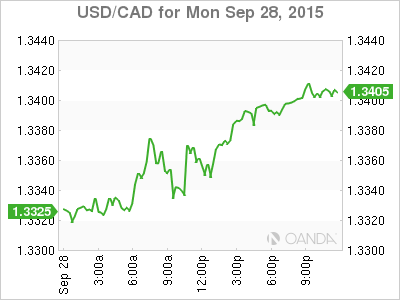

The USD/CAD continues to hover near an eleven year old high as macro economic headwinds are clipping the wings of the loonie. The pair touched a 24 hour high 1.3412 as uncertainty around China have hit the price of commodities. The other part of the equation is the uncertainty about the next step for the Federal Reserve. Chair Yellen and company have talked up the rate hike so much that the timing became the top priority, rather than the actual size or speed with they will be delivered.

The Canadian economy is bouncing back after the first shock of lower energy prices finally hit earlier this year. Bank of Canada Governor Stephen Poloz made a proactive rate cut in January, followed up by another one in July. The softer loonie has helped exporters offset some of the losses from commodity exporters. Services have risen to the challenge, although manufacturing is still struggling from a previous resilient loonie that drove most multi nationals to move their factories abroad.

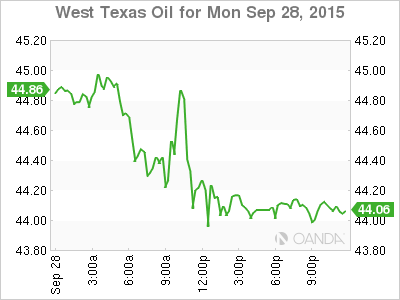

Chinese Industrial Data Slump Putting Pressure on Energy Prices

Chinese data has underwhelmed of late. There are multiple signs that point to a harder landing than originally thought. The drop in the demand for commodities to feed Chinese growth is affecting producers from Australia to Canada.

The price of oil has dropped almost 3 percent on Monday as global stock markets recorded heavy losses, with most of the commodity sector the biggest loser as uncertainty about China grows. The Federal Reserve has not helped matters much with a series of statements from Fed members have confused investors more due to their contradictory nature.

The main factor keeping prices from falling further is the lower inventories seen in the U.S. Discounting that, all factors point to a lower price per barrel as production is far ahead of demand and that is not taking into consideration the return of Iranian production after the nuclear deal comes into effect.

Loonie to Fly with No Help from Data

The CAD will have little support in terms of economic indicators and this week the American non farm payrolls will hog the spotlight and have the final word on the forex market on Friday. To make matters more lopsided, Canadian jobs data will not be published at the same time as NFP Friday.

The lack of action from the Federal Reserve has put all central banks on alert. The Bank of Canada might hold off another rate cut given the current price of the CAD, but could be forced if the economic conditions which were favourable for the U.S. rate hike start to weaken. The U.S. NFP is expected to be a strong reading after the August data. The end of the summer is the worst performer as companies turn in their questionnaires late, resulting in an upward revision the following month.

The CAD will navigate a hostile environment as it welcomes an expected positive monthly gross domestic product result on Wednesday that could forecast and end to the “technical” recession that the economy experienced after two negative quarters.

Here are the top Canadian dollar events this week:

Tuesday, September 29

8:30am CAD RMPI m/m

8:30am CAD IPPI m/m

Wednesday, September 30

8:30am CAD GDP m/m

Thursday, October 1

9:30am CAD RBC Manufacturing PMI