- Friday's U.S. PCE data could indicate inflation remained high in March

- This could force the fed to extend the rate-hike cycle beyond may, which would intensify the pressure on banks

- In that case, gold could garner buying interest again, and a rally could be in the offing

The markets, shaken by the unexpected banking crisis in March, are trying to catch their breath this week. However, there are two issues making markets nervous: one is central bank rate hikes, and the other is the banking crisis, which could worsen.

Central banks met this month in the wake of the banking crisis and continued to raise interest rates, stating that they believe the situation is manageable. This is because inflation in the U.S., the eurozone, the U.K., Switzerland, and many other countries began to rise again last month. Although rents are the biggest contributor to inflation, there has been a noticeable increase in food prices in the last month, despite the decline in global prices.

According to the latest February report from the Food and Agriculture Organization (FAO), food prices, which hit a record high in March 2022 due to the war, have fallen for 11 consecutive months since April. The most notable increase in February was in sugar prices. Sugar prices increased by 6.9% in one month. The rise in sugar prices led to price increases in packaged products, especially beverages. March data will be released on April 7.

Friday's U.S. Personal Consumption Expenditures data will show consumer spending on more items than the CPI basket. A rise in the data may reinforce the perception that inflation remained buoyant in March.

What Does This Mean?

An increase in the data may increase the expectation that the Fed will raise interest rates by 25 basis points at the May meeting. At the same time, it may also mean that the waiting period for the last rate hike, which is currently seen as being in June, may extend. More indirectly, the likelihood of a cut this year may diminish.

Concerns about economic stagnation would also increase with further rate hikes and a longer wait for a rate cut.

The worst-case scenario is a deepening of the banking crisis, which could shorten the Fed's waiting period to start cutting rates and inflict more damage on the economy. So the worst thing for the markets at the moment is an escalation of the banking crisis. And the further we get away from that, the more we will return to inflation-interest pricing.

Gold

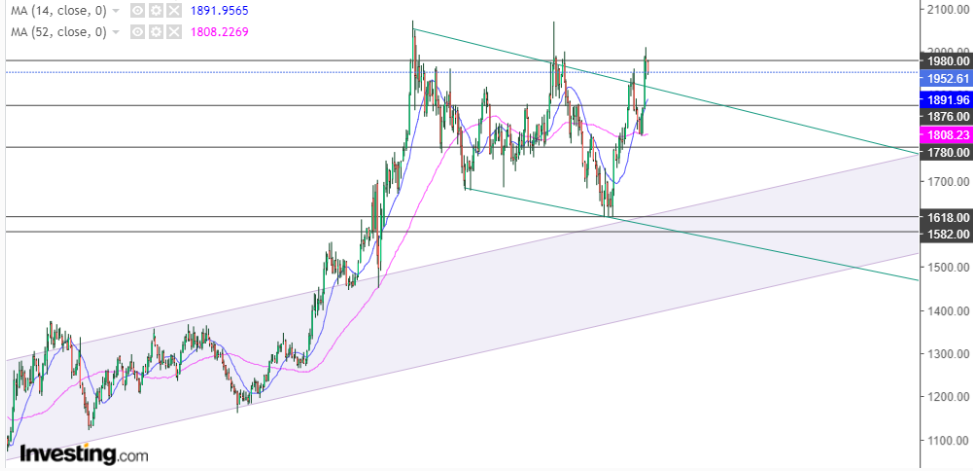

If you recall, when the probability of a 50 basis point hike increased, the price of gold fell more than it should have. It fell from $1,960 to $1,805. The reason for gold's strong rally in March was actually to recoup some of the previous excess loss. The other reason was, of course, the safe-haven feature.

Now that the market has eased after testing the $2,000 level, gold is trading near $1,986. The more fear wanes, the less upward momentum gold will have. If the crisis pricing is replaced by the aforementioned inflation-interest-rate cycle, and the data creates an expectation of rising inflation, then gold could fall towards $1,876, which is a strong support.

If we look at the long-term chart, $1,876 is an extremely strong level. The 14-week moving average is also above this level. Indeed, the 52-week moving average above $1800 confirms that gold is looking for an excuse to accelerate higher.

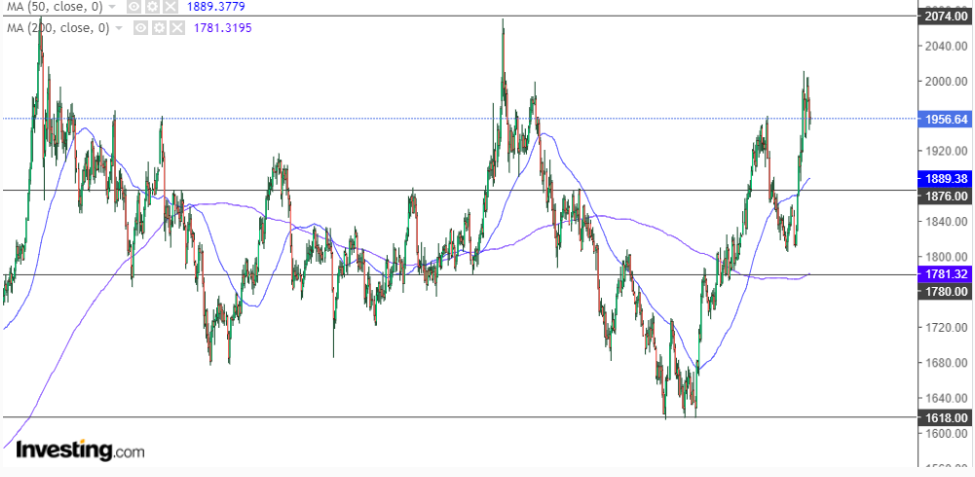

Looking at the short term, the 50-day moving average is back above $1876. The 200-day moving average is at $1780, which is the point that gold will take into account in determining its direction. So the short and medium term outlook for gold is positive.

In the short term, $1,876 is an important resistance; new levels lie above this level, especially above $1,980. Below $1,876, $1,780 is important. If it falls towards $1,780, and the level holds, that is a big positive for gold prices.

$1,780 is an important level in the medium term. However, if we look at the chart, it is clear that $1,618, which was tested but protected in the post-peak decline, is the real critical point.

The gap between these levels is very large for daily and weekly traders. The areas above and below $1,876 can be monitored in the short term.

Looking a little further ahead, you may want to keep an eye on a situation. After hitting the $2,074 high, gold has been in a descending channel, which is not very reassuring and technically a bit threatening.

However, the price is high enough for this channel to be nullified, so its reliability may be misleading.

Disclosure: The author doesn't own any of the securities mentioned.