- Reports Q3 results on Thursday, Nov. 4, after the market close

- Revenue Expectation: $4.42 billion

- EPS Expectation: loss of $0.34

Uber Technologies (NYSE:UBER) is finding it hard to impress investors these days. The shares of the world’s largest ride-hailing service remain under pressure despite the company’s announcement that it’s on course to deliver its first adjusted profit when it reports after the US close today.

The ride-hailing giant that once posted a quarterly loss of $5.2 billion, told investors in September that its third-quarter adjusted earnings before interest, taxes and other expenses may range from a $25-million loss to a $25-million profit.

If the company delivers a profit, it would arrive slightly earlier than previously anticipated. The Q4 adjusted earnings could range from flat to a $100-million profit. This potential turnaround, however, has failed to generate much excitement in the market, where Uber stock is down about 14% for the year. It closed on Tuesday at $42.89.

One potential reason for this underperformance is the adjustment that’s taking place in the ride-hailing business in the post-pandemic environment. Though the rides are coming back, as more and more people leave their homes after lockdowns and movement restrictions, the shortage of drivers and escalating inflation are hurting margins at the same time.

During lockdowns many drivers took other jobs or stayed home when the coronavirus wiped out ride-hailing demand. In April, Uber said it would spend $250 million on bonuses and other recruitment incentives.

Thriving Food-Delivery Unit

San Francisco-based Uber is no longer just a ride-hailing company. It expanded aggressively in the food-delivery business during the pandemic. That part of the business is still thriving. But that shift skewed Uber’s business toward a lower-margin segment that, despite its massive scale, may not have a comparatively significant impact on the bottom line as yet.

Government intervention is another threat to its business model, as the company faces pressure from politicians and regulators on the status of its drivers.

According to Bloomberg, it recently lost a Dutch suit, where a court ruled that those who ferry passengers using the Uber app in the Netherlands are covered by their labor laws.

In August, a California state judge struck down a voter-approved ballot measure bankrolled by Uber and other gig-economy companies that declared drivers for the companies were independent contractors.

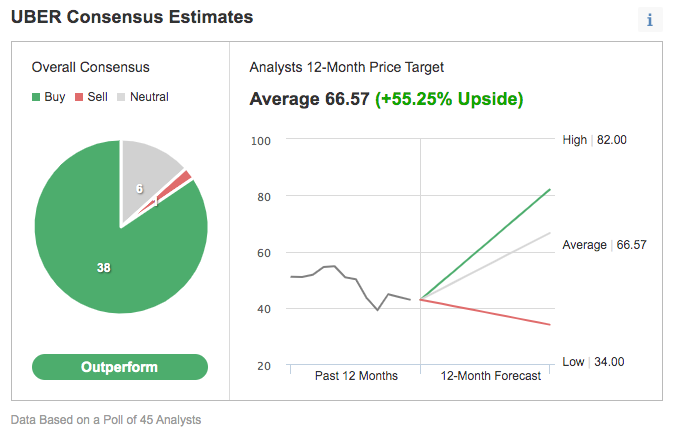

Analysts, on the other hand, are extremely bullish on Uber business prospects, especially after its success in the delivery business and due to the fast-improving gross bookings for rides. Of 45 analysts, 38 have an outperform rating, according to an Investing.com poll, with a 52% potential upside in the stock price in the next 12 months.

Evercore ISI analysts added Uber to its “tactical outperform” list, saying that the company’s Q4 report will be revealing.

Their note added:

“While we expect Q3 earnings have been relatively ‘de-risked’ given the company’s September update, where the company provided updated GMV (gross margin value) and EBITDA guidance (now expecting to be EBITDA profitable as early as this quarter), we view Q4 as a potential ‘show me’ quarter.”

Bottom Line

Uber earnings continue to face significant uncertainty from labor shortages, cost escalations and the future status of labor laws governing gig workers. These factors might continue to depress its shares despite the company’s likelihood to produce a small profit tomorrow.