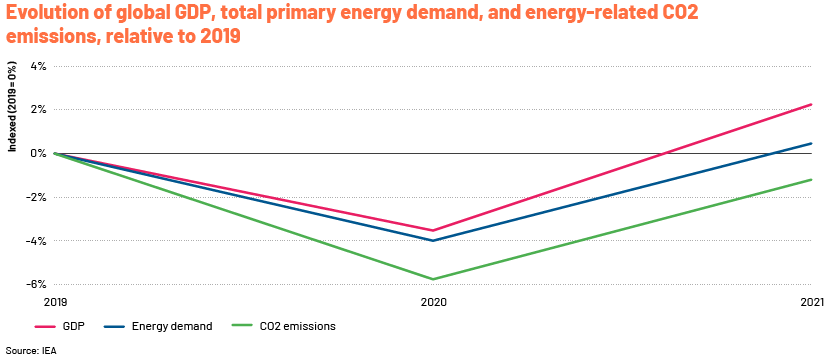

The Paris Agreement has called for rapid decarbonisation to limit the rise in average global temperatures to 1.5 degrees Celsius above pre-industrial levels. This is much easier said than done, considering we require all sectors of the economy to achieve net-zero carbon emissions by 2050. The race towards achieving meaningful climate targets is impossible without transitioning from the use of conventional sources of energy to renewable resources. COVID-19 pandemic-induced lockdown measures have contributed significantly to the reduction in greenhouse gas emissions around the globe due to reduced economic activity. However, in the long run, investments in renewable energy are considered a key factor in the fight against climate change.

Path towards net zeroConclusion

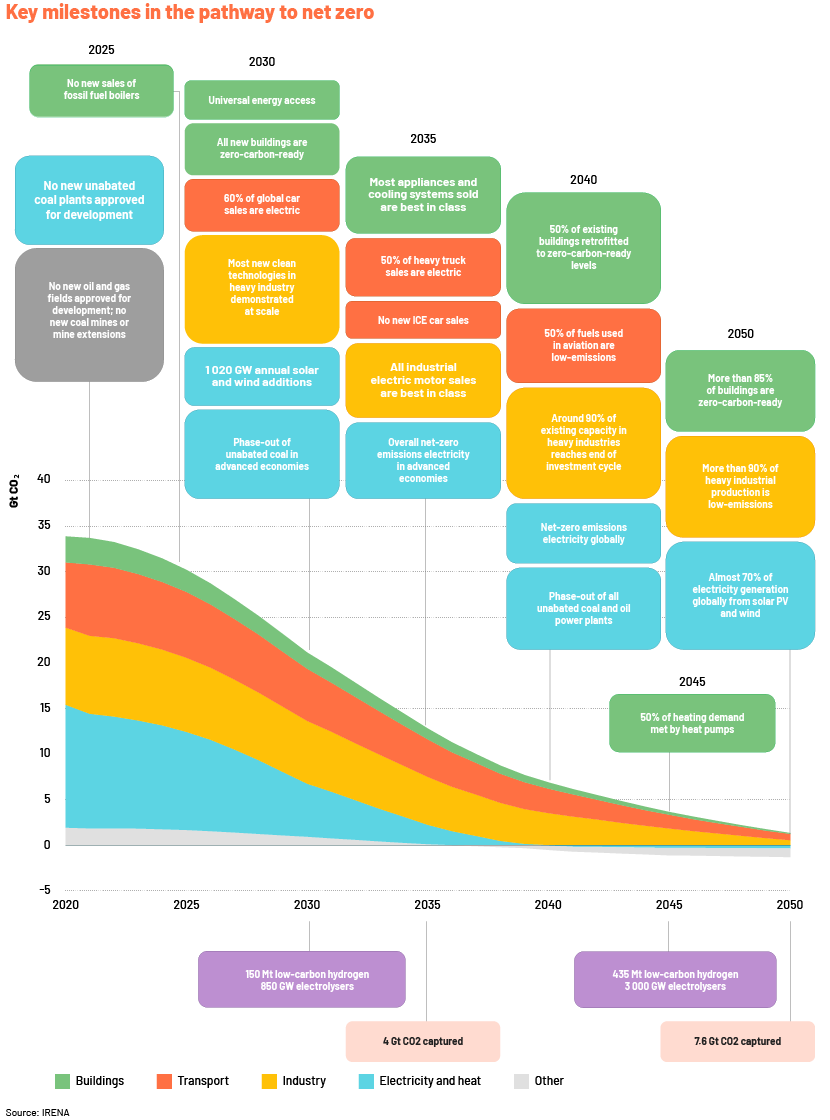

Global energy demand in 2050 is expected to be 8% lower than it is at present, even though the economy is projected to be more than twice as big and the population is expected to have grown by two billion by then, according to a report by the International Energy Agency (IEA). The report also said the global energy sector would rely heavily on renewable energy, with solar accounting for almost a fifth of all energy supply by 2050.

How soon can renewables replace fossil fuels?

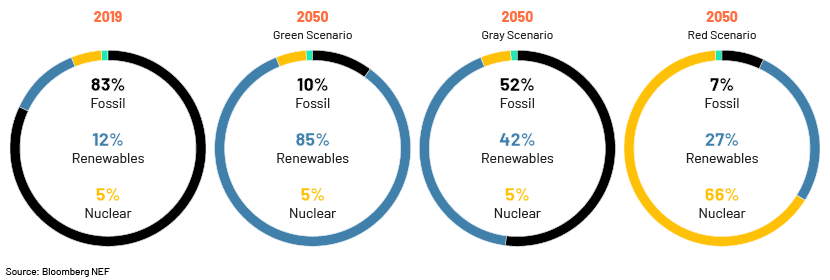

The recent coal crisis has shown the world that the current levels of renewable energy resources are falling short in compensating for the dip in traditional energy. According to the Renewable Energy Policy Network for the 21st century (REN21), the share of fossil fuels in the global energy mix was 80.2% in 2019, compared with 80.3% in 2009, with wind and solar power together accounting for 11.2% of the energy mix in 2019 and 8.7% in 2009. Although there has been a sharp fall in the production of fossil fuels over the past few years, investments in renewable energy are too low to offset the shortfall. Despite the slowdown in global economic activity following the pandemic, many countries and corporations have continued to announce or implement decarbonisation plans. The new administration in the US has decided to re-join the Paris Climate Accord, pledging to achieve net-zero carbon emissions by 2050. China and India, ranked first and third in terms of global carbon emissions, have targeted achieving net-zero emissions by 2060 and 2070, respectively.

Advancements in technology have considerably reduced the cost of solar and wind power generation over the past few years. Further developments in this area could help unlock energy reserves that can meet global power demand 100 times over, according to a report published by think tank Carbon Tracker. The report also says reduced costs would trigger exponential growth, which would help the world rely only on wind- and solar-based power sources for all electricity generation by 2030 and for all of its energy requirements by 2050.

The New Energy Outlook (NEO), Bloomberg NEF’s annual long-term scenario analysis of the future of the energy economy, presented the following net-zero scenarios that aim to predict the transformation in energy supply. Renewable energy is likely to account for 85% of all primary energy supply by 2050, according to its “Green Scenario”.

Where does the world stand in terms of renewable energy transition?

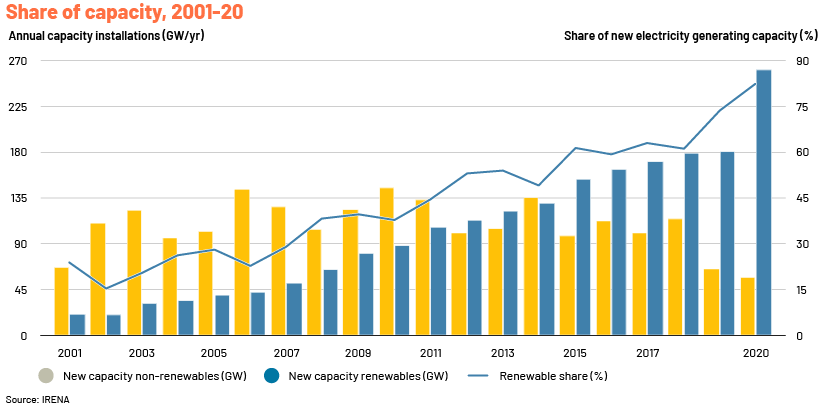

The energy sector has been undergoing a dynamic transition even in the midst of the havoc caused by the COVID-19 pandemic. The past seven years have seen the dominance of renewable energy over fossil fuels, and this is expected to increase in the coming years.

Global energy demand during the pandemic

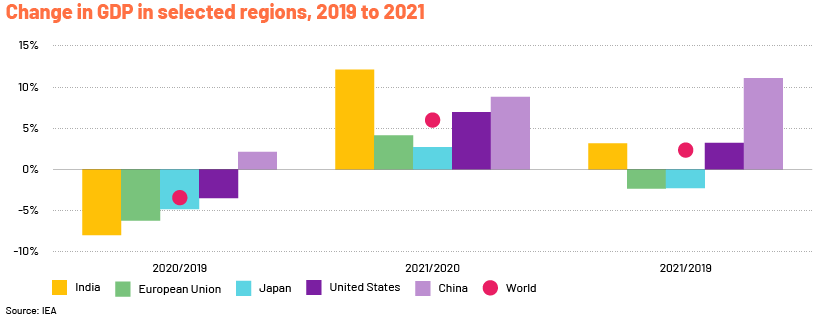

Most countries have now lifted or eased pandemic-related restrictions. The stimulus packages introduced have also been producing positive results. These have resulted in a strong bounce-back of the world economy, increasing global energy demand. Early trends indicate global gross domestic product (GDP) and energy demand in 2021 could exceed 2019 levels.

Global outlook for renewable energy investments

The long-term energy transformation scenario requires energy-related carbon dioxide emissions to fall by 3.8% on average annually until 2050. Subsidies for fossil fuels must be phased out, and investments in the fossil fuel sector need to be channelled towards renewables and other energy-efficient alternatives.

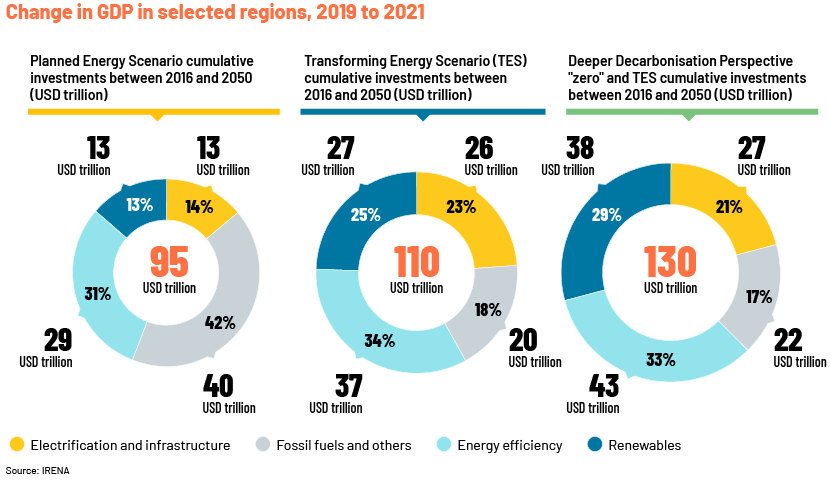

The International Renewable Energy Agency’s (IRENA’s) Transforming Energy Scenario demands total investment of USD110tn by 2050. This translates into USD3.2tn annually.

There has been a rapid increase in commitment by governments, companies and financial institutions in recent years to achieve net-zero emissions by 2050. However, the current level of investments is far below what is required to avoid severe impacts from climate change.

The recently concluded COP 26 called for a threefold increase in investments towards renewable energy and carbon pricing to aid the energy transition. Developing economies should encourage more private and public participation in aggregating investments to accelerate the transition process. Developed economies must prioritise developing nations’ access to finance and technology.

The IEA’s Global Energy Review 2021 said due to the decline in demand for other fuels during the pandemic in 2020, demand for renewable energy rose by 3%. Annual renewable capacity additions increased 45% to almost 280 gigawatts, the highest y/y increase since 1999.

In 2021, this is set to increase across the key sectors of power, heating, industry and transport, largely influenced by a 330 terawatt-hour increase in power generation from solar photovoltaics and wind turbines, the report added.

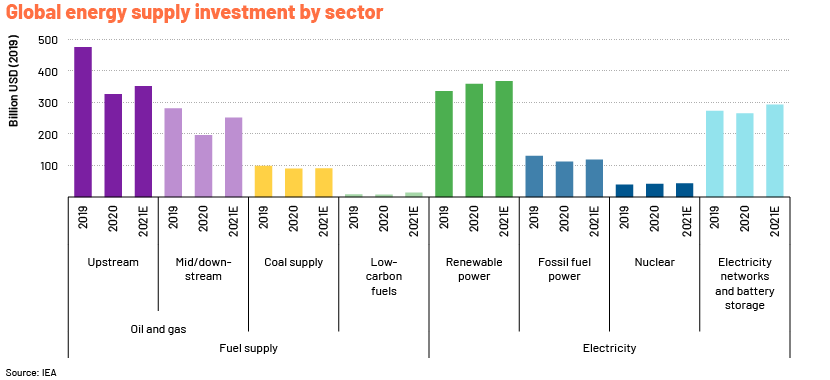

The latest trends highlight a strong rebound in global energy investments. Most of these investments will be channelled towards power and end-use sectors. According to the IEA, around 70% of these investments will be for adding power generation capacity, with renewables attracting the most investments towards capacity addition thanks to rapid technology improvements and cost reductions. A dollar spent on wind and solar photovoltaic deployment today would result in four times more electricity than a dollar spent on the same technology ten years ago, the IEA noted.

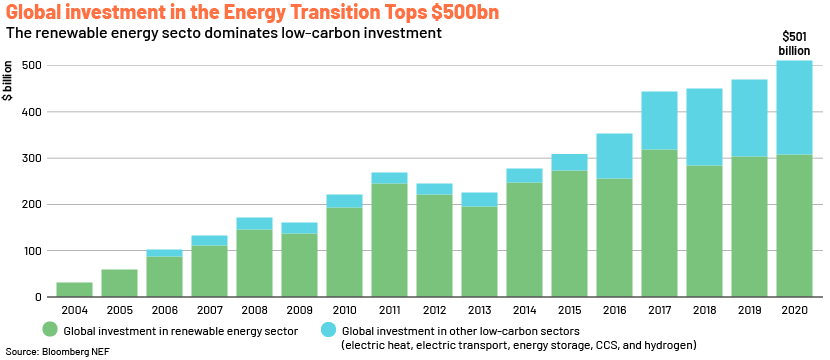

The renewable energy sector is one of the few sectors where investors have pumped in money despite the disruptions caused by the pandemic. According to Bloomberg NEF, investments in the global energy transition reached USD501.3bn in 2020. Bloomberg’s analysis also showed that companies, governments and households invested USD303.5bn in new renewable energy capacity in 2020, showing that despite COVID-19-related uncertainties, this was a 2% increase from 2019.

Main reasons for renewable energy investments rising despite the pandemic

-

Electricity generation from renewable sources rose c.7% in 2020, pushing renewables' share of the global electricity generation mix to 29% from 27% in 2019, according to the IEA’s Global Energy Review 2021 report

-

More countries are relying on electrification of heat using renewables

-

The popularity of electric vehicles has increased globally

-

Solar and wind generation costs have dropped significantly

-

Policy support from governments, low interest rates and rising oil prices also led to increased consumption of renewable energy

Conclusion

At the recently concluded COP 26 conference, United Nations Secretary-General António Guterres said, “It is an important step but it is not enough. Our fragile planet is hanging by a thread. We are still knocking on the door of climate catastrophe. It is time to go into emergency mode — or our chance of reaching net zero will itself be zero.”

Every decision taken by world leaders during this pandemic will have a long-term impact on the global economy. Reopening economies with a jump-start in clean energy investments would help the world achieve its net zero emissions target and also protect the health and welfare of its inhabitants.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI