Uranium prices surged above $60 per pound in early September, marking an eight-week rally driven by persistent supply risks and robust long-term demand, a scenario last seen in April. Adding to the supply risks, Cameco (TSX:CCO), the world's second-largest uranium producer based in Canada, has lowered its production outlook for this year due to difficulties at its Cigar Lake mine and Key Lake mill.

Furthermore, political instability in Niger, a significant uranium producer, adds to the supply concerns and presents additional challenges for Western utilities. Western nuclear fuel manufacturers also grapple with tight supplies amidst escalating uncertainty over Russian nuclear fuel imports, exacerbated by a halt in uranium shipments intended for North America at the St. Petersburg port.

Such incidents highlight the limited capacity of domestic production avenues since Russia accounts for nearly half of the global uranium conversion and enrichment, according to the most recent data. Simultaneously, the ongoing construction of mega power plants in China is bolstering demand.

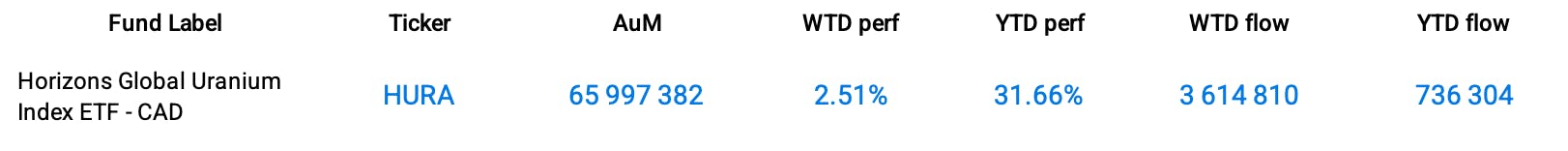

Consequently, the Horizons Global Uranium Index ETF (HURA) gained +2.51% this week while attracting $3.6 million in inflows.

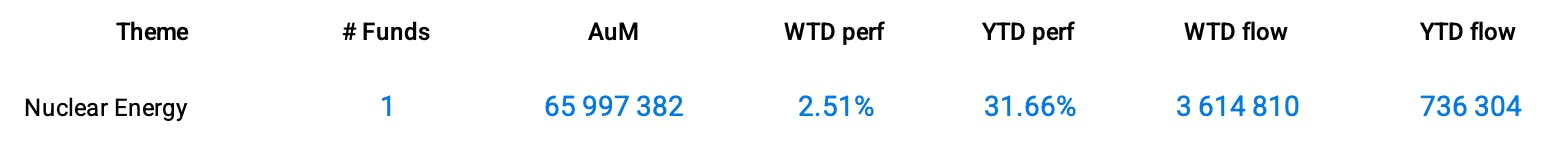

Group Data

Funds Specific Data: HURA

This content was originally published by our partners at the Canadian ETF Marketplace.