Yesterday the pair fell amid weakening in the US dollar.

The American currency was pressured by weak data from the US. Initial Jobless Claims grew from 261 to 263 thousands that was only 2 thousands better than expectations of economists, while the number of Continuous claims increased from 2.145 million to 2.159 million. In addition, the Markit Manufacturing PMI in August fell from 52.1 to 52.0 points. The ISM Manufacturing PMI dropped from 52.6 to 49.4 points while economists predicted a fall to only 52.0 points.

The dollar is also pressured by expectations of key data on the US labour market that is due later today. The data could have a crucial impact on the decision to tighten monetary policy at the September meeting of the Fed.

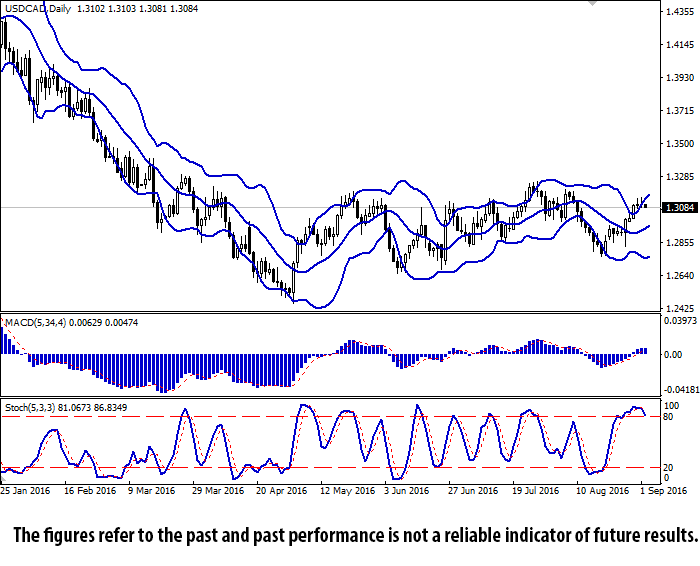

Bollinger Bands® on the daily chart is moving up while the price range is widening. MACD is growing and giving a buy signal.

Stochastic is in the overbought zone, trying to turn down.

The indicators recommend waiting for clearer trading signals.

Support levels: 1.3079 (local low), 1.3055, 1.3024, 1.3000 (psychologically important level), 1.2964, 1.2932, 1.2900, 1.2858.

Resistance levels: 1.3100 (local high), 1.3147 (local high), 1.3170, 1.3200 (5 August high), 1.3218 (27 July high).