Fortune favors the bold, an adage that is true in life; and investing – particularly growth-focused investing. Within the Large Cap segment, growth-focused investing is generally centered on market leading companies that have gone through the innovation cycle, ultimately creating a product that has achieved mass consumer adoption and usage, which has allowed them to establish a dominant industry position.

In this article, we will provide a brief summary of growth investing, examine its current performance in the marketplace, and discuss a solution that provides pure-play exposure to the investment strategy.

Growth investing in the large cap space

When growth investing is applied to large-cap companies, investors seek out those with the potential for continued expansion and earnings growth that can outperform the broader market. Growth-oriented large-cap companies are often leaders in their respective industries as they have a track record of success, a strong competitive advantage, and substantial market share. In looking at the Russell 1000 Growth Index’s factsheet, its dollar weighted average market capitalization, as of May 2023, is $960.476 Billion; highlighting the scale of the companies considered to be ‘Growth, Large Cap’ ; with leading names such as Apple Inc (NASDAQ:AAPL), Microsoft Corp (NASDAQ:MSFT) and Amazon.com Inc (NASDAQ:AMZN). being among this category grouping.

Overall, growth investing within the large market capitalization section of equity markets involves identifying established companies with strong growth prospects. Investors seek out these companies based on their ability to maintain or enhance their market position, sustain high rates of earnings growth, and generate long-term value for shareholders.

A look at current performance

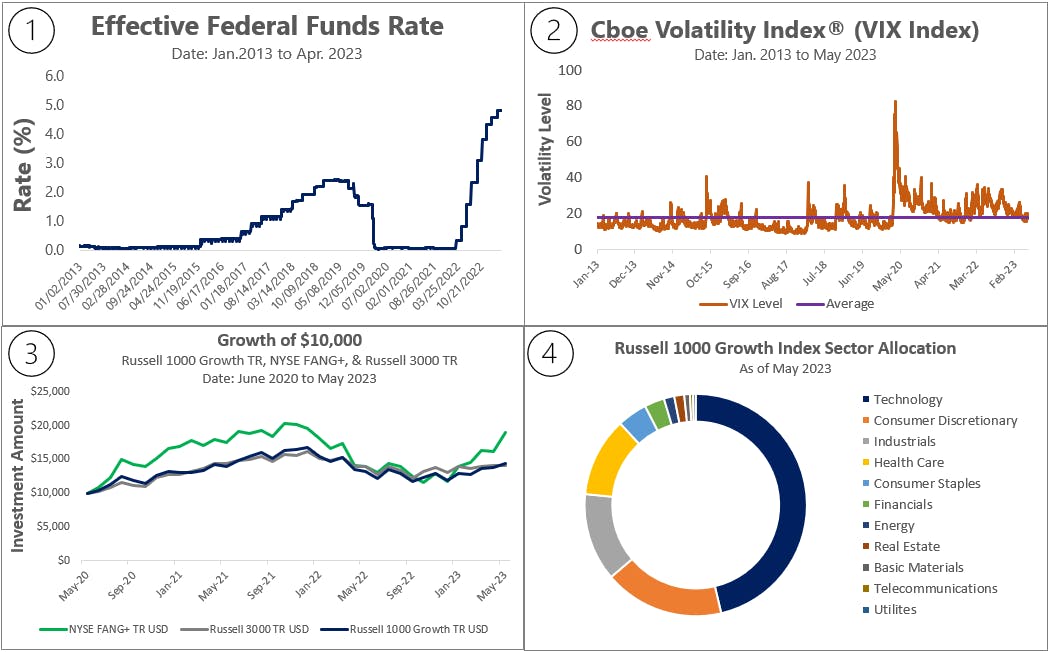

In the current market environment of elevated interest rates (panel 1) and above-average market volatility (panel 2), the performance of Growth, Large Cap equities wavered during 2022 but is exhibiting a strong resurgence thus far in 2023 (panel 3). Many growth, large-cap companies reside within the technology sector (panel 4) and have an outsized influence on the markets. While we all remember the hiring-spree many technology firms undertook during the pandemic, in the present, many of these same firms have decided to ‘right-size’ their organization, citing the macroeconomic environment and a need to find discipline on a tumultuous path to profitability. As outlined in an article from Techcrunch (read here), these layoffs include many notable big-tech firms, as well as tech-starts ups on the cusp of entering their next stage of progress.

The resurgence in performance of growth, large scale companies, particularly the mega-cap technology companies has been exceptional thus far in 2023. In looking at the New York Stock Exchange FANG+ Index, which aims to measure the performance of some of the largest, most liquid U.S. stocks including Apple Inc., Amazon, Netflix Inc (NASDAQ:NFLX)., Facebook (NASDAQ:META) parent Meta Platforms Inc. and Google parent Alphabet (NASDAQ:GOOGL) Inc., year to date performance (as of May 2023) has been 61.27%, whereas the Russell 1000 Growth TR and Russell 3000 TR has been 20.76% and 8.74%, respectively.

Simply put, given the uncertainty that currently exists in the market, the strength and scale of growth, large cap companies are being viewed as a place of safety; as the biggest tech stocks have outperformed the broader market.

JP Morgan (NYSE:JPM) Active Growth ETF (Ticker: JGRO)

The JP Morgan Active Growth ETF is a pure growth equity portfolio that combines research, valuation, and stock selection to identify companies that will achieve above-average earnings growth over the next several years.

The underlying strategy for the ETF will utilize the firm’s Large Cap Growth and Growth Advantage strategies, combining them to construct the portfolio. In executing the ETF’s investment objective, the manager will integrate financially material Environmental, Social and Governance (ESG) factors in investment analysis and investment decisions, with the goal of enhancing long-term, risk-adjusted financial returns.

For investors seeking a growth-style focused investment solution, this ETF from JP Morgan provides them with a single ticket solution to a mandate solely focused on companies that exhibited the potential to grow over time and through varying market cycles.

This content was originally published by our partners at ETF Central.