Canadian investors could be having trouble deciding what to do with their investments in this uncertain economic environment, and there are enough stock gurus on Youtube and TikTok out there to make one’s head spin.

But as we near the mid-point of 2023, one thing cannot be argued with: returns. The investment returns of different sectors can often provide a level of insight as to what has happened in the financial markets and possibly help to inform future decisions.

To date in the Canadian markets, there has been a clear winner in terms of performance —the Information Technology sector. However, as of May 10th, essentially every sector (outside of Energy) is in the green suggesting that recessionary fears and inflation persistence have not dented company profitability, investor optimism or consumer sentiment anywhere near the extent that had been anticipated last year.

Top Year-to-date (YTD) Sector Performers in Canada

When gauging the performance of individual Canadian sectors, corresponding indices (offered by S&P/TSX) provide a helpful benchmark. Alternatively, passive ETFs which have been designed to track these indices can same the serve purpose as returns should be essentially identical.

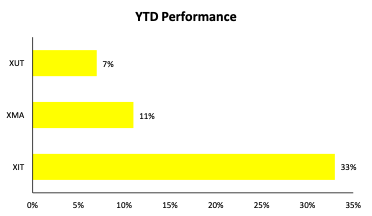

BlackRock’s iShares offers a suite of low-cost ETFs that passively track key Canadian sectors. Here are the top three Canadian sector-based ETFs according to YTD performance:

1.iShares S&P/TSX Capped Information Technology Index ETF (TSX:XIT) (XIT)

2. iShares S&P/TSX Capped Information Technology Index ETF(TSX:XMA) (XMA)

3. iShares S&P/TSX Capped Utilities Index ETF (TSX:XUT) (XUT)

For alternative sector ETFs, CBOE’s ETF Screener provides a useful resource enabling you to customize the sectors, geographies, asset classes etc., you’d like to screen for.

Source: CBOE Canada

However, looking at returns alone is not enough to draw any meaningful conclusions as to the state of play. Let’s dive a bit deeper into possible reasons why these sectors have outperformed and consider potential future risks.

Investing in Information Technology

Information technology is a relatively small sector within Canada however it is extremely top-heavy, with two companies, namely Shopify (TSX:SHOP) and Constellation Software (TSX:CSU), making up a staggering 50% of the representative S&P/TSX Information Technology index.

Essentially, Canada’s technology sector is a slightly more diversified play on four companies which collectively make up around 80% of the index. The sector’s performance has been pulled upwards by an extremely strong 79% rally in Shopify shares and a 24% increase in Constellation shares.

Of course, this year-to-date dynamic could move in the opposite direction as well given that Shopify has historically proven to be a fairly volatile stock.

Canadian ETF investors looking for more diversified exposure than currently offered through funds tracking the S&P/TSX Information Technology index could consider TD (TSX:TD) Asset Management’s TD Global Technology Leaders Index ETF (TSX:TEC) (TEC). TEC aims to replicate the performance of the Solactive Global Technology Leaders Index which provides exposure to the growth potential of a broad number of both traditional technology companies and those engaged in technology-related themes.

Investing in the Materials sector

The Materials sector is underpinned largely by commodity prices, whether that be precious metals such as gold or silver, base metals such as copper, or even fertilizers and lumber. The largest weights in this index are underpinned by gold miners such as Barrick Gold (NYSE:GOLD), Franco Nevada (TSX:FNV) and Agnico Eagle Mines (TSX:AEM)—who collectively make up more than 30% of the sector’s weighting.

Gold prices have seen a 12% rally thus far in 2023, which has helped boost this sector’s returns. Recessionary fears or a loss of confidence in the dollar’s value have typically led to positive returns for Gold, so it’s likely the recent news headlines relating to the U.S. debt ceiling and rampant inflation are helping drive the current gold rally.

Should this sentiment pivot, however, then gold prices could come off and lead to greater underperformance in the sector.

Investing in Utilities

The Utilities sector is often thought of as the “boring” sector generally housing companies that produce consistent returns and provide strong dividend payments, including globally diversified utility and infrastructure companies such as Fortis (TSX:FTS), Brookfield Infrastructure (TSX:BIP_u), Northland Power (TSX:NPI) and Brookfield Renewables (NYSE:BEPC).

This sector typically outperforms in uncertain or recessionary environments because while investors can’t predict exactly where consumers might choose to spend their hard-earned cash when times are tight, they do know a steady amount will be allocated to heating and powering homes and businesses. Again, should recessionary fears begin to taper, however, we could see a material underperformance in this sector.

Data as of May 10th, 2023, unless otherwise noted.

This content was originally published by our partners at the Canadian ETF Marketplace.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI