly “Fund Manager Survey.”

Here were the 5 key points:

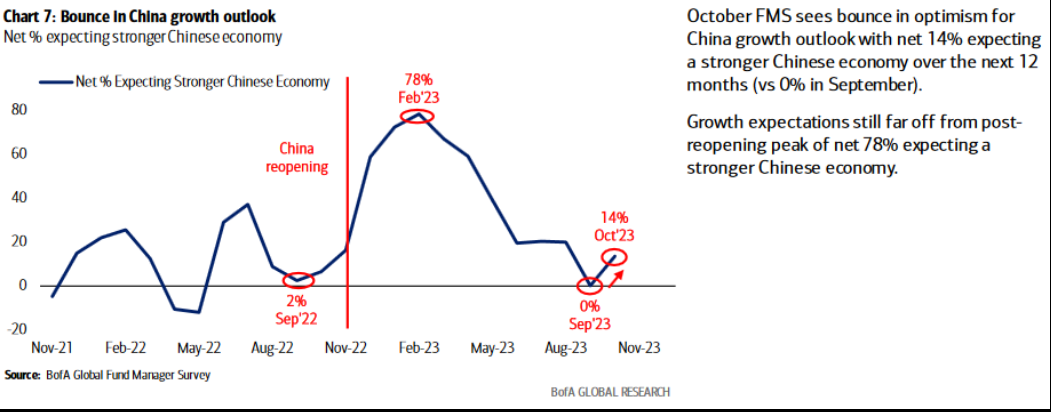

1) China’s growth outlook is starting to rebound. This change in sentiment is very similar to late October, early November of last year:

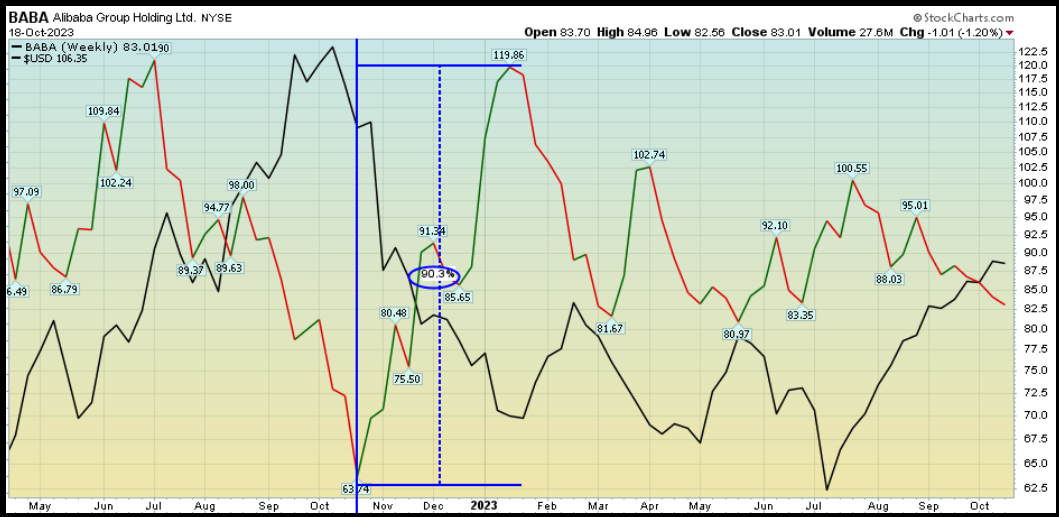

History doesn’t repeat but it tends to rhyme. Of note is the dollar was ALSO very strong last year into the inflection point (just before BABA rallied 90% in the following ~11 weeks). As the dollar weakened, BABA took off like a rocket. Will we see a similar inflection into year-end (black line USD, red/green line BABA)?

Fed speakers have been coming out regularly in recent days and weeks claiming the bond market has done its work (dovish talk implying Fed is done). The market won’t believe it until they hear it from the horse’s mouth. Chair Powell speaks today.

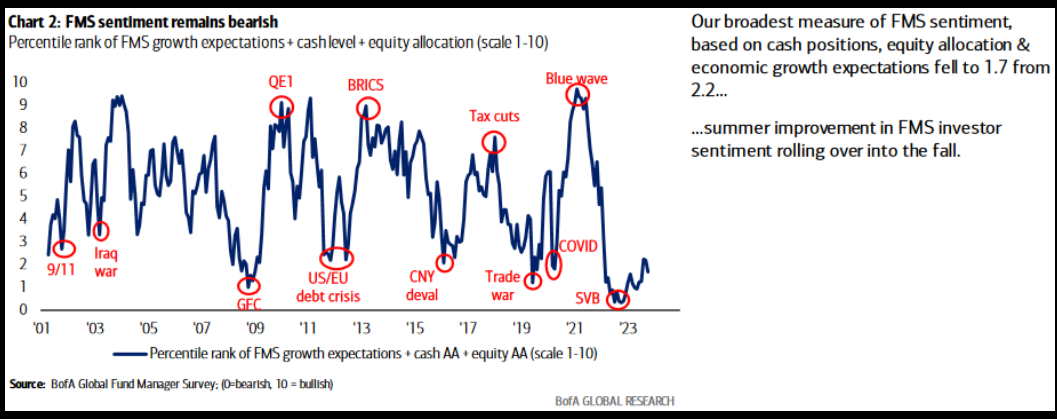

2) Manager sentiment at GFC and COVID low levels. Was time to be a BUYER, not a SELLER:

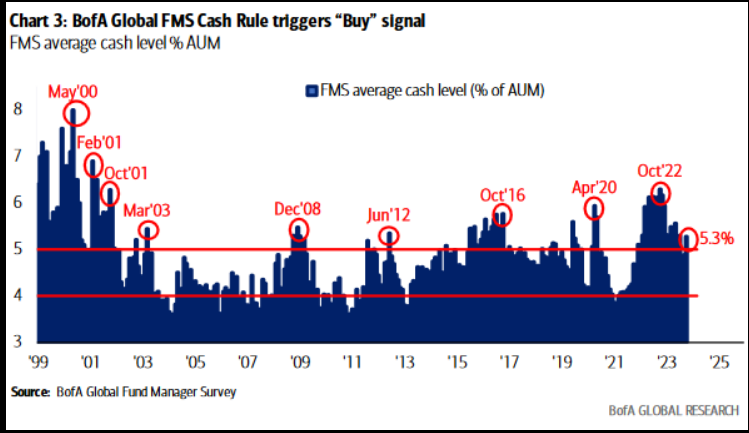

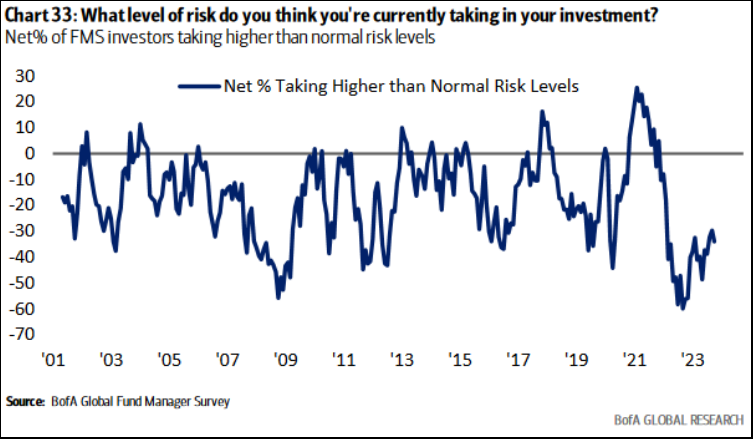

3) Managers not positioned for upside and will have to chase into year-end:

4) Short China Equities is the second most crowded trade. When it unwinds, the rally will be BRUTAL for shorts – similar to last year.

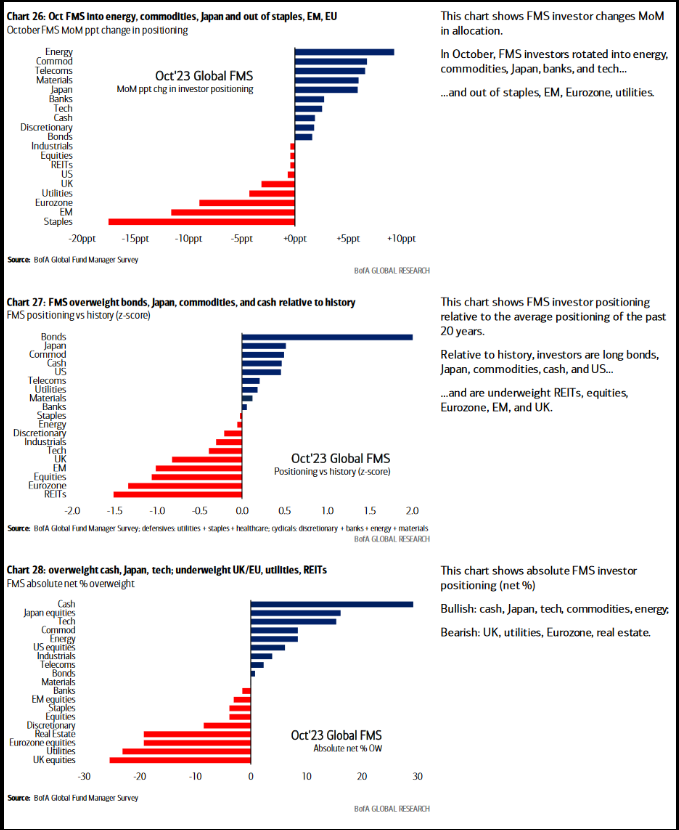

5) Contrarian Trades: Long EM, REITs, Staples. We agree!

Of Note…

10 day moving average put/call ratio at/near extreme fear:

Now onto the shorter term view for the General Market:

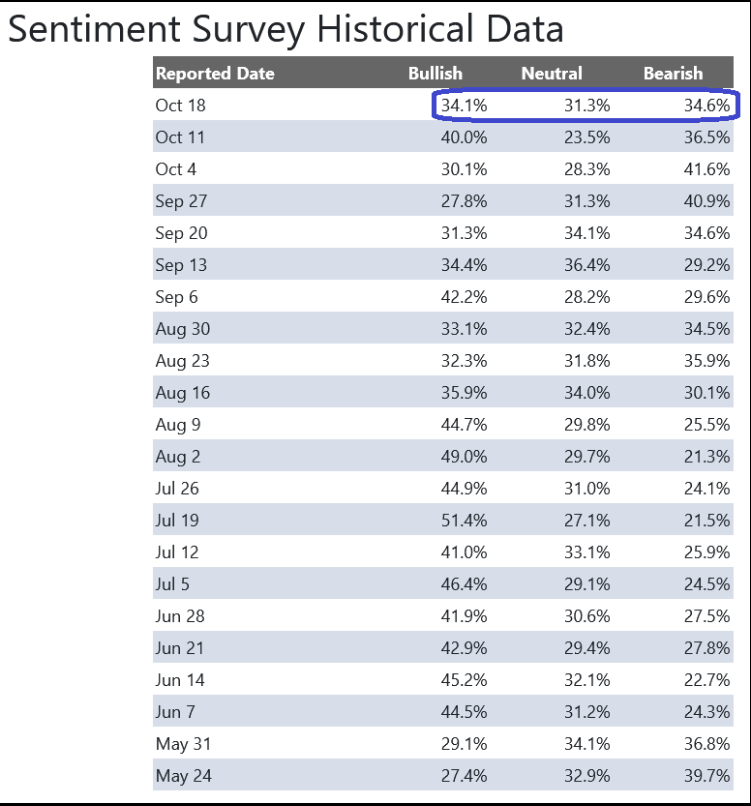

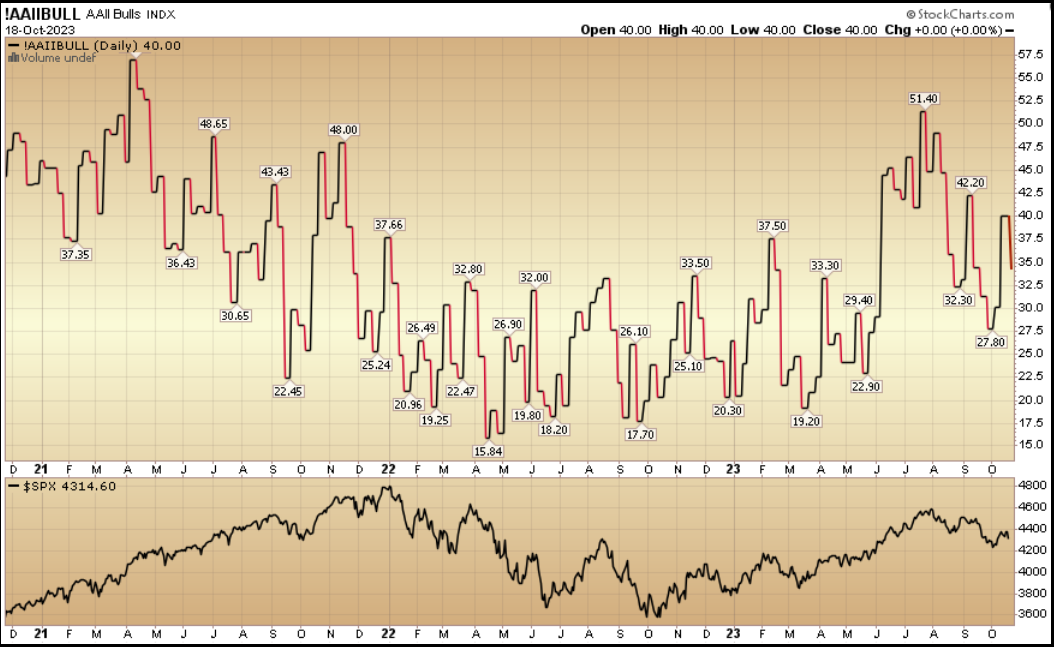

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) dropped to 34.1% from 40% the previous week. Bearish Percent moved down to 34.6% from 36.5%. Retail investors are neutral.

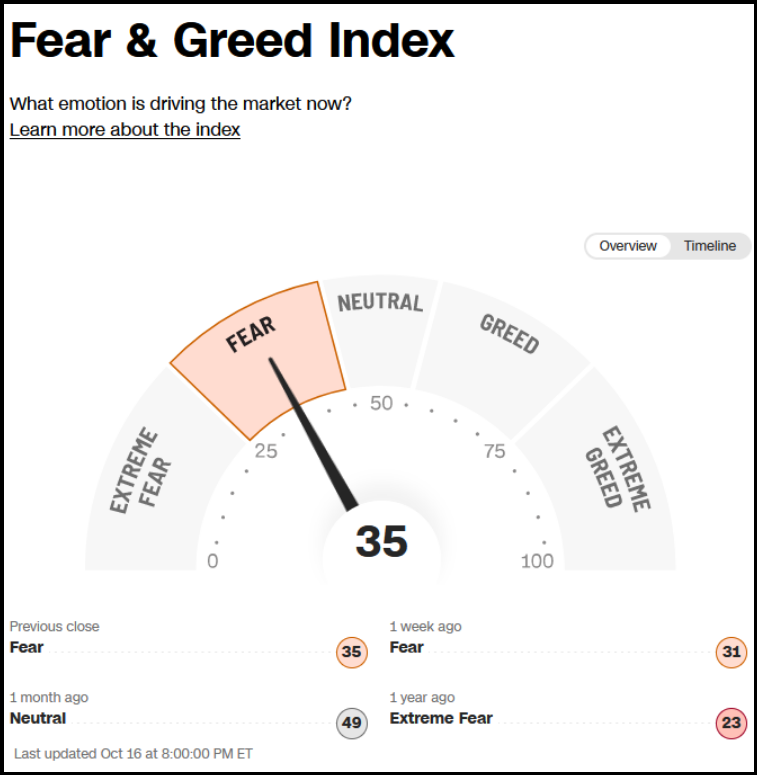

The CNN “Fear and Greed” ticked up from 33 last week to 35 this week. Investors are still fearful. You can learn how this indicator is calculated and how it works here: (Video Explanation)

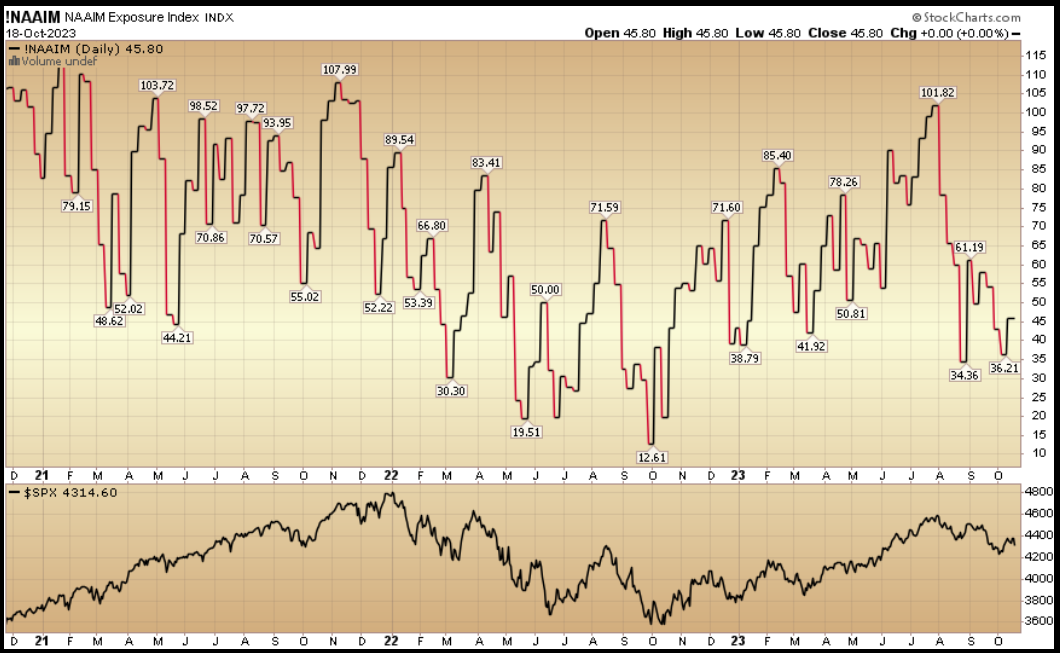

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) ticked up to 45.80% this week from 36.21% equity exposure last week. As the tide continues to turn, the “end of year chase” will be on full force.

This content was originally published on Hedgefundtips.com.