Emerging market equity returns have been a mixed bag over the past decade, with performance varying widely from country to country.

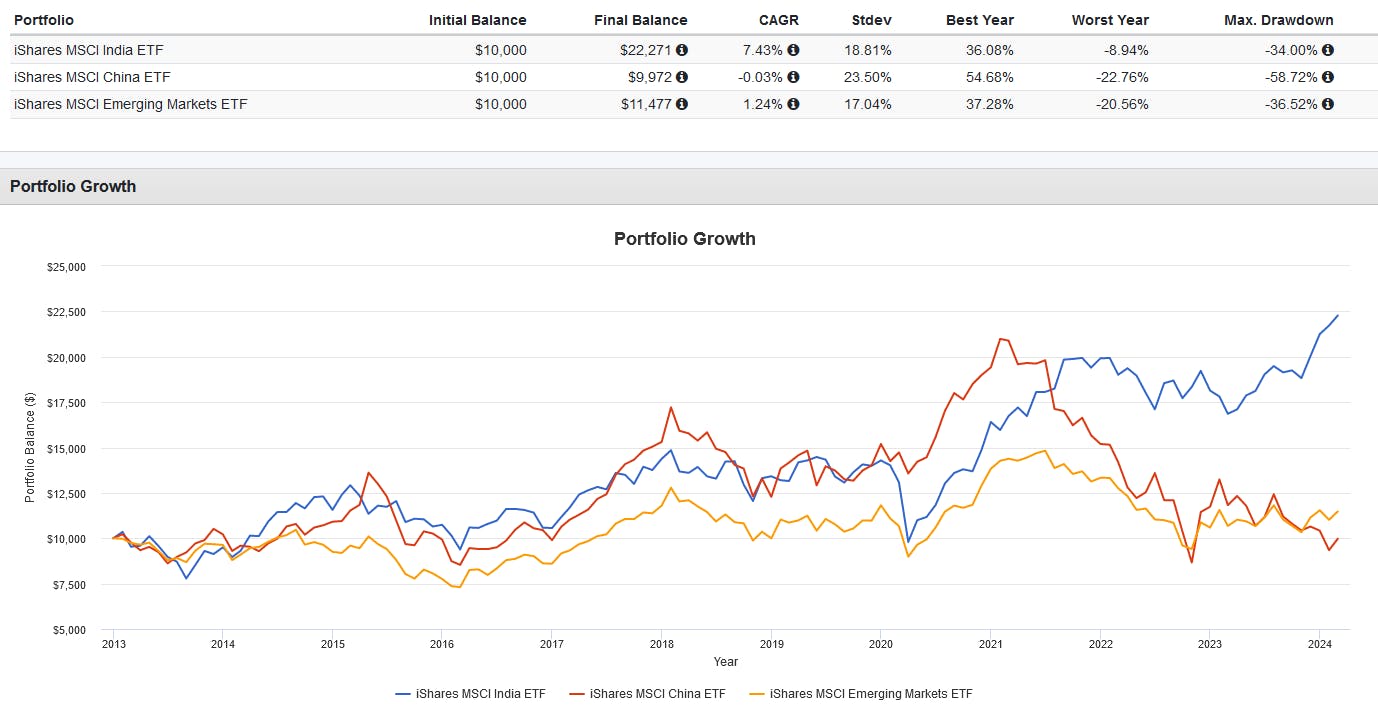

For instance, the broad iShares MSCI Emerging Markets ETF (NYSE:EEM) has seen an annualized return of just 1.24% since 2013, while the iShares MSCI China ETF (MCHI), representing the largest emerging market country, has fared even worse, with returns hovering around -0.03%.

However, India, the second-largest emerging market, has bucked this trend impressively, delivering an annualized return of 7.43% over the same period based on the performance of the iShares MSCI India ETF (INDA).

Today, Deloitte's India economic outlook further bolsters the case for investing in India, projecting growth rates of between 6.9% and 7.2% through fiscals 2023 to 2024, and 6.4% to 6.7% in the subsequent year.

Deloitte also notes that India's economy has benefited from significant tailwinds, including a digital economy that expanded 2.4 times faster from 2014 to 2019, creating approximately 62.4 million jobs.

In addition, the government's focus on attracting investment has led to commitments worth INR $3 trillion, with a significant portion directed towards the manufacturing sector. This ramp-up in manufacturing capacity is also enhancing India's share of exports.

For investors looking to tap into this growth, there are several NYSE-listed ETFs that provide cost-effective access to the Indian stock market. Below are three of the best options available for investing in India. For a more comprehensive list, the ETF Central screener offers detailed insights and comparisons.

WisdomTree India Earnings Fund (EPI)

While the two dominant iShares ETFs for India typically weight their holdings by market capitalization, favoring proportionately larger stocks, EPI adopts a distinct approach.

EPI employs a "fundamentally weighted" method, where Indian equities are weighted based on their earnings, defined by net income in the fiscal year preceding the Index measurement date, with adjustments for factors that account for shares available to foreign investors.

This methodology aims to emphasize companies with strong earnings potential, potentially offering a more balanced representation of the market's value and mitigating the concentration risk associated with cap-weighted indices.

Despite a relatively high expense ratio of 0.85%, EPI has demonstrated its value to investors, delivering an annualized return of 9.17% since 2013. This performance not only showcases the potential benefits of its earnings-weighted strategy but also significantly outpaces the 7.43% annualized return of the market-cap-weighted INDA over the same period.

Franklin FTSE India ETF (FLIN)

One of the primary concerns for investors considering foreign equity ETFs is the associated cost. For instance, the widely held INDA ETF incurs a 0.65% expense ratio, which translates to $65 in annual fees for a $10,000 investment.

From the ETF issuer's perspective, emerging market equities tend to be more expensive due to factors such as higher transaction costs, regulatory compliance complexities, and currency conversion costs.

In response to the demand for more cost-effective investment options, Franklin Templeton offers a compelling alternative with FLIN. This ETF, which tracks the FTSE India Capped Index, comes with a significantly lower expense ratio of just 0.19%.

FLIN provides exposure to 213 large and mid-cap Indian equities, following a market capitalization-weighted approach. Its top holdings include major companies such as Reliance Industries, Infosys, Tata Consultancy, and HDFC Bank, offering investors a diversified portfolio of some of India's leading firms.

Columbia India Consumer ETF (INCO)

For investors interested in a more targeted approach within an emerging market country, specific sectors or industries can offer unique growth opportunities. In the case of India, one compelling theme is consumer growth.

The reason is straightforward: India's large and still expanding population serves as a continual tailwind, fueling demand across a wide range of consumer goods and services. This demographic advantage, coupled with increasing digitalization, creates fertile ground for consumer sector expansion.

INCO caters precisely to this theme, selecting the 30 largest companies in the consumer staples and discretionary sectors within India. To ensure diversification within its portfolio, INCO caps individual holdings at 4.9% and undergoes annual reconstitution and rebalancing.

Despite a relatively high expense ratio of 0.75%, INCO has demonstrated its value by outperforming both INDA and EPI since 2013, delivering an impressive 10.90% annualized return.

This content was originally published by our partners at ETF Central.