The Canadian dollar is steady on Wednesday, as USD/CAD trades at the 1.30 line in the European session. Canadians voted in a new government on Monday, as the Liberal party, headed by Justin Trudeau, easily won a majority of seats in parliament and handily defeated the incumbent Conservatives. In economic news, US housing numbers were a mix, while Canadian Wholesales disappointed, posting a decline of 0.1%. All eyes are on the BOC, which will set interest rates for October later in the day, followed by a press conference. A surprise rate cut by the BOC would likely send the Canadian dollar sharply lower. The only economic release from the US is Crude Oil Inventories. As well, FOMC member Jerome Powell will speak at an event in New York.

After an awful summer, the Canadian dollar has rebounded in the past three weeks, gaining about 400 points. The loonie has benefitted from higher prices for oil, a key Canadian export. As well, expectations that the Federal Reserve might raise rates in October failed to materialize, disappointing the markets and pushing the US dollar lower against other currencies, including the Canadian dollar. Meanwhile, the Canadian dollar posted slight gains following the election results. Justin Trudeau, son of former prime minister Pierre Trudeau, won a convincing majority over the Conservatives, as Prime Minister Stephen Harper failed to win a fourth mandate. The BOC will make an interest rate announcement on Wednesday, and most analysts expect the central bank to hold rates at the current level of 0.50%. Still the central bank cut rates twice this year, surprising the markets on both occasions. So a rate cut, while unlikely, should not be ruled out.

US numbers have been mixed recently, which has reduced the likelihood of a rate hike by the Federal Reserve before the end of 2016. The Fed hasn’t cleared the air, as FOMC members continue to send out contradictory messages about the Fed’s plans regarding a rate hike. Still, an improvement in US numbers, especially employment and consumer indicators, could quickly revive speculation about a rate hike and boost the US dollar against its major rivals. This means that the upcoming US Unemployment Claims report will be carefully monitored, and an unexpected reading could have a sharp impact on the direction of GBP/USD. The estimate stands at 266 thousand, higher than the previous report of 255 thousand.

USD/CAD Fundamentals

Wednesday (Oct. 21)

- 14:00 BOC Monetary Policy Report

- 14:00 BOC Rate Statement. Estimate 0.50%

- 15:15 BOC Press Conference

Upcoming Releases

Thursday (Oct. 22)

- 12:30 US Unemployment Claims. Estimate 266K.

- 12:30 Core Retail Sales.

*Key releases are highlighted in bold

*All release times are GMT

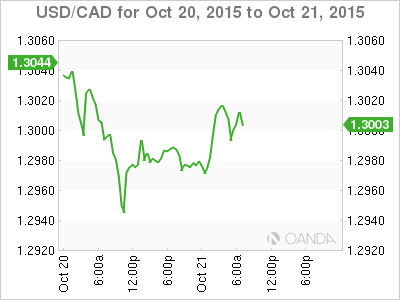

USD/CAD for Wednesday, October 21, 2015

USD/CAD October 21 at 11:35 GMT

USD/CAD 1.2996 H: 1.3024 L: 1.2967

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2646 | 1.2798 | 1.2930 | 1.3063 | 1.3165 | 1.3213 |

- USD/CAD was unchanged in the Asian session. In European trading, the pair posted slight gains.

- 1.2930 is a weak support level.

- 1.3063 is an immediate line of resistance.

- Current range: 1.2930 to 1.3063

Further levels in both directions:

- Below: 1.2930, 1.2798, 1.2646 and 1.2552

- Above: 1.3063, 1.3165 and 1.3213

OANDA’s Open Positions Ratio

USD/CAD ratio is pointing to a slight gain in long positions on Wednesday, as long positions have a slight majority of positions (54%). This is indicative of a slight bias by traders towards USD/CAD moving higher.