Yesterday the pair fell amid weakening in the US dollar that was pressured by poor statistics on the US labour market. The Nonfarm Productivity in the second quarter of the year fell by 0.5% while economists predicted a growth of 0.4%. In the first quarter, the index fell by 0.6% as well.

The Canadian Dollar, in its turn, remains under pressure after the publication of weak data on the property market in Canada. According to the data, the number of Building Permits in June fell by 5.5%, instead of the forecasted growth of 2.1%. In May, the index declined by 1.9%. In addition, Housing Starts in July fell from 218.3 thousands to 198.4 thousands, which was, however, slightly better than the expectations of 195.0 thousands.

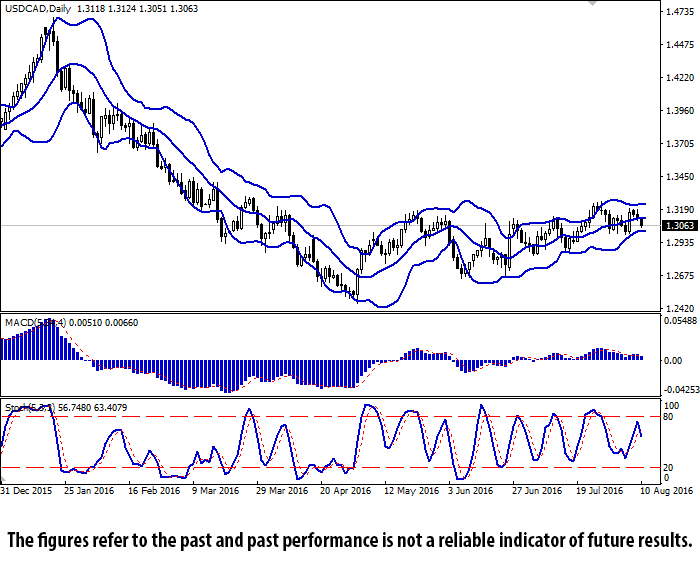

Bollinger Bands® on the daily chart is moving horizontally while the price range remains very narrow. MACD turned down having formed a weak sell signal. Stochastic turned down near the border of the overbought zone.

The indicators recommend short positions.

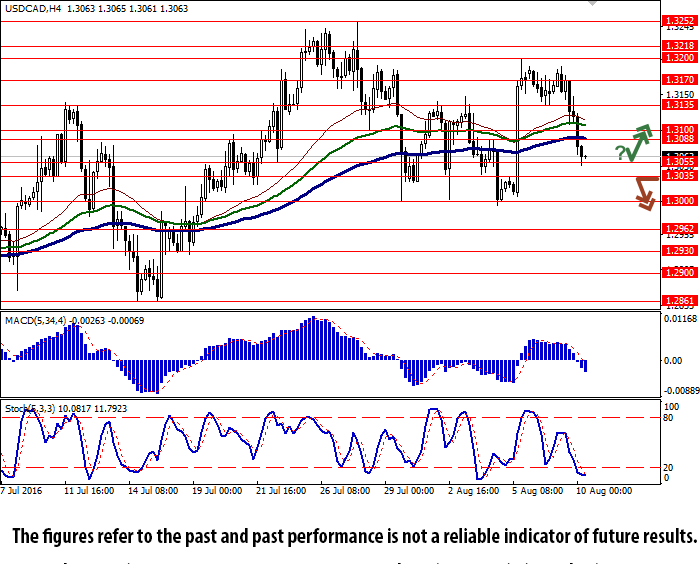

Support levels: 1.3055 (local low), 1.3035, 1.3000 (psychologically important level), 1.2962, 1.2930, 1.2900, 1.2861 (15 July low).

Resistance levels: 1.3088 (local high), 1.3100, 1.3135, 1.3170, 1.3200 (5 August high), 1.3218, 1.3252 (27 July high).