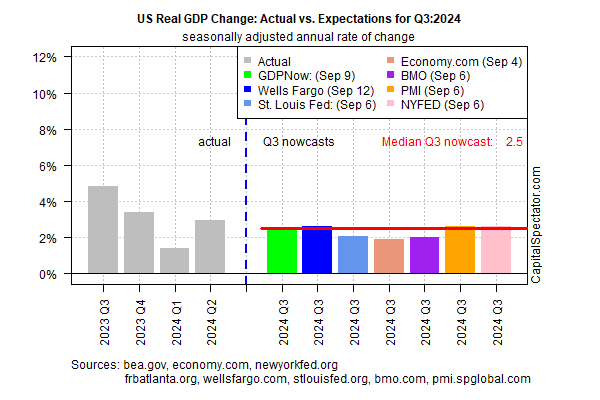

Today’s revised estimate of US economic activity for the upcoming third-quarter GDP report continues to point to a slower-but-still-solid growth rate, based on the median nowcast for several estimates compiled by CapitalSpectator.com.

The median estimate firmed up to a 2.5% real annualized rate for Q3. That compares with Q3’s previous 2.1% estimate published on Sep. 5.

If the current median nowcast is accurate, US growth will downshift from a strong 3.0% increase reported for Q2. The initial Q3 estimate from the Bureau of Economic Analysis is scheduled for release on Oct. 30.

Today’s upbeat GDP nowcast conflicts with recent concerns that US recession risk is rising. Today’s median GDP estimate for Q3 suggests otherwise, at least in terms of the real-time profile.

A popular indicator, however, says the US economy is already in recession. The Sahm Rule, which summarizes the trend in unemployment, rose above the 0.5 mark for a second straight month in August – an increase that signals the start of recession.

Yet the economist who designed the rule says her indicator may be wrong this time or perhaps early.

“The Sahm rule right now is overstating the weakness in the economy,” says economist Claudia Sahm. “But it is picking up on weakness in the economy. It’s telling us something bigger than itself.”

By some accounts, the odds still look relatively high for a so-called soft landing.

But Michael Darda, chief economist and macro strategist at Roth Capital Partners, explains:

“It’s not unprecedented to have a slowdown period that looks like a soft landing, and then a recession ends up taking shape.”

The fourth quarter, in other words, could be a stress test for the economy. Meantime, Q3 still looks unlikely to mark the start of an NBER-defined recession, based on the latest GDP nowcasts.