Basics of taxable/tax-exempt muni bonds

Taxable and tax-exempt municipal (muni) bonds are popular avenues for municipal/local authorities wanting to raise capital to fund public projects such as for constructing roads, schools, sewage systems, airports, public buildings and infrastructure. Tax-exempt muni bonds have traditionally been attractive due to their low borrowing costs vis-à-vis taxable muni bonds with higher costs.

What prompts municipal/local authorities to issue taxable muni bonds despite their high borrowing costs?

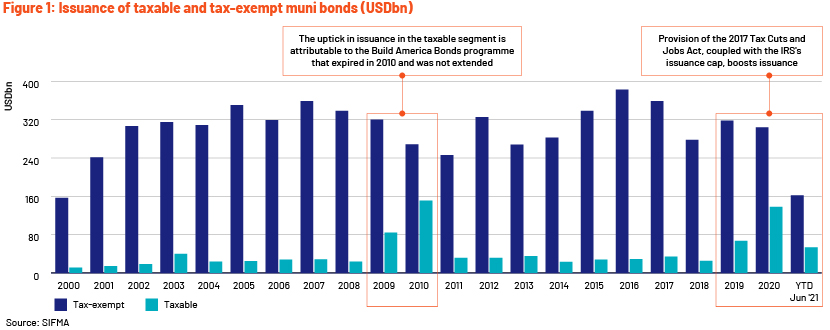

The concept of taxable muni bonds is not new, although due to the high borrowing costs on the issuance of taxable muni bonds, issuers prefer to borrow funds using tax-exempt bonds. We, therefore, need to understand the rationale behind the surge, which was evident during 2020, with a massive jump of more than 100% in issuance over 2019. Issuance continued to increase in the first six months of 2021, with total taxable issuance of USD53.3bn.

This uptick is attributable primarily to two factors:

- Annual cap on tax-exempt muni bond issuance and flexibility: The different states have different limits on the maximum annual issuance of tax-exempt bonds, leaving no headroom to fund high-value projects. Taxable muni bonds come to the rescue in such circumstances. In addition, the IRS stipulates that tax-exempt bonds can be issued only to finance “qualified” projects that directly benefit the general public; this creates a further bottleneck, which could be resolved by issuing taxable muni bonds. This gives a state the flexibility to even fund high-value projects, including qualified and unqualified ones.

- Refinancing outstanding muni bonds: The usual practice of the issuing authority is to advance refund deals with higher borrowing costs using tax-exempt bonds with low borrowing costs. This phenomenon changed after the introduction of the Tax Cuts and Jobs Act of 2017, which discourages advance refunding through tax-exempt bonds. In addition, in the low interest rate scenario, the borrowing costs of taxable bonds are only marginally higher, further boosting issuance of taxable muni bonds.

Investors lost confidence during the financial crisis of 2008 and even invested in highly rated government bonds. To restore confidence, the federal government introduced financial measures such as the Build America Bonds programme. This bolstered issuance of taxable muni bonds in 2009 and 2010, enabling municipal/local authorities to issue taxable bonds at subsidised interest rates to keep borrowing costs low.

A similar trend has been observed from 2019 to date: 17-37% of muni bonds issued every quarter during the period were taxable bonds, compared to just 10% previously. In June 2021, USD33.9bn worth of tax-exempt muni bonds and USD11.4bn worth of taxable muni bonds were issued (while corporates issued USD172.9bn worth of bonds).

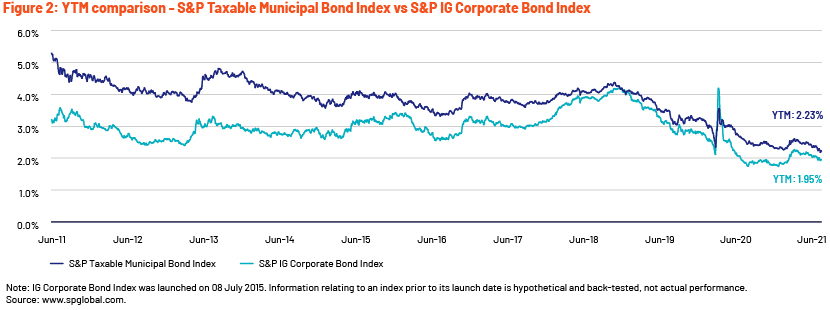

Taxable muni bonds offer more attractive yields than other fixed-income investments

Taxable muni bonds look attractive because they offer higher yields without having to take on too much additional credit risk. They also provide an alternative way for investors to widen their portfolios without compromising credit quality.

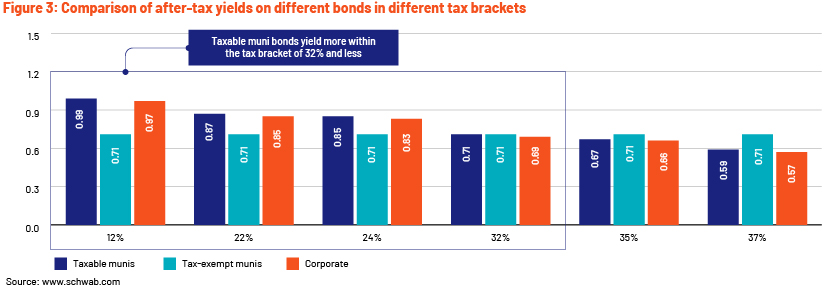

Yields on taxable muni bonds are more attractive than yields on many other-fixed income investments. Even after adjusting for taxes, taxable muni bonds offer higher yields than do tax-exempt muni bonds for taxpayers in the tax bracket of 32% and less. Taxable muni bonds provide better yields than corporate bonds for taxpayers in all tax brackets.

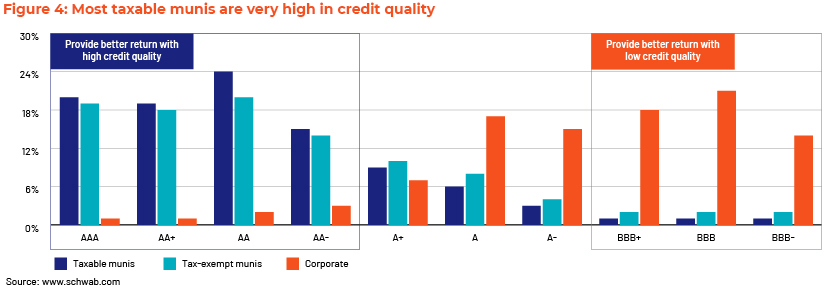

Taxable muni bonds provide not only higher yields but also higher credit quality than corporate bonds, providing investors with a better alternative. The chart above shows that taxable muni bonds constitute 78% of the muni bond market with a credit rating of AA- or above, compared with only 7% of the corporate bond market.

Conclusion: Muni bond market is all set for growth in taxable muni bonds

The US market has provided better long-maturity yields than many prominent bond markets in Europe and Asia, creating a new opportunity for international institutional investors who can take more advantage of higher-yielding municipal bonds than of developing-nation sovereign debt with zero or negative yields.

Moreover, taxable muni bonds are currently providing a better option for international institutions such as life insurance and pension fund companies. This is primarily due to the absence of high-quality, long-duration bonds globally and the excess of investment-grade taxable muni bonds versus equivalent corporate bonds. This factor further drives issuance of taxable bonds to diversify the buyer base and access low-cost opportunities arising from refunding deals.

In addition to all this, there are upcoming proposals by the Biden government, including a new infrastructure bill in early 2022, that may overturn the Tax Cuts and Jobs Act of 2017, but the outcome remains to be seen. The impact on the market from President Biden’s proposal on Build Back Better World, a G7 global infrastructure initiative of USD40tn+, also remains to be seen, as it is in a nascent stage.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI