Turmoil in the Middle East as Turkey Downs Russian Aircraft

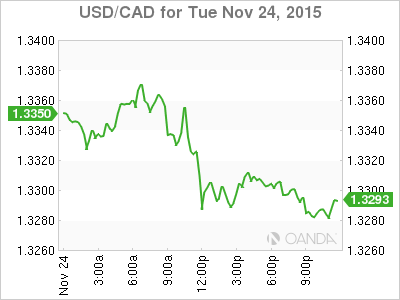

Geopolitical tension triggered a surge in crude prices after Turkey confirmed it had shot down a Russian warplane that it alleged was entering Turkish airspace and refused to communicate. The USD/CAD depreciated as the Loonie was supported by the higher price of crude. The USD depreciated 0.521 versus the CAD and is trading at 1.3304 although the session low was 1.3285.

As anticipated this week’s lack of liquidity has made for a volatile trading environment. Social and armed conflict have pressured global stock markets and the USD has been on the back foot as the currency is being sold across the board.

The loonie was able to get under the $1.33 price level albeit briefly on this short trading week, but the real test of the CAD’s resilience will come next week. The Bank of Canada will release its rate statement with investors focused on Governor’s Poloz reaction to the new Canadian government growth forecasts downgrade. The biggest indicator in the forex market will be published on Friday, December 3. The nonfarm payrolls report (NFP) is expected at around 200,000 after the monster 271,000 jobs report last month that crushed forecasts. At this point, not even a disappointing NFP could be enough to derail the December rate hike that the Federal Reserve has teased all year.

The next challenge for market participants is to figure out what does the Fed mean by “gradual”

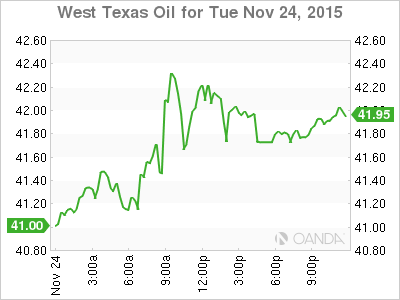

OPEC Statement and Middle East Turmoil Drive Energy Prices Higher

The price of West Texas Oil gained 2.71 percent after the tensions between Turkey and Russia escalated after a Russian plane was shot down near the Turkish border. Oil went from a low of $40.84 to reaching the daily high of $42.51 before settling just below the $42 price level. The surge in pricing made crude one of the biggest movers and this came a day after the price of energy was also volatile after the market reacted to the Organization of the Petroleum Exporting Countries (OPEC) statement about bringing stability to the pricing of the commodity.

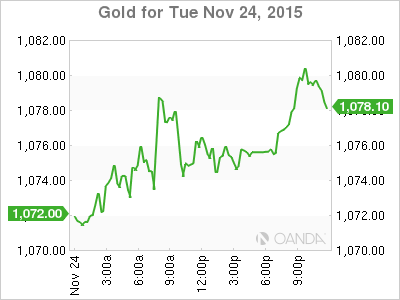

Downed Russian Plane Triggers Safe Haven Flows into Gold

With investors mostly looking for deals ahead of the Black Friday shopping event the news of Turkey shooting down a Russian airplane took the market by surprise and Gold was one of the main asset classes who rose following the attack. The yellow metal rose 1.2 percent and is trading at $1,074.95. Gold has traditionally been a safe haven in times of geopolitical turmoil, but considering the two nations engaged in a skirmish on the borders of Syria as there is a global movement of condemnation to the attacks in Paris and a Russian passenger plane earlier, the reaction was subdued.

The biggest threat to gold remains the Federal Reserve’s plans to raise the U.S. benchmark interest rate in December. Even after the OPEC’s statement the drop in energy prices has put a damper in inflation which also hurts the mid term outlook for the metal. Low energy prices do seem to be bottoming out and inflation measures will be readjusted for next year, which could mean more positives for gold in 2016.

CAD events to watch this week:

Friday, November, 27

8:30 am CAD RMPI m/m