Canada’s federal government is committed to aggressive emission targets that focus heavily on its heavyweight oil and gas sector. Although well-intentioned, the regulations will likely have little (or a net negative) impact on global emissions, whilst hamstringing Canada’s most value-creating sector. What will the net result likely be instead? Canadian energy will be (even) less competitive on the global market, Canuck companies will benefit less than their American counterparts, and investors will likely be better off investing in American energy stocks rather than those native to the TSX. On the economic front, Canadian consumers can expect even higher prices for oil and gas, adding upwards inflationary pressure to the CPI (which is the highest it has been in 2 decades, and rising steadily), and slowed economic growth that is the inevitable consequence of crippling an industry that contributes 10% of Canada’s GDP and 25% of its exports.

The economic and environmental opportunity cost of Canada’s climate targets

In line with the Liberal’s vision for Canada, and its oil and gas sector to reach zero net emissions by 2050, Trudeau’s government is aiming for a Canadian energy sector that has, by 2030, entirely phased out coal, virtually no reliance on oil, and natural gas fully regulated for greenhouse emissions. Canada has also committed to ending new direct public financing to the sector by 2022. Unfortunately, the targets are unlikely to make a positive difference on global net emissions even if they are achieved. Canada produces only 1.5% of global emissions: too little to make a major impact, particularly when high emitters like India, China, and Russia continue full steam ahead, with ambiguous or unambitious targets for emission cuts. Whilst any net reduction in emissions is admirable, Trudeau’s policies may well have a counterproductive impact on global net emission, and come at a heavy economic and environmental opportunity cost.

One need not imagine a worst-case scenario but only look to Europe, where soaring gas prices and blackouts have resulted in Germany and the UK begging for natural gas from Russia, a producer that ironically is far less emission-conscious than Europe. Similarly, the U.S., once energy-independent and a net exporter of crude, has been reduced to begging and bargaining with OPEC+ for lower crude prices, raising the oft-asked question: why is OPEC oil more environmentally friendly than Brent or WTI? (Spoiler alert: it isn’t.) The greatest environmental and economic cost is certainly the missed opportunity to export natural gas to Asian markets as a substitute for higher-emitting coal, which major emitters like India and China are willing to burn at any environmental cost to supply their populations with affordable energy.

Despite climate change commitments and reinvestment into Emerging Future Technologies, even the most green-friendly forecasts show that oil and gas demand is yet to peak. In this instance, Canada is perhaps too far ahead of the curve. Multiple forecasts, including both McKinsey’s bullish and accelerated transition scenarios and all EIA’s scenarios (most fossil fuel reliant STEPS, moderate NZE, and greenest APS) agree that gas is set to peak in the mid-late 2030s, diverging only in the anticipated intensity of decline until 2050. India’s demand for natural gas alone is expected to triple by 2030. Although the scenario for oil is less bullish, demand for crude is not expected to peak until 2029 as per McKinsey, until which time will require increased production as the world enters what recently has been called an extended period of oil scarcity.

The eventual decline in the demand for crude will certainly be accelerated for heavier Canadian crude relative to WTI, Brent, and other lighter crudes as supply free up and the demand for more preferred crudes is more easily met. This leaves Canada with a very limited window of opportunity to capitalize on its vast reserves of crude oil and its contributions to the Canadian and Albertan Economy. In the long term, particularly after 2050, even the most bullish forecasts for fossil fuels agree that they’re on the way out. But 2050 is a long way away. Until then, whether reduced or not, demand for fossil fuels will remain, combined with scarce supply (whether organic or artificially maintained by producers) that will keep prices expensive enough to remain profitable. Canada would do well to capitalize on the opportunity.

The impact on Canadian Energy prices and differentials with U.S. products

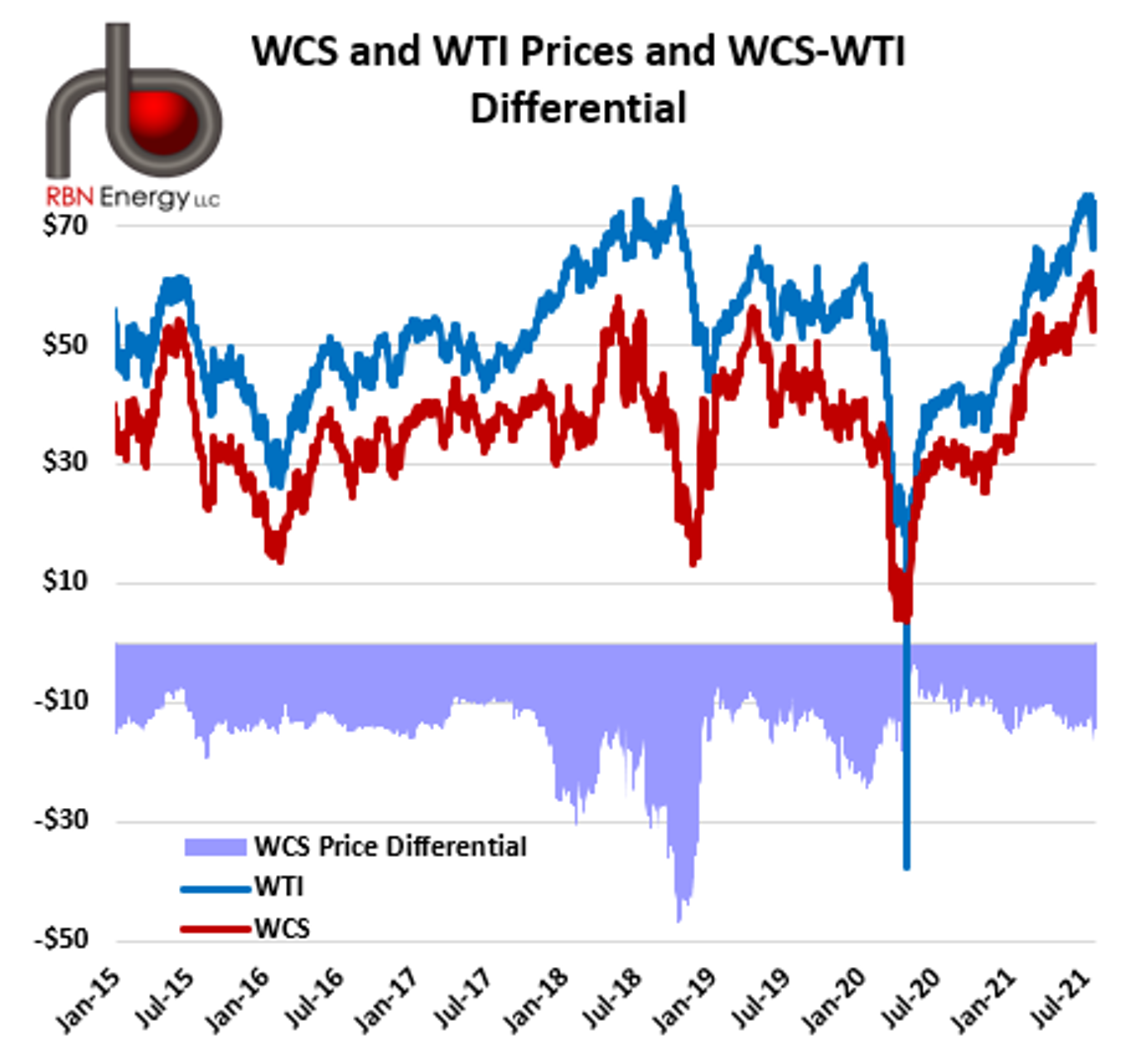

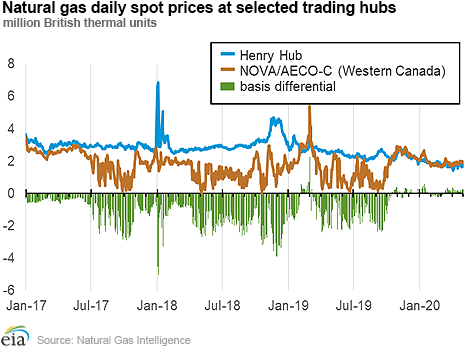

Whilst Canadian energy prices will continue to benefit from the forecasted demand and predicted scarcity, the increased cost of greener production will likely make Canadian energy prices (even) less competitive on global markets, particularly as resource-rich exporters like Saudi Arabia, Iran, Iraq, Russia, Qatar, Norway, and the U.S. amp up drilling, and both the U.S. and Russia continue to step up production and exports of gas. The effect of less competitive Canadian energy prices will likely be felt in widening differentials between U.S. and Canadian energy. Canadian energy prices for both crude oil and natural gas typically trade at wide and volatile differentials compared to U.S. benchmarks, at least partially due to production locations far from demand centers, and inadequate energy infrastructure that cannot efficiently respond to demand (WCS is said to be “twice-discounted”, once due to quality, and secondly due to the cost of transport).

These issues will likely be exacerbated as Canadian producers seek to capitalize on higher-priced markets, whilst public investments into energy infrastructure taper out. A worst-case for Canadian crude could see a scenario similar to the last quarter of 2018, when the WCS/WTI differential - which has averaged around USD 15 over the last 5 years - widened to USD 50 per barrel on some trading days in October, caused largely by the production of Canadian crude oil exceeding the combined capacity of pipelines and crude by rail. A worst-case scenario for AECO gas could be similar to the mid-2017 and late 2019, when a localized lack of storage and transportation capacity led Canadian natural gas markets to become oversupplied. This caused the differential between Henry Hub and the Alberta benchmark to spike to as much as USD 5 on some trading days in January from a differential that has typically remained under a dollar.

Investor Takeaway: The Impact on Canadian Energy Stocks

Canadian energy companies will no doubt continue to benefit from gains in energy prices, even as regulations cut into profit margins, and can be expected to increase production to capitalize on higher-priced markets. Canada’s top natural gas producer Tourmaline provides a case study of growth from demand-driven headwinds, despite regulation. Benefiting from the roaring comeback of natural gas demand, Tourmaline delivered a record quarterly cash flow of $761.3 million and free cash flow of $369.5 million in the Q3 2021, increased production, accelerated drilling and added more wells - whilst also achieving its methane reduction targets (25% reduction from 2018 levels) 3 years ahead of targets. However, whilst Canadian producers will likely seek (and be able) to capitalize on the anticipated headwinds in energy, they can be expected to gain less than comparable companies located in less regulatory stringent jurisdictions that are also the beneficiaries of higher energy prices.

For investors, energy companies in the U.S. will likely yield higher risk-adjusted returns, and not only because of the unfavourable WCS/WTI and AECO/Henry Hub differentials. With the increased cost regulation, Canadian energy companies, which have so far prioritized payouts to investors and paying off debt, will need to invest a significant part of their profits into the energy translation instead: an October 21 report from Royal Bank of Canada, the cost of carbon reduction in the oil sands is pegged at $5.5 billion per year until 2030. For investors in Canadian companies, tighter profit margins due to more stringent regulation and tax environment, compounded by energy price differentials can be expected to reflect in lowered price/Earnings ratios and an accelerated rate of decline relative to their U.S. counterparts, a clear trend documented in an October 2021 study by the Fraser Institute.

From 2011 - 2021 (inclusive) the price-to-earnings ratio of Canadian energy companies consistently fell compared to U.S. counterparts, even as price-to-sales and price-to-book value ratios provided a more mixed picture (possibly a reflection of a tightened regulatory and corporate tax environment under the Biden administration relative to the Trump administration). The Institute’s findings imply and confirm the general sentiment and “expressions of concern by executives of Canadian oil and gas companies that Canada is a less and less profitable location for capital investment compared to jurisdictions in the U.S. — notwithstanding the rise in the WCS price relative to the WTI price from 2017 to 2019”. Investors can also likely expect leaner or less stable dividends. Tourmaline CEO’s recent statement warned investors that the exact size of payouts to their shareholders is difficult to predict because of the volatility in commodity prices, which will likely be amplified by increasingly sensitive differentials between Canadian energy prices and comparable products on the global market.

Europe is the canary in the coal mine; is Quebec a worst-case scenario?

Canada, as the world’s third-largest holder of oil reserves and fifth largest producer of natural gas, could make a greater difference to net emissions if it chose to step up and seize the opportunity to export clean energy to high-emitting nations. Canada needs to invest, rather than divest from its energy industry, in particular, its energy transportation infrastructure. To make Canadian Crude more competitive, Canada requires additional pipeline capacity, optimization of its embattled existing pipeline capacity, and an increase in crude-by-rail exports. To capitalize on the opportunity for natural gas exports, Canada needs more LNG facilities and at least one domestic LNG export terminal: the closest one is on the U.S. Gulf Coast over 4000+ miles away. Sadly, Canada seems set to continue to follow Europe’s path, the canary in the (literal?) coal mine for ill-advised green energy policies focused on divesting from fossil fuels, in particular the fallout of divesting from core infrastructure required to supply additional base energy.

As in Europe, the increased cost of production and tightening profit margins will at least partially be offset by price hikes to consumers, ensuring that as energy prices rise worldwide, they will be exceptionally inflationary in Canada. Closer to home, Quebec provides a worst-case scenario for Canada’s energy industry. The province has chosen to abandon its hydrocarbon resources - an estimated $93 billion in wealth and $15 billion in funding to the government, as estimated by The Montreal Economic Institute. The province now imports approximately 300,000 barrels of oil daily from Alberta and the U.S., at the cost of $5 billion a year. Oil and gas now make up over 80% of its trade deficit.