This week, the USD/CAD pair has been under pressure amid poor macroeconomic data from the US and uncertainty over the timing of interest rate increases in the country. The number of initial jobless claims grew from 274K to 294K, while a fall to 270 was expected. The Import Price Index came in at 0.3% against a forecast of 0.5%.

Today, dynamics in the pair can be influenced by data on Retail Sales, the Producer Price Index and Business Inventories. Analysts expect the indicator of Retail Sales to be up from -0.4% to 0.7% and the Producer Price Index to grow from -0.1% to 0.3%. This will support the US dollar.

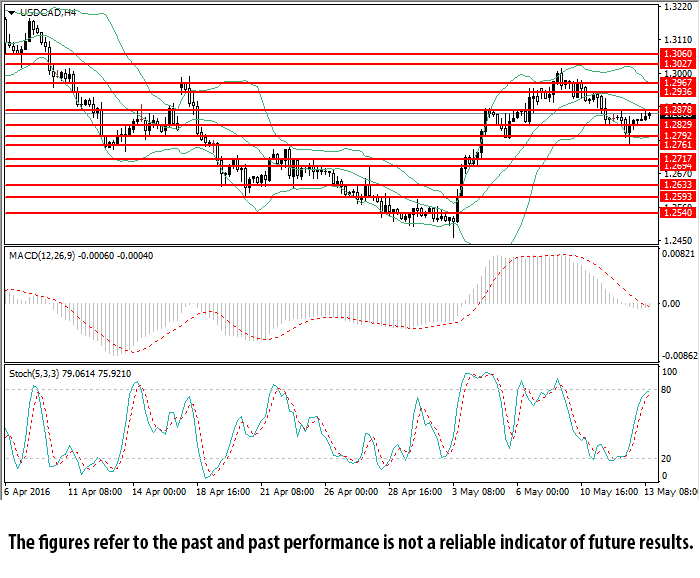

On the 4-hour chart, the price has corrected up to the middle MA of Bollinger Bands. The price range is narrowing down. MACD histogram is entering the negative zone and keeping a sell signal. Stochastic has approached the overbought zone.

The indicators recommend short positions.

Support levels: 1.2829, 1.2792, 1.2761, 1.2717, 1.2694, 1.2633, 1.2593, 1.2540.

Resistance levels: 1.2878, 1.2936, 1.2967, 1.3027, 1.3060.