Investment Thesis

With an emphasis on supply chain efficiency and an integrated business strategy, ExxonMobil hopes to produce $20 billion in earnings and $30 billion in cash flow over the next five years. By 2030, the business anticipates $18 billion in structural cost reductions and 30% and 15% CAGR growth in profits and cash flows, respectively. However, Increased worldwide capacity is putting pressure on ExxonMobil’s refining margins, which has caused a 67% decline in Energy Products sector earnings from $12.1 billion in 2023 to $4 billion in 2024. If these pressures continue, profitability may be limited.Investment Upsides

ExxonMobil has a combination of diversified and high-value assets portfolio which represents an advantage in terms of mitigating risks. ExxonMobil’s strong presence in the prolific Permian Basin and Guyana has consistently resulted in increased production capacity. By doubling daily production in the Permian to 2.3 million barrels of oil equivalent (MMBoE/D) and increasing Guyana’s production capacity to 1.7 million barrels per day (MMBbl/D) by 2030, the company is leveraging its most efficient, cost-effective assets. After acquiring and integrating operations with Pioneer Resources, ExxonMobil has not only strengthened its presence in the Permian Basin but also expects to generate over $3 billion per year through synergies. This amount is roughly 50% higher than the company’s prior estimate, reflecting better-than-expected benefits, such as cost reductions, improved productivity, and enhanced resource utilization from the integration.ExxonMobil’s debt to capitalization stands at a low of 11.96%, providing significant financial flexibility. This strong balance sheet allows the company to continue investing in high-return projects. The company plans to invest around $140 billion in major high-return projects and Permian basin development though 2030 and expects a return of more than 30% over the investment life. The strong investment returns allows the company to provide a dividend hike for 42 consecutive years and plan for a $20 billion buyback pace annually.

ExxonMobil has outlined an ambitious goal to generate an extra $20 billion in earnings potential and $30 billion in cash flow potential over the next five years. Supported by its integrated business model and a strong focus on optimizing supply chains and streamlining business processes, the company anticipates its earnings and cash flows will grow at a 5-year compound annual growth rate (CAGR) of 30% and 15%, respectively, while also achieving an additional $18 billion in structural cost savings by 2030 compared to 2019.

ExxonMobil is positioning itself to capitalize on low-carbon technology, with an aim to invest around $30 billion on low emission projects from 2025 to 2030. The company is advancing projects like the Baytown hydrogen facility, expected to be one of the largest low-carbon hydrogen plants globally, with 98% of its CO2 emissions captured and stored. The low carbon business is expected to generate earnings of about $2 billion in 2030.

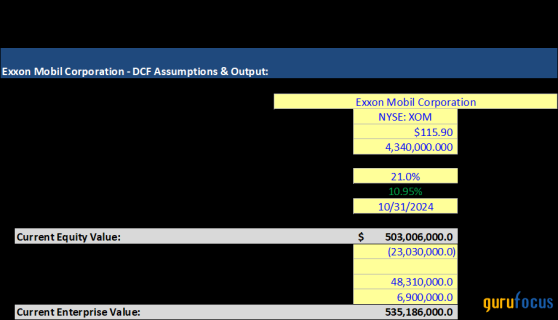

Valuation

Free Cash Flow

DCF

Guru Activity

The falling WTI Crude prices sparked a wave of scepticism among the gurus. The meniscule volume of shares traded depicts a larger sense of volatility in oil prices , stemming primarily from geopolitical tensions globally.

Investment Downsides

ExxonMobil’s refining margins are notably pressured due to additional global capacity resulting in softening of ExxonMobil’s refining profits. For 2024 the earnings in the Energy Products segment fell by nearly 67% from $12.1 billion in 2023 to $4 billion because of the collapse of the refining margins to their lowest in 2024 since 2020. If these industry-wide pressures continue, margin compression could constrain ExxonMobil’s profitability.The downturn in refining earnings could intensify reliance on upstream operations, contributing mostly to the company’s earnings, to sustain overall profitability. The profitability from the upstream operations is also vulnerable to fluctuating oil and gas prices. This volatility exposes ExxonMobil’s business model to significant financial risk, as its profitability heavily relies on the market prices of these commodities.

ExxonMobil projects its capital expenditure to be in the range of $27-$29 billion in 2025 which will focus on investments in new and early-stage projects. While the capital expenditures are always aimed at long-term growth, but, the high spending could pose significant risks if market conditions or expected returns do not materialize as projected.

The success of ExxonMobil’s Low Carbon Solutions business relies heavily on favorable government policies and regulatory clarity. Execution of key projects, such as the Baytown hydrogen facility and carbon capture initiatives, is contingent on regulatory support, which introduces uncertainty.

Portfolio Management

The target price for XOM is $146.12, presenting an upside of 26%.ExxonMobil’s portfolio of high-value, diversified assets reduces risk. With plans to treble daily output in the Permian Basin to 2.3 million barrels of oil equivalent and boost Guyana’s capacity to 1.7 million barrels per day by 2030, its presence in both Guyana and the Permian Basin has expanded production capacity. ExxonMobil anticipates that the acquisition of Pioneer Resources would create in synergies that will lower costs, increase productivity, and improve resource utilization, generating over $3 billion annually.This content was originally published on Gurufocus.com