USD/CAD is drifting on Tuesday, continuing the lack of movement which has marked the pair since the start of the week. In the European session, the pair is trading just below the 1.32 line in the European session. In economic news, there are no Canadian economic releases. In the US, we’ll get a look at two key events later on Tuesday – Core Durable Goods Orders and CB Consumer Confidence.

The Canadian dollar is struggling, as the currency dropped 250 points last week, after the Bank of Canada painted a gloomy picture of the Canadian economy. The BOC noted that weak oil prices have had a negative impact on the export sector and hurt economic growth. The BOC released a monetary policy report which said that the Canadian economy will grow just 2 per cent in 2016 and 2.5 per cent in 2017, lower than the previous forecasts of 2.3 per cent and 2.6 per cent. The BOC has cut rates twice in 2015, each time catching the markets by surprise, which led to the Canadian dollar losing ground. Although the BOC didn’t lower rates last week, monetary divergence with the Federal Reserve will continue to weigh on the Canadian currency.

The US housing sector is sending mixed messages to the markets. Existing Housing Sales looked sharp last week, improving to 5.55 million, which was well above the estimate of 5.38 million. The news was much worse from New Home Sales on Monday, as the indicator slid to just 468 thousand, its lowest level in 10 months. The markets had expected a strong reading of 546 thousand. It promises to be a busy week, as the Federal Reserve issues a policy statement on Wednesday. Any hints about a rate hike could spark a dollar buying spree. Will the Fed finally provide some clarity about its monetary plans? Such transparency and lack of communication from the Fed has been lacking and has been a source of frustration for the markets, which continue to receive conflicting signals from Fed policymakers regarding the timing of a rate hike. On Thursday, the US releases a market-mover, Advance GDP for the fourth quarter. The markets are expecting a gain of 1.6%, compared to Final GDP in the third quarter of 3.9%.

USD/CAD Fundamentals

- 12:30 US Core Durable Goods Orders. Estimate 0.0%

- 12:30 US Durable Goods Orders. Estimate -1.1%

- 13:00 US S&P/CS Composite-20 HPI. Estimate 5.1%

- 13:45 US Flash Services PMI. Estimate 55.3 points

- 14:00 US CB Consumer Confidence. Estimate 102.5 points

- 14:00 US Richmond Manufacturing Index. Estimate -3 points

- 15:20 BOC Deputy Governor Timothy Lane Speaks

Upcoming Events

Wednesday (Oct. 28)

- 18:00 FOMC Statement

- 18:00 Federal Funds Rate. Estimate

*Key releases are highlighted in bold

*All release times are GMT

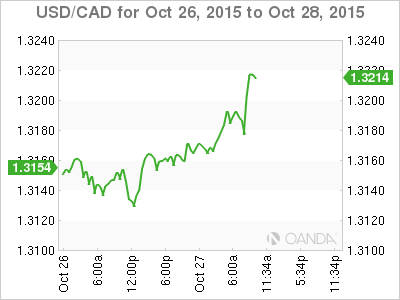

USD/CAD for Tuesday, October 27, 2015

USD/CAD October 27 at 12:05 GMT

USD/CAD 1.3186 H: 1.3200 L: 1.3156

USD/CAD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.2930 | 1.3063 | 1.3165 | 1.3213 | 1.3327 | 1.3457 |

- USD/CAD was unchanged in the Asian session and has posted small gains in European trading.

- 1.3165 has switched a support role and is a weak line.

- 1.3213 is an immediate resistance line. It could be tested during the day.

- Current range: 1.3165 to 1.3213

Further levels in both directions:

- Below: 1.3165, 1.3063, 1.2930 and 1.2798

- Above: 1.3213, 1.3327 and 1.3457

OANDA’s Open Positions Ratio

USD/CAD ratio continues to have a majority of short positions (53%). This is indicative of trader bias towards USD/CAD moving to lower ground.