by Chaim Siegel of Elazar Advisors, LLC

We last spoke about oil in a post on April 20th. At the time, we didn’t like the “action.” All the good news wasn’t getting oil to move up, which meant anything could take it down. Now we think the short-term trading story is turning around, back to positive. Trading “action” and upcoming news could cause oil to start moving back up.

Rewind: April 20th

“Oil is still having a tough time below a key technical resistance line. That portends downside for oil.”

Here’s the chart we showed then:

Ever since the OPEC production cuts started in early January, the price of oil has peaked. Lower lows, lower highs and a big overhead resistance helped it drop further.

That Was Then, This Is Now: The Tide May Be Turning

On April 20th oil was trading at about $50. While it hasn’t been a big move, it’s dropped into some support at $47-48. Fundamentals and technicals could be turning more bullish.

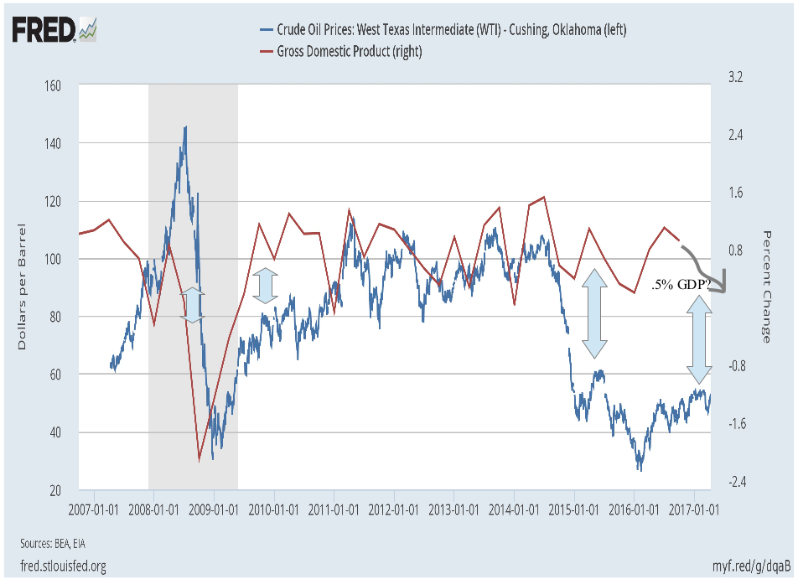

Here’s the chart we showed at the time. We expected a .5% GDP based on the Atlanta Fed’s GDP Now expectation at the time. GDP ended up coming in at .7% for Q1 as reported last Friday.

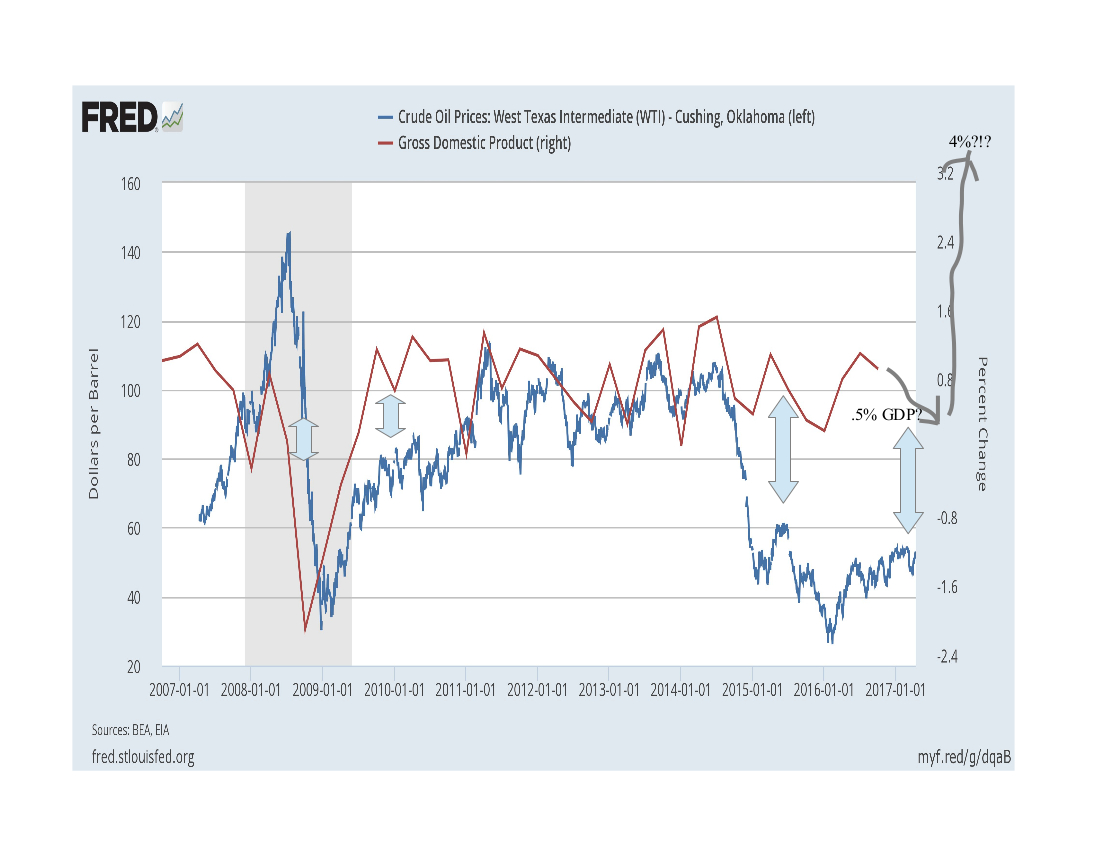

Now we have to respect a change in fundamentals. The latest Atlanta Fed’s GDP expectation for Q2 is now 4.3% which would be a monster pickup from Q1.

GDP Heading To 4%?!? Are You Joking?

Wait a minute, 4% wouldn’t just be a pickup, it would be off the charts:

4%...are you serious? Above is our literal rendition of “off the charts” 4% GDP.

If you remember, in our earlier post we made a case that oil, the blue line, tracks the red line, GDP.

4% GDP would be a crazy number. The Atlanta Fed regularly revises their number so it's possible it will come back down. But if the above chart’s relationship (GDP and oil) and the Atlanta Fed’s expectations are anywhere close to correct, look out because oil could launch.

You already have a pickup globally to some degree. If the US were to follow, oil would finally find some demand to sop up all that shale production.

We have to pay attention to a fundamental change if it does occur.

OPEC May 25th

Remember these guys, OPEC? They still matter for oil. They have a meeting on May 25th where they’ll probably decide to continue production cuts.

Those cuts helped keep oil from dropping to never never land and it’s helped the OPEC economies. We’d guess they’ll continue.

Now for some simple trader talk. With oil down on its tail into an OPEC meeting where they are looking to extend the cuts, oil has a chance to get a lift just on that.

Oil’s been known to get excited ahead of OPEC decisions. It ran up into the last OPEC decision. Heading into this meeting, oil could care.

Technicals Not That Bad

We massaged some lines here to help our case, but we think they are pretty fair.

You have two things working for you here:

- One, there is a lot of support right there at that horizontal line. That line was the cause of breakdowns, breakouts and failures.

- Two, you have an uptrend, of which we are at the bottom end.

If the two lines can hold in unison thanks to fundamentals, or even just because of too many bears and shorts, we have a decent chance of working our way back higher into the OPEC meeting.

Doesn’t sound so crazy, right?

Yesterday’s “Good Action”

If you read our April 20th report you know we love to watch action when it comes to oil. Action is the trading mechanism to watch what should happen versus what actually happens. Therein you can find clues on direction.

Yesterday’s EIA inventory numbers were decent but worse than expected. What should oil have done? Go down, right? Instead, it held and even closed up. That is a sign of “good action” and can be a clue for a near-term change in momentum.

We like it.

Conclusion

OK, we admit, at the time we wrote the April post we were hoping for a bigger move lower. But fundamentals and a key OPEC meeting have to be paid attention to. It makes sense that oil could actually catch that bid this month.

Disclosure: Securities reported by Elazar Advisors, LLC are guided by our daily, weekly and monthly methodologies. We have a daily overlay which changes more frequently which is reported to our premium members and could differ from the above report.

Portions of this report may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.