With the latest round of 13F filings released over the past month, investors and market watchers alike are interested in seeing where the major hedge fund managers are finding value opportunities.

BackgroundManagers with more than $100 million in assets under management are required to disclose their holdings to the SEC each quarter via 13F filings. These filings are due 45 days after the quarter end date. For second-quarter 2024, that means managers must disclose all qualifying assets held on June 30, 2024 by Aug. 15, 2024. Qualifying assets include long positions in U.S. equities and ADRs, call/put options and convertible debt securities. Shorts, cash positions, foreign investments and other assets are not included.

Investors can take advantage of these 13F filings to create portfolios from managers that have proven past success. Despite the 45-day delay in reporting, research has shown that investing alongside a single manager or group of managers can outperform the market. The key is to identify the best and most consistent funds to copy.

The statistics in this report are based on our Premium gurus. These gurus are our hand-picked, best-performing value investors that have proven long-term records.

Magnificent 7 stocks make up large portion of the Aggregated PortfolioThe GuruFocus Aggregated Portfolio, a Premium feature based on these managers' quarterly filings, shows the 10 most broadly held stocks as of the end of the second quarter of 2024 included some Magnificent Seven names that were also popular in the previous quarter, such as software giant Microsoft Corp. (NASDAQ:MSFT), Google parent Alphabet Inc. (NASDAQ:GOOGL) and social media leader Meta (NASDAQ:META) Platforms Inc. (NASDAQ:META).

TickerCompanyNo. of Guru OwnersNo. of BuysNo. of Sells| MSFT | Microsoft Corp. | 65 | 17 | 39 |

| GOOGL | Alphabet Inc. | 54 | 9 | 36 |

| AMZN | Amazon.com Inc (NASDAQ:AMZN). | 49 | 14 | 28 |

| META | Meta Platforms Inc. | 47 | 13 | 33 |

| UNH | UnitedHealth Group Inc (NYSE:UNH). | 44 | 26 | 15 |

| AAPL | Apple Inc (NASDAQ:AAPL). | 42 | 21 | 17 |

| BRK.B | Berkshire Hathaway Inc. (NYSE:BRKa) | 39 | 12 | 19 |

| DIS | The Walt Disney (NYSE:DIS) Co. | 36 | 12 | 19 |

| TSM | Taiwan Semiconductor Manufacturing Co. Ltd. | 35 | 15 | 18 |

| BAC | Bank of America Corp (NYSE:BAC). | 35 | 10 | 22 |

| UNH | UnitedHealth Group Inc. | 25 | 13 | 40 |

| AAPL | Apple Inc. | 21 | 16 | 41 |

| CVS | CVS Health Corp. | 19 | 8 | 26 |

| XOM | Exxon Mobil Corp. | 19 | 9 | 25 |

| MSFT | Microsoft Corp. | 17 | 39 | 59 |

| AVGO | Broadcom (NASDAQ:AVGO) Inc. | 16 | 11 | 26 |

| COP | ConocoPhillips (NYSE:COP) | 16 | 10 | 27 |

| ADBE | Adobe (NASDAQ:ADBE) Inc. | 16 | 11 | 29 |

| GEV | GE Vernova Inc. | 15 | 13 | 18 |

| TSM | Taiwan Semiconductor Manufacturing Co. Ltd. | 15 | 18 | 33 |

| NTRA | Natera Inc. | 8 | 9 |

| MOH | Molina Healthcare Inc. | 8 | 9 |

| GRAL | Grail Inc. | 7 | 7 |

| COLL | Collegium Pharmaceutical Inc. | 7 | 7 |

| TS | Tenaris SA | 6 | 6 |

| IBIT | iShares Bitcoin Trust ETF | 6 | 6 |

| IWF | iShares Russell 1000 Growth ETF | 6 | 7 |

| ZETA | Zeta Global (NYSE:ZETA) Holdings Corp. | 6 | 6 |

| CAVA | Cava Group (NYSE:CAVA) Inc. | 6 | 6 |

| TDY | Teledyne Technologies Inc. | 6 | 8 |

| NWSA | News Corp. | 0 | 9 | 9 |

| BERY | Berry Global Group Inc. | 0 | 8 | 6 |

| L | Loews Corp (NYSE:L). | 0 | 8 | 7 |

| MSA | MSA Safety Inc. | 0 | 8 | 4 |

| REVG | REV Group Inc. | 0 | 8 | 4 |

| IDCC | InterDigital Inc. | 0 | 8 | 7 |

| FTAI | FTAI Aviation Ltd. | 0 | 7 | 7 |

| GFI | Gold Fields Ltd. | 0 | 7 | 7 |

| UPWK | Upwork Inc. | 0 | 6 | 4 |

| ES | Eversource Energy | 0 | 6 | 4 |

| Software | 335 | 311 | 1,168 |

| Biotechnology | 190 | 302 | 737 |

| Oil & Gas | 188 | 217 | 767 |

| Banks | 136 | 159 | 745 |

| REITs | 134 | 185 | 482 |

| Hardware | 125 | 129 | 455 |

| Insurance | 119 | 79 | 415 |

| Retail- Cyclical | 118 | 117 | 441 |

| Semiconductors | 109 | 128 | 393 |

| Industrial Products | 100 | 123 | 425 |

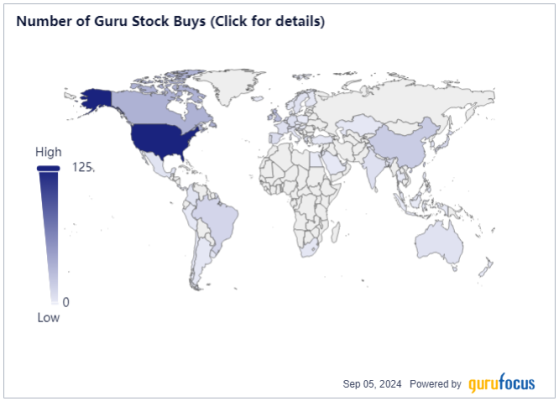

| United States | 125 | 123 |

| Canada | 35 | 46 |

| United Kingdom | 30 | 27 |

| Ireland | 20 | 16 |

| China | 19 | 24 |

| Bermuda | 17 | 9 |

| Luxembourg | 15 | 7 |

| Israel | 13 | 16 |

| Brazil | 13 | 7 |

| Switzerland | 13 | 12 |

During the quarter, a number of well-known gurus were also making large bets in international companies by either entering new positions or expanding their existing holdings. For example, Canadian investor Francis Chou (Trades, Portfolio) boosted his stake in the Netherlands-based Stellantis NV (NYSE:NYSE:STLA). Spain's Azvalor also established a holding in Linea Directa Aseguradora SA (XMAD:LDA).

TickerCompanyGuruImpactNo. of Shares| XMAD:LDA | Linea Directa Aseguradora SA | Azvalor Iberia Fi | +8.43% | 2.73 million |

| CNH | CNH Industrial NV | Tweedy Browne (Trades, Portfolio) | +6.66% | 15.36 million |

| STLA | Stellantis NV | Francis Chou (Trades, Portfolio) | +6.04% | 456,388 |

| BIDU | Baidu Inc (NASDAQ:BIDU). | Michael Burry (Trades, Portfolio) | +5.77% | 155,000 |

| TSXV:RET.A | Reitmans Ltd. | Chou RRSP Fund (Trades, Portfolio) | +5.51% | 429,100 |

| BABA | Alibaba (NYSE:BABA) Group Holding Ltd. | Michael Burry (Trades, Portfolio) | +4.11% | 155,000 |

| AZN | AstraZeneca PLC (LON:AZN) | George Soros (Trades, Portfolio) | +3.66% | 2.45 million |

| BORR | Borr Drilling Ltd. | Azvalor Internacional FI (Trades, Portfolio) | +3.65% | 6.66 million |

| TSX:MRC | Morguard Corp. | Chou RRSP Fund (Trades, Portfolio) | +3.62% | 5,800 |

| XMAD:GRF | Grifols SA | Azvalor Iberia FI (Trades, Portfolio) | +3.31% | 157,506 |

| SPY | S&P 500 ETF Trust | 18 | 9 | 7 |

| GLD | SPDR Gold Shares (NYSE:GLD) ETF | 10 | 5 | 6 |

| RSP | Invesco S&P 500 Equal Weight ETF | 9 | 6 | 4 |

| XLF | Financial Select Sector SPDR | 9 | 4 | 3 |

| EFA | iShares MSCI EAFE ETF | 9 | 4 | 2 |

| GDX | VanEck Gold Miners ETF (NYSE:GDX) | 8 | 2 | 4 |

| IVV | iShares Core S&P 500 ETF | 8 | 4 | 3 |

| XLE (NYSE:XLE) | Energy Select Sector SPDR Fund | 8 | 3 | 6 |

| IJH | iShares Core S&P Mid-Cap ETF | 7 | 5 | 2 |

| IWM | iShares Russell 2000 ETF | 7 | 5 | 2 |

Related Guru Screens you may be interested in:

Real-Time Picks

Aggregated Portfolio

Consensus Picks

Hot Picks

Guru Bargains

Industry Trends

This content was originally published on Gurufocus.com