By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

When the European Central Bank unveils a fresh round of stimulus on Thursday, the announcement will not be a surprise for most investors. Euro traders have had plenty of time to prepare for the move and based upon the 8% decline in the EUR/USD over the past 6 weeks, they sufficiently discounted fresh easing from the central bank. However many analysts believe that EUR/USD is headed for parity and we agree that the path of least resistance for the euro is lower. Euro is extremely oversold but with less than 24 hours to go before the monetary policy announcement, there's still significant uncertainty surrounding the actions that the ECB will take. ECB President Draghi pledged to "do what we must" to return inflation to 2% "as quickly as possible" and the desire to get ahead of the slowdown could mean more aggressive policy action.

The 5 Most Alluring ECB Options:

- Cut the deposit rate by 0.1% or 0.2%

- Extend the QE end date beyond September 2016

- Frontload bond purchases

- Broaden types of assets purchased

- Introduce a two-tired deposit system

We do not believe that investors have sufficiently discounted the potential aggressiveness of the central bank's actions. Draghi could choose one or a combination of these measures and the more actions they take the more weakness we expect in EUR/USD. Extending the end date of QE is almost certain since it was always a soft target. The same is true for front loading bond purchases -- they've done it before and will do it again. Lowering the deposit rate will automatically broaden the bonds they can purchase because the ECB prefers not to lose money but yields would adjust quickly. Broadening the types of assets purchased to include sub-sovereign bonds and nonperforming loans is the most controversial. In addition to these actions, the ECB's forward guidance will also have a significant impact on the euro -- if they maintain an easing bias and suggest that they are willing to increase stimulus further, then a 2 to 3 big-figure move in EUR/USD would not be a surprise. If the ECB shifts to wait-and-see mode after easing, the initial 1 to 2 big-figure decline (depending on the aggressiveness of the program) could find support quickly.

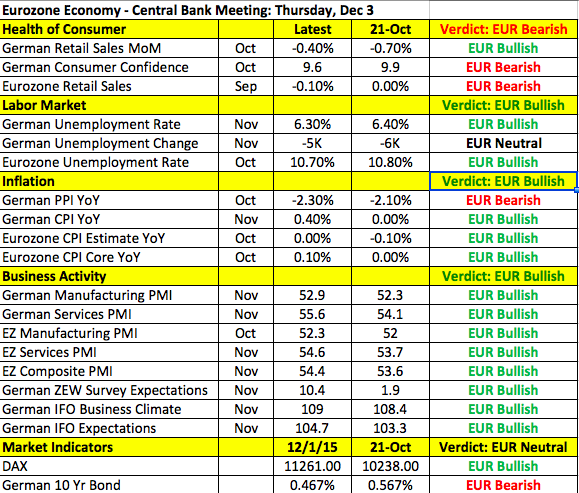

It is extremely difficult to handicap the central bank's level of aggressiveness. Based on ECB rhetoric, low inflation, the decline in commodity prices and the risks that the Paris attacks pose to the region's economy, the actions by the central bank should be bold. However some investors may find it surprising that the German and Eurozone economies saw more improvement than deterioration since the October meeting. The table below shows the decline in unemployment rates, uptick in consumer prices, acceleration in manufacturing and service-sector activity. In other words, the ECB has less to be worried about in December than October. There's no doubt that the French economy slowed as a result of the Paris attacks but the markets avoided a major sell-off. So if Draghi chose to do so, he could reserve some stimulus for a later time when the slowdown actually manifests in the data -- but that is not generally his style.

Investors should brace for big moves on Thursday starting with the 07:45 NY Time rate decision and the 08:30 NY Time press conference. If the ECB lowers rates at 07:45, expect EUR/USD to lose close to 1 big figure shortly after the announcement and stabilize prior to Draghi's press conference. How much the EUR/USD declines afterwards will hinge on the additional measures announced by the ECB head. Since we are looking for relatively aggressive action, by the end of the day we expect the EUR/USD to be trading approximately 2 big figures lower than its pre-ECB level, which would still keep the currency pair above parity. If a test of parity were to occur, it should be closer to FOMC.

Wednesday's trading was marked by broad-based U.S. dollar strength. Thanks to a healthy ADP report, the greenback moved higher against all of the major currencies. A total of 217k jobs was added to U.S. payrolls according to the latest report. Not only was that much stronger than anticipated, but unit labor costs rose sharply in the third quarter as well. Janet Yellen also made it clear that she is ready to hike. In her speech on Wednesday, she talked about labor gains since October, strong household spending, lessened downside risks abroad and her expectations that inflation will rise above 2% in the coming years. Considering that labor gains bolster her confidence on inflation, "delaying liftoff too long risks abrupt tightening later." Between the stronger ADP report and Yellen's comments, we expect further U.S. dollar strength pre-FOMC.

Of all the major currencies, GBP was the day's worst performer. On an intraday basis, sterling fell more than 1% versus USD, CHF and CAD. Construction activity grew at its slowest pace in 2 years according to the PMIs but what killed the currency was U.S. dollar strength and triggering of stops below 1.4990. A quick look at a daily GBP/USD chart shows that there is typically continuation after strong one-day moves. In early November, for example, GBP/USD dropped from 1.54 to 1.5205 in 24 hours and the day after, it lost another 180 pips. On September 21, a 160-pip decline was followed by a 140-pip move. With Yellen and her counterparts speaking again on Thursday and U.K. PMI services scheduled for release, there's scope for additional weakness in GBP/USD. The next level of support is the 2013 low of 1.4815.

The Bank of Canada's monetary policy decision ended up having less impact on the Canadian dollar than oil prices. The BoC left policy unchanged and maintained a dovish-to-slightly-neutral monetary policy outlook. They said inflation risks were roughly balanced and that rate sensitive non-resource exports were picking up. The low dollar and policy easing are helping the recovery and not much has changed since October. USD/CAD's price action in the lead up to BoC indicates that investors were bracing for more dovishness. However the primary driver of loonie flows was oil, which fell close to 4% intraday. Speculation about an output cut at this week's OPEC meeting on December 4 sparked significant volatility in the currency.

The Australian and New Zealand dollars also traded lower versus the greenback despite stronger Australian growth in the third quarter. The performance of both currencies were dictated by the market's appetite for U.S. dollars.