The Trade Desk (NASDAQ:TTD) has long been a dominant force in the programmatic advertising industry, consistently delivering strong growth. However, for the first time in 33 quarters, The Trade Desk missed its own guidance, marking a pivotal moment for the company. Compounding this, its Q1 2025 outlook was also disappointing. While revenue growth remained robust, management’s commentary revealed operational headwinds tied to strategic shifts.

In this article, I will analyze management’s commentary from the earnings call, with a particular focus on the restructuring efforts and their implications for The Trade Desk’s future trajectory.

Overview of The Trade DeskThe Trade Desk is the leading buy-side player in open internet advertising. The firm’s two most compelling revenue segments are streaming, where it has relationships with most major players, and retail media, where it works with countless Fortune 500 vendors.

Its competitive advantages were built by allowing advertisers to bid on and purchase unique impressions with precision, scale, and open reporting. Purchases are essentially made on an impression-by-impression basis, optimizing targeting efficacy and doubling ad return metrics. Needed data is infused into every purchasing decision to ensure ads provide the best return on investment. Unlike traditional advertising models, advertisers no longer need to commit millions upfront; instead, they can make real-time, high-accuracy ad buys, eliminating guesswork. They now know where their most valuable consumers are and how to reach them efficiently.

Kokai is The Trade Desk’s new AI-powered advertising platform. It combines its leading open-internet scale with third-party data to inject more signal into each campaign. Kokai allows buyers to focus on their key performance indicators or campaign objectives in a self-serve or fully managed environment, emulating the ease of data onboarding that made Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Meta (NASDAQ:META) successful.

Unified ID 2.0 (UID2) is the company’s omnichannel identifier, utilizing hashed emails to ensure responsible, privacy-conscious tracking. UID2 helps brands and consumers by ensuring a seamless user experience across sites and apps, complementing Kokai’s targeting capabilities by providing precise audience placement.

The Trade Desk remains committed to exclusively representing the buy-side, eliminating conflicts of interest. Products like OpenPath and UID2 are designed to enhance the sell-side ecosystem rather than replace it, ensuring a more efficient advertising supply chain.

Earnings OverviewThis was an exceptionally challenging quarter for The Trade Desk. The company posted disappointing earnings, missing not just Wall Street Q4 estimates but also its own internal projections. More notably, its adjusted EBITDA came in markedly below analysts’ expectations. CEO Jeff Green did not shy away from taking accountability, stating:

For the first time in eight years, we missed the expectations we set, and it was our fault.(All transcripts in this article are from The Trade Desk Q4 2024 earnings call)

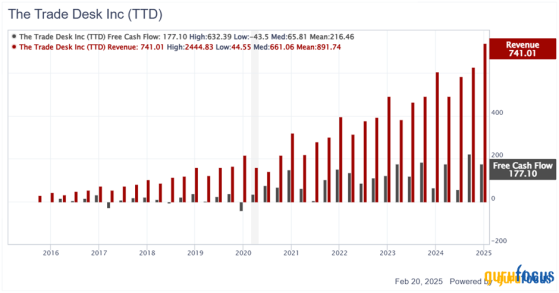

In Q4, The Trade Desk’s revenue grew 22% year-over-year (YoY) to $741 million but still missed consensus estimates by $18.55 million. More importantly, management admitted missing their guidance by at least $15 million. Despite this, The Trade Desk continues to outpace global digital advertising market growth, which is expected to grow at a CAGR of 15.4%.

GAAP EPS came in at $0.36, marking a 129% YoY growth, demonstrating The Trade Desk’s ability to leverage profitability even amidst revenue shortfalls.

The company remains in a stellar financial position, boasting $1.9 billion in cash and short-term investments with no debt. Additionally, its Free Cash Flow (FCF) margin hovers around 25%.

Source: Gurufocus

For the eleventh consecutive year, The Trade Desk maintained a customer retention rate above 95%.

Guidance for Q1 FY25 was set at at least $575 million, representing 17% YoY growth, slightly below the 18% consensus estimate.

Key Themes from the Earnings Call

Reorganizing for Growth

CEO Jeff Green repeatedly emphasized that missing guidance for the first time in 33 quarters was unacceptable, and he was notably transparent about the issue:For Q4, the reality is that we stumbled due to a series of small execution missteps, while simultaneously preparing for the future.He also noted instances where The Trade Desk could have optimized for short-term performance but chose to prioritize long-term initiatives instead, implying the company might have met its guidance if not for these strategic decisions.

In my opinion, Green protected those involved in the missteps by not naming them, but his blunt accountability ensures everyone remains on their toes.

The Trade Desk is now undergoing its largest reorganization in history:

While we often make structural changes at the end of the year to improve our business, this was bigger than usual. For most people in the company, we provided a much clearer view of their roles and responsibilities, and for most that also meant a change in reporting structure.As part of this process, The Trade Desk is adding senior leadership to support long-term scalability. Although this move will likely create short-term margin pressures, particularly with increased stock-based compensation (around 20% of revenue), management believes it will drive efficiency and innovation in the long run. In my view, The Trade Desk has outgrown its current leadership framework, and bringing in experienced executives is crucial to guiding the company’s next phase of growth.

More Focus On Brands & Competition

Beyond internal restructuring, The Trade Desk is sharpening its focus on direct brand relationships, recognizing that advertisers are becoming more strategic and data-driven. This shift aligns well with The Trade Desk’s expanding partnerships, including Disney (NYSE:DIS), Roku (NASDAQ:ROKU), Walmart Vizio (NYSE:WMT), Home Depot (NYSE:HD), Amazon (NASDAQ:AMZN), and DoorDash (NASDAQ:DASH).Although Amazon is a partner, it remains a formidable competitor. However, Green emphasized that The Trade Desk holds a significant advantage due to its objectivity and independence:

Amazon is asking advertisers, big and small, for their advertising budgets. Meanwhile, Amazon competes with most of the Fortune 500 companies in some way, whether we’re talking about Microsoft (NASDAQ:MSFT) in cloud or P&G in CPG products or UPS or Nike (NYSE:NKE) or all the rest. In our very first business plan 15 years ago, we argued that the objective independent DSP should get the lion’s share of the marketplace. They’d be the only company that can be trusted.Additionally, The Trade Desk is positioning itself to capitalize on Google’s anticipated exit from the open internet:

Most of their antitrust and regulatory problems come from the draconian ways they have engaged with the open Internet in the past. () when Google exits the open Internet, they will leave a big hole and a big opportunity for the rest of us.In my opinion, Google’s exit presents an opportunity for The Trade Desk to capture even more market share, particularly in Connected TV, where it already enjoys strong positioning.

Kokai

Kokai represents The Trade Desk’s most significant platform evolution, bringing AI-powered enhancements to programmatic advertising. CEO Jeff Green acknowledged that while Kokai is designed to enhance efficiency and improve ad-buying precision, the transition has been more complex than initially anticipated.While the rollout has been slower than expected, this appears to be a deliberate move by management. In a rapidly evolving AI landscape, The Trade Desk chose to pace Kokai’s deployment to strengthen its foundation and inject AI capabilities. While this approach has created short-term headwinds, it is likely to yield long-term benefits.

Management remains committed to completing the transition of 100% of clients to Kokai within this calendar year. Kokai will streamline operations, reduce inefficiencies, and provide advertisers with an unprecedented level of control over their campaigns. The company is investing heavily to accelerate adoption while also enhancing Kokai’s integration with UID2.

Advertisers leverage Kokai to access data from leading retailers and optimize their return on ad spend. This data is analyzed by The Trade Desk and shared with advertisers to provide valuable performance insights. Crucially, advertisers trust The Trade Desk to handle this sensitive data precisely because of its impartiality and independencean advantage Amazon lacks due to inherent conflicts of interest.

Valuation and Investment ConsiderationsThe Trade Desk has historically traded at a premium multiple, which, in my opinion, is justified by its strong execution, revenue growth, and excellent balance sheet. However, this premium also means that any misstep results in sharp stock price corrections, as evidenced by the 30%+ drop post-earnings, bringing the stock to levels not seen since February 2024.

Source: Gurufocus

Thanks to this sell-off, The Trade Desk now trades at a forward P/E of 43x, significantly below its historical mean of 89x. While this valuation remains elevated, it reflects a re-rating of expectations following the company’s recent restructuring and strategic shifts.

Source: Author

Compared to its peers, the picture is mixed. The Trade Desk holds an advantage in P/S, forward P/S, and P/GP while maintaining strong revenue growth estimates. AppLovin (NASDAQ:APP), for instance, currently boasts the highest revenue growth projections, but recent short-seller allegations have raised concerns about the quality of its revenue growth. While I haven’t fully analyzed these claims, they serve as a reminder to approach growth estimates with caution.

My Final TakeThis quarter was a defining moment for The Trade Desk. CEO Jeff Green acknowledged the company’s execution missteps, taking full accountability while simultaneously resetting expectations for the future. I believe he intentionally front-loaded all negative factors into this quarter to effectively clean the slate and reposition the company for renewed growth.

After all, despite the weaker fourth quarter, revenue was up 26% and GAAP net income grew 119% for FY2024. The Trade Desk remains a leader in programmatic advertising for the Open Internet with no conflicts of interest compared to other players. This year is expected to be UID2’s biggest year since its launch four years ago, as well as a major leap forward for digital audio and programmatic advertising.

I don’t believe this will be a quick recovery, but for long-term investors who believe in the CEO’s ability to turn the ship around, this post-earnings sell-off may present an opportunity. If management successfully executes its restructuring and strategic vision, this quarter’s disappointment will be a short-term setback.

This content was originally published on Gurufocus.com