- Fed's jumbo rate cuts have eased recession fears as stocks reach record highs.

- Meanwhile, the industrial sector shows growth potential amid the broadening rally.

- We'll take a look at the sector's prospects and one stock worth considering.

- Looking for actionable trade ideas to navigate the current market volatility? Unlock access to InvestingPro’s AI-selected stock winners for under $9 a month!

The market has made it clear: rate cuts don't signal an imminent recession, won't bring inflation back, and don’t cap equity yields.

Despite early fears in 2022 that a recession was inevitable due to the inverted yield curve and soaring inflation, those concerns never materialized.

Inflation appears to be under control, the Fed has already cut rates, and the stock market continues to hit record highs.

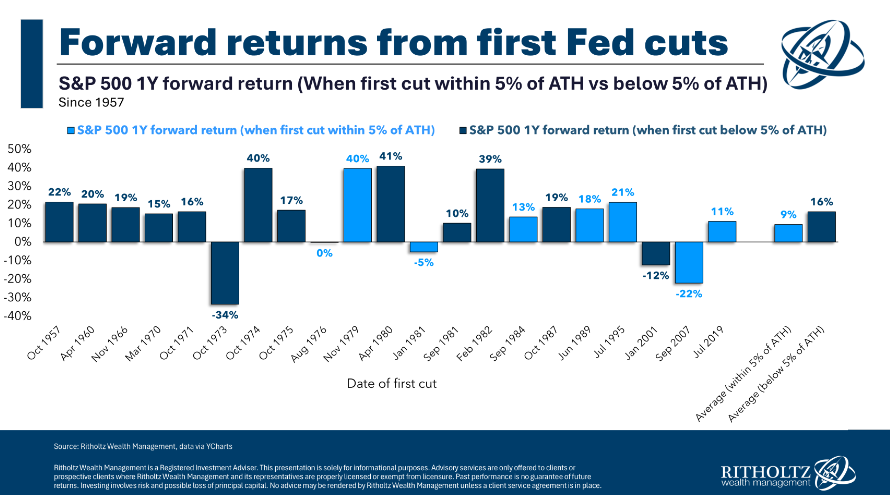

Historically, the 12-month returns following a Fed rate cut have been solid. The chart below tracks future yields after each rate cut since 1957, and the numbers speak for themselves—annual returns have been impressive.

Industrials Could Ride the Rate-Cut Wave Higher

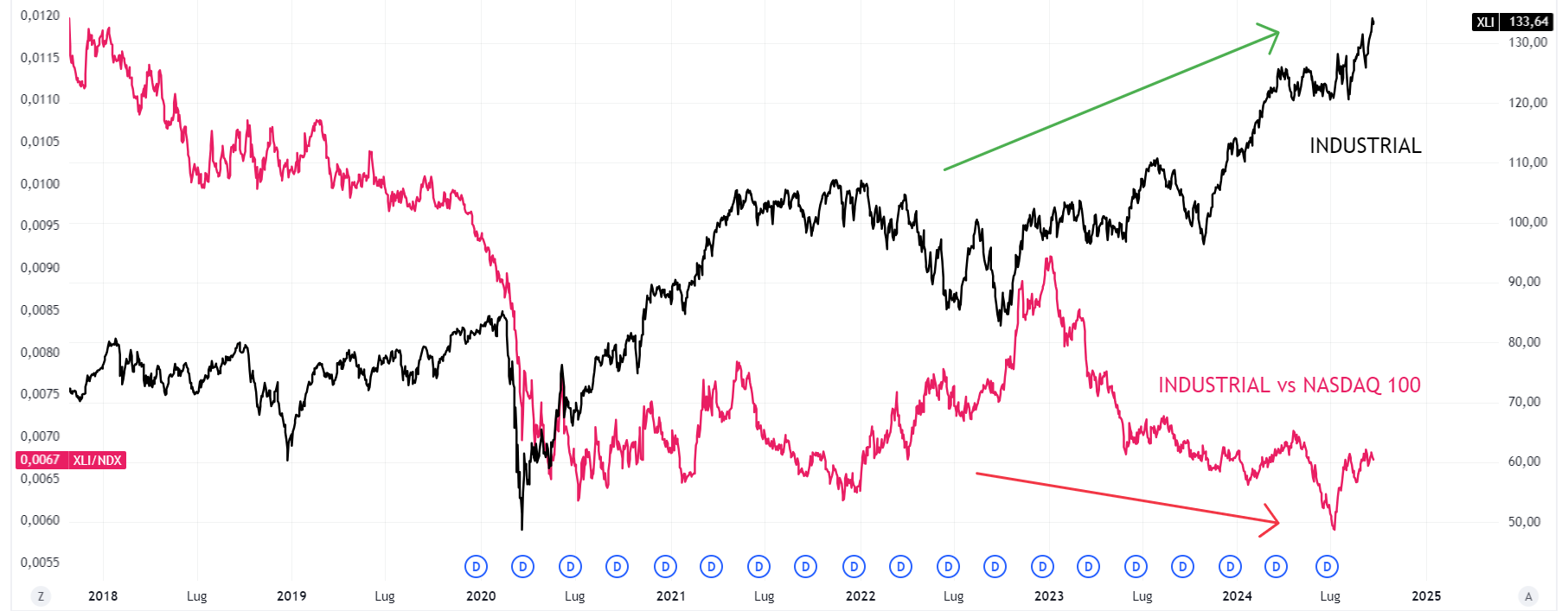

If you're looking for the next hot sector, consider industrials. Over the past decade, it has surged over 200%, driven by a strong bullish trend.

But when we compare it to the Nasdaq, we see industrials have hit new lows in the past four years. This isn’t a sign of weakness in industrial stocks but rather the exceptional strength of growth stocks.

Top Stocks to Watch From the Sector

Here are 10 stocks that could extend the bullish trend in the coming months:

- GE Aerospace (NYSE:GE)

- Caterpillar (NYSE:CAT)

- RTX Corp. (NYSE:RTX)

- Union Pacific (NYSE:UNP)

- Uber Technologies (NYSE:UBER)

- Honeywell International (NASDAQ:HON)

- Eaton Corporation (NYSE:ETN)

- Lockheed Martin (NYSE:LMT)

- Boeing (NYSE:BA)

- Automatic Data Processing (NASDAQ:ADP)

We’ve ranked them in Pro watchlists based on analysts' predicted upside potential.

Source: InvestingPro

A review of their performance over the past five years, as well as the last year, reveals robust growth across the board, with analysts projecting an average upside of 20%.

The majority of these companies belong to the aerospace and ground transportation sectors.

Source: InvestingPro

Uber Technologies: The Top Pick?

Additionally, when ranked by growth rate, Uber Technologies stock emerges as both a top performer and one of the most undervalued stocks. Analysts' watchlists indicate substantial upside potential.

Source: InvestingPro

This indicates a substantial price increase during this period, signaling a favorable market response to the company's strategies.

Source: InvestingPro

Uber’s financial health score supports its bullish outlook, with a rating of 4 out of 5.

The company boasts a low price-to-earnings (P/E) ratio relative to its short-term earnings growth, further highlighting its undervalued status.

Source: InvestingPro

Analysts expect Uber to be profitable this year, signaling stronger revenue than costs—a key indicator of its potential to continue growing and reinvesting in its business.

Source: InvestingPro

Bottom Line

The current market landscape offers attractive opportunities, especially in the industrial sector. With rate cuts alleviating recession concerns and some stocks showing notable growth potential, investors should look for strategic positions.

Companies like Uber Technologies highlight a mix of strong financial health and undervaluation, positioning them well for future gains.

Subscribe now with an exclusive discount and unlock access to several market-beating features, including:

- InvestingPro Fair Value: Instantly find out if a stock is underpriced or overvalued.

- AI ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.