Markets were unusually choppy overnight, with the US dollar initially falling against European currencies before recovering into the US lunch session…and following the exact opposite path against the commodity dollars. The whippy, rangebound trade is no doubt frustrating many traders, but the heavy economic calendar later this week (including Yellen and ADP payrolls Wednesday, Chinese and US Manufacturing PMIs Thursday, and US Nonfarm Payrolls on Friday) could produce some more consistent trends.

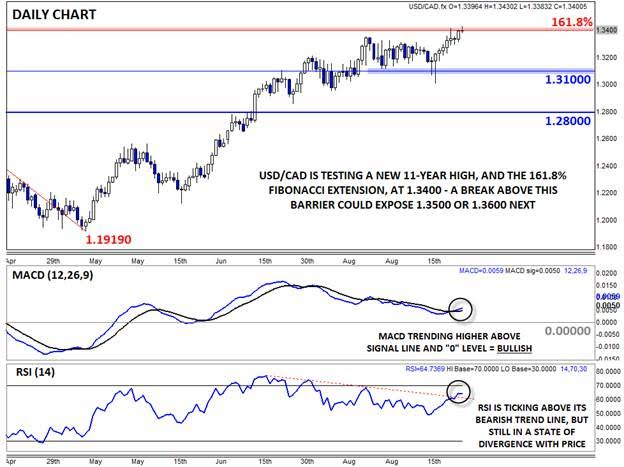

Speaking of trends, USD/CAD has been in a persistent uptrend since bottoming back in mid-May. While the trend has definitely been slowing over the last month or two, the unit did peek out to a fresh 11-year high above 1.3400 earlier Tuesday. Readers should note that the 1.3400 represents the 161.8% Fibonacci extension of the March-May pullback and is therefore a critical barrier to watch as we move through the week.

Turning our attention to the secondary indicators, there are some signs that USD/CAD could conclusively break the 1.3400 barrier. For one, the MACD indicator is turning higher and remains above the “0” level, showing a shift back toward bullish momentum. Meanwhile, the RSI indicator has broken its near-term bearish trend line, though it is still in a state of divergence with the price (the RSI is lower than its previous high, while the exchange rate itself is higher).

Taking the above into account, the technical outlook will hinge on whether USD/CAD can conclusively break above the 1.3400 level this week. If we see a break and close above that level, a bullish continuation toward 1.3500 or 1.3600 is in play. On the other hand, if the bears are able to rebuff bulls at this key barrier, a return back toward 1.3100 would become more likely.

As always, traders should also monitor the price of oil, which is closely correlated with the Canadian dollar. As it stands, WTI is consolidating in a tight range between about $44 and $47, and a breakout from that zone could set the tone for USD/CAD as well.

Source: FOREX.com