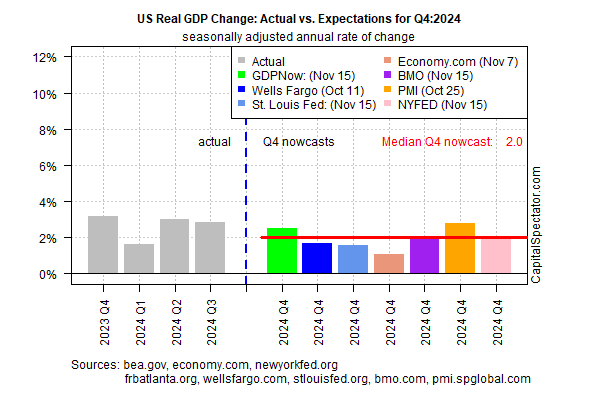

Fourth-quarter economic output for the US looks set for another downshift, based on CapitalSpectator.com’s initial GDP nowcast. The estimate reflects the median for a set of nowcasts published by several sources.

Real (inflation-adjusted) growth is projected to increase 2.0% in Q4 for the annualized comparison, down from Q3’s 2.8% advance. The Q4 nowcast is a respectable pace, but if correct it will mark the second straight quarter of moderately softer output.

For the moment, the so-called soft-landing scenario for the economy remains intact. Although a 2.0% growth rate equates with the slowest increase since Q1:2024, recession risk remains low for the near term. The US economy has outpaced its G7 peers recently and that’s likely to continue for the foreseeable future.

Some economists see America’s economic momentum continuing well into 2025. “In the year ahead, our baseline forecast sees the American economy growing at a pace of 2.5% or more, which is well above the 1.8% long-term trend that held in the years after the financial crisis,” wrote an economist at RSM US LLP. “We assign a 55% probability to this scenario.”

By some accounts, however, expectations are evolving. “We are rapidly moving from the era of the Goldilocks soft landing consensus on Wall Street toward splitting into two camps: the ‘no landing’ crowd and the ‘buckle your seatbelts, bumpy landing’ crowd,” an economist at BMO (TSX:BMO) Economics advised.

Optimists say that the incoming Trump administration will strengthen economic growth by lowering taxes and reducing regulations. But there’s a view in other camps that sees a Trump 2.0 policy era as raising inflation risk if the president-elect implements campaign promises to sharply raise import tariffs and deport millions of immigrant workers.

“We are in the soft landing,” Nobel prize-winning economist and Columbia University professor Joseph Stiglitz opines. “But that ends Jan. 20.”

“The biggest risk is a large across-the-board tariff, which would likely hit growth hard,” warns Jan Hatzius, chief economist at Goldman Sachs (NYSE:GS).