By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

There are 2 monetary policy announcements this week with the Bank of Canada batting first on Wednesday. After rising to a high of 1.3049 after the initial election results, USD/CAD dropped to a low of 1.2935. Markets hate minorities and love majorities so when they realized that Justin Trudeau managed to win enough seats for the Liberals to secure a Parliamentary majority, they sent the loonie sharply higher. A rebound in oil prices also helped the move but the contribution was small because the gains in crude were nominal. A Parliamentary majority would allow for easier implementation of Mr. Trudeau’s promise for fiscal stimulus.

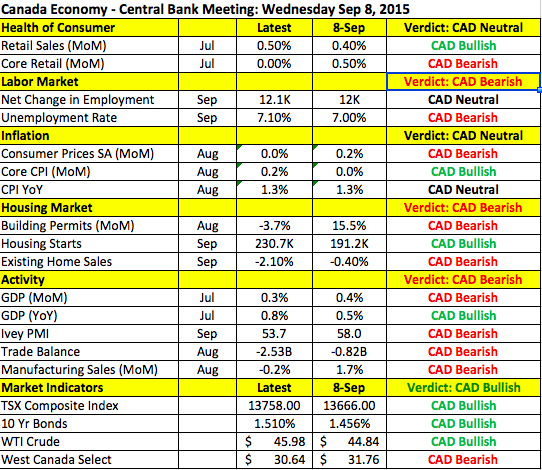

Canada’s election results could also play a role in monetary policy. If the government provides fiscal stimulus, the Bank of Canada may not need to cut interest rates again but there is a very good chance that Trudeau’s government could press Stephen Poloz to keep monetary policy easy. When the BoC meets Wednesday they are not expected to cut interest rates for the third time this year but given the recent performance of Canada’s economy, they have more reasons to be cautious than optimistic. Since the September meeting, the unemployment rate increased, full time jobs were lost, core retail sales stagnated, consumer prices stagnated, building permits and existing home sales continued to fall, GDP growth slowed, manufacturing activity slowed and the trade deficit ballooned. Oil prices were mixed but the low Canadian dollar, which the BoC said helped to offset the decline in oil prices reversed course in October. In other words, CAD is stronger in October vs. September. As shown in the table below, there was good news – retail sales in general increased, housing starts ticked up and stocks edged higher but we do not believe that these improvements are significant enough to offset the deterioration, especially at a time of weak U.S. labor market and consumer spending activity. The Bank of Canada does not want to see USD/CAD fall further and for that reason we believe that the Monetary Policy Report will sound more dovish.

Tuesday's worst-performing currency was the New Zealand dollar. For the first time in 2 months, dairy prices declined and while the 3.1% drop was small compared to recent increases, it was enough to solidify NZD/USD's near-term top. After coming within a few pips of 69 cents last week, NZD/USD has fallen for 3 days in a row. Typically the New Zealand dollar’s reaction to the dairy auction carries over into the Asian trading session, which means NZD/USD could test 67 cents. The Australian dollar on the other hand was resilient, ending the day unchanged versus the greenback. According to Monday night’s RBA minutes, weaker growth in China is a concern but the domestic economy is expected to have strengthened in the third quarter. The RBA is in no rush to raise interest rates and their relatively relaxed attitude helped AUD hold onto its gains (for the time being).

There was very little consistency in the USD's performance, which strengthened versus the JPY, GBP and NZD but weakened versus EUR, CAD and AUD. The latest housing-market numbers were mixed with starts rising 6.5% and permits falling 5%. As we expected, U.S. housing data posed no threat to USD/JPY, which climbed within a few pips of 120. No news is good news for the dollar but gains beyond 120.30 will be difficult to achieve without an underlying catalyst and unfortunately we don’t have any major reports from the U.S. or Japan Wednesday.

The euro traded higher versus the greenback Tuesday despite weaker economic data. Producer prices dropped 0.4% in September and the current account surplus narrowed sharply. ECB member Linde also suggested that the central bank could extend its QE program if needed. We continue to look for the euro to weaken going into the ECB meeting (Wednesday and Thursday morning). Germany had a tough month with manufacturing- and service-sector activity slowing. Inflation also remains extremely low and as ECB member Nowotny pointed out last week, “inflation targets are clearly being missed.” If the outlook for the global economy is bright, the ECB would have less to be worried about but between declining orders, weaker demand from China and a stronger euro, Germany and the region’s overall economy could slow further in the fourth quarter and for these reasons, the ECB needs to seriously consider increasing stimulus. They are not going to pull the trigger this week but their willingness to do so could be all investors need to drive EUR/USD lower.

Another day, another failed attempt by GBP/USD to break 1.55. Sterling gained a bit of upside momentum on Tuesday after Bank of England member McCafferty said rates should rise sooner rather than latter. No data was released from the U.K. but his hawkish comments coupled with the uptick in wage growth suggest that we could see an upside surprise in this week’s retail sales report. For the next 24 hours however, 1.55 and the 100-day SMA should cap the pair’s gains.