This post was written exclusively for Investing.com

The U.S. dollar has been dropping recently, and it's looking like it may decline even further, perhaps to around 94 or even lower on the Dollar Index. On Aug. 30, I wrote that the dollar’s days were likely numbered. Since that time, the greenback has started to weaken, and based on yield spreads from around the globe, it may only continue to drop.

A weaker dollar may hold a hidden surprise for the equity market. It could give multi-national companies a much-needed revenue and earnings boost, which could help to push stocks even higher.

The Dollar Index appears to have topped out based on the technical chart at around 99. Now the index has fallen below a long-term uptrend that has been in place since September 2018, and appears to be heading towards a second uptrend, which also started around the same time. Should the index fall below that second uptrend, it is likely to drop to its next major level of technical support around 94 to 95 — a decline of about 3.5%.

The Fed’s action on Oct. 30 may help to push the dollar lower, as suggested by the technical chart. Based on the commentary and the press conference, we could be entering a lower interest rate period for longer than expected. That could be especially true given Fed Chair Jerome Powell's comments surrounding the need to see a significant rise in inflation to tightening rates.

One can infer that type of commentary, given the low inflation rates we have witnessed in the past on metrics such as the core PCE, to suggest that the Fed Funds rate could stay at their current levels or perhaps go even lower should inflation and economic growth not improve.

If 'lower for longer' proves to be the case, then it could mean that bond yields remain low for some time as well, making the U.S. currency less appealing to investors.

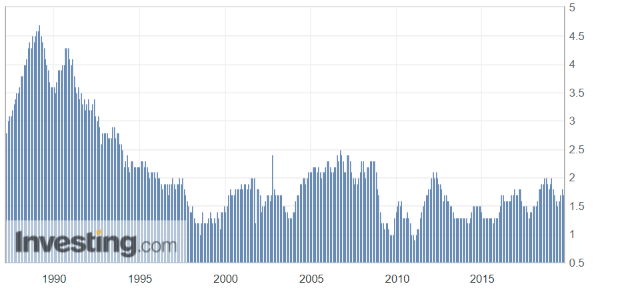

Spreads between U.S. bonds and those in Europe have been contracting over the course of the past year. Currently, the difference between U.S. and German 10-year bond yields is around 2.1% after hitting a historic high at the end of last year at 2.75%, a level not seen since the late 1980s. The reason spreads between the U.S. and Germany were widening was due to the U.S. raising interest rates, while rates in Europe remained depressed. But now, the Fed has cut rates three times as growth has slowed — and falling rates in the U.S. are causing the spreads to contract and return to their historical norms.

Now, as those spreads contract, the dollar, as measured by the Dollar Index, has stopped strengthening and likely peaked this summer. It appears that the greenback may give way and begin to finally weaken.

If that happens, it could provide a meaningful boost to equities and their earnings, especially for multinational companies. A weakening USD helps to make goods produced by U.S. companies more appealing abroad. Additionally, a weaker buck can help to boost revenue and earnings for companies as they benefit from the more favorable foreign exchange rate. Higher corporate earnings will help to contract the price-to-earnings ratio on stocks and make those stocks more attractive.

Overall it seems the winds of change may be blowing, which suggests that the dollar could be about to begin to weaken versus other currencies. Should that happen, it could give a very big boost to the U.S. economy, and maybe stoke some inflationary forces too.