September is a busy month in the Forex market where economic performance and monetary policy divergences is becoming very apparent.

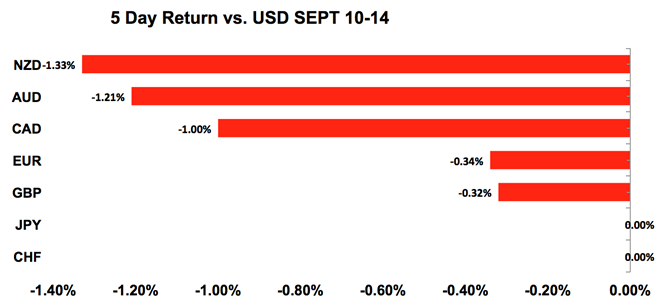

Last week we had the Reserve Bank of Australia and Bank of Canada rate decisions and this week, the European Central Bank and the Bank of England are up to bat. Like the RBA and BoC, the ECB and BoE are widely expected to leave interest rates unchanged. However, with the US dollar extending its gains over the past week on the back of a strong jobs report, investors will be thinking about how their policies compare to the Fed’s steady hand. The Swiss franc is the only currency that has managed to outperform the greenback whereas all other currencies struggled to find buyers. The worst performer was the New Zealand dollar, followed by the loonie and aussie. Looking ahead, we expect US dollar bulls to remain in control as we look for equities to descend further.

U.S. Dollar

Data Review

- ISM Manufacturing 61.3 vs 57.6 Expected

- ISM Employment 58.5 vs 56.0 Expected

- Trade Balance -$50.1bn vs -$50.3bn Expected

- ADP Employment Change 163k vs 200k Expected

- Services PMI 54.8 vs 55.2 Expected

- Composite PMI 54.7 vs 55 Prior

- ISM Non-Manufacturing Composite 58.5 vs 56.8 Expected

- Factory Orders -0.8% vs -0.6% Expected

- Factory Orders Ex Trans 0.2% vs 0.4% Prior

- Durable Goods Orders -1.7% vs -1.7% Expected

- Durables Ex. Transportation 0.1% vs 0.2% Prior

- Change in NFPs 201k vs 190k Expected

- Unemployment Rate 3.9% vs 3.8% Expected

- Avg. Hourly Earnings 0.4% vs 0.2% Expected

Data Preview

- PPI - No major changes in gas prices but the dollar has been strong so prices could be lower

- Fed Beige Book Release – Beige book likely to highlight ongoing improvements in the economy

- CPI - Will have to see how PPI fares but gas prices were steady. Inflation could rise

- Retail Sales - Potential for upside surprise given strong wage growth. Redbook also reported an increase in spending

- The University of Michigan Report - Potential for upside surprise given strong stocks and strong wage growth

Key Levels

- Support 110.00

- Resistance 112.00

There are a number of reasons why we think September should be a good month for the US dollar. On the top of the list is the prospect of an interest-rate hike from the Federal Reserve on September 26. The market is pricing in a 96% chance of a quarter point hike and after the latest nonfarm payrolls report, a rate hike is guaranteed. This week’s retail sales and inflation reports should also be strong, reinforcing the case for tightening and solidifying the greenback’s positive momentum. Not only was there more than 200K jobs created in the month of August, but wages are growing! Average hourly earnings rose 0.4% last month, which was the strongest pace of growth in nearly a year. Between the record highs in US stocks last month and the pickup in earnings, retail sales should rise nicely in August. We’re not looking for any major changes in inflation because gas and oil prices have fallen but between these 2 reports, retail sales is definitely more important. Comments from US policymakers have also been hawkish with Fed Presidents Mester, Rosengren and Kaplan looking for the policy rate to move toward neutral. The US dollar should also benefit from ongoing trade tensions. Two weeks into the latest round of talks, a deal has not been reached with Canada and now investors are worried that President Trump will turn his focus on Japan.

While the USD could outperform EUR, AUD and other major currencies, trade tensions pose a big problem for USD/JPY. Safe-haven carry flows returned home after President Trump hinted that Japan could be the target for their next trade fight. He’s focused on reducing deficits and in a phone interview with the Wall Street Journal he said they may not be happy “as soon as I tell them how much they have to pay.” At the end of last week, he also tightened the noose on China by threatening to impose another $267bn in tariffs. These threats make it very difficult for stocks and USD/JPY to rise. Although the yen crosses could be hit the hardest, if Trump throws out more threats next week or China-Japan return with hard words of their own, USD/JPY will fall as well. At the beginning of the month, we talked about how September is historically a weak month for stocks and President Trump’s trade war could make things even worse.

AUD, NZD, CAD

Data Review

Australia

- RBA Leaves Rates Unchanged

- AU Manufacturing PMI 56.7 vs 52 Prior

- AU Retail Sales 0.0% vs 0.3% Expected

- AU Current Account Balance -$13.5b vs $-11.0b Expected

- AU PMI Services 52.2 vs 53.6 Prior

- AU GDP (QoQ) 0.9% vs 0.7% Expected

- AU Trade Balance $1551m vs $1450m Expected

New Zealand

- Terms of Trade Index (QoQ) 0.6% vs 1.0% Expected

- GDT Auction Prices Fall 0.7%

Canada

- Bank of Canada Leaves Rates Unchanged

- International Merchandise Trade -0.11b vs -0.80b Expected

- Building Permits -0.1% vs 1.0% Expected

- Unemployment Rate 6.0% vs 5.9% Expected

- Net Change in Employment -51.6k vs 5.0k Expected

- Full-Time Employment Change 40.4k vs 35k Expected

- Part-Time Employment Change -92k vs -30k Expected

- IVEY PMI 61.9 vs 61.8 Prior

Data Preview

Australia

- AU Employment Report - Weaker services employment offset by stronger employment in manufacturing so tough call

- CH Retail Sales and Industrial Production - Chinese data is hard to predict but can be very market moving

New Zealand

- Manufacturing PMI - Potential for downside surprise given lower dairy prices and weaker NZ activity

Canada

- No Data

Key Levels

- Support AUD .7000 NZD .6500 CAD 1.3000

- Resistance AUD .7200 NZD .6600 CAD 1.3250

The big question everyone is asking is whether the commodity currencies could extend their slide and we think the answer is 'yes.' The Australian and New Zealand dollars hit a 2-year low and further losses are likely. The Reserve Bank ignored the mortgage rate hikes by local banks and maintained a neutral but optimistic tone. Yet AUD fell sharply as Trump increased pressure on China. Stronger than expected second-quarter GDP growth failed to help the currency because investors are worried about how slower growth in China could affect Australia’s economy. We’ve already seen retail sales stagnate and service-sector activity slow. Between the mortgage rate hikes, global trade tensions and yuan weakness, the outlook for Australia is grim and for these reasons, AUD/USD could extend its slide below 70 cents. This week’s labor-market report probably won’t help. The New Zealand dollar also tumbled as lower dairy prices, weaker terms of trade and job ads weighed on the currency. There’s been an irrefutable downtrend in New Zealand data and the deterioration should be evident in this week’s manufacturing PMI report. We believe there could be another 2% to 3% drop in NZD/USD before the pair finds a bottom.

The outlook for the Canadian dollar is more difficult to predict because it is all based on trade. Fundamentally the Canadian economy is performing well but there are certainly pockets of weakness like the labor market. On Friday we learned that Canada lost 51K jobs last month with the nation’s largest province, Ontario, seeing part-time work decline by the biggest amount in close to a decade. The increase in full-time work is encouraging but with such a significant pullback, the economy is not at risk of overheating. However, the market is looking for a rate hike from the Bank of Canada this year and according to Deputy Governor Wilkins, the central bank debated dropping the line “gradual approach” to rate hikes from their policy statement, adding that normally there would be a rise at this point to preempt inflation. This tells us that the central bank is clearly hawkish and open to the idea of raising interest rates before the end of the year. Yet they also don’t want to pre-commit without seeing how the trade talks progress. If a deal with the US is reached before the October meeting, there’s nothing standing in the way of a hike. Not only would we see USD/CAD fall aggressively when the headline hits, but it will be the start of a new downtrend that could take the pair down to 1.29. If there’s no deal, USD/CAD could hold strong into the rate decision.

Euro

Data Review

- GE Manufacturing PMI 55.9 vs 56.1 Expected

- EZ Manufacturing PMI 54.6 vs 54.6 Expected

- EZ PPI 0.4% vs 0.3% Expected

- GE Services PMI 55.0 vs 55.2 Expected

- GE Composite PMI 55.6 vs 55.7 Expected

- EZ Services PMI 54.4 vs 54.4 Expected

- EZ Composite PMI 54.5 vs 54.4 Expected

- EZ Retail Sales -0.2% vs -0.25 Expected

- GE Factory Orders -0.9% vs 1.8% Expected

- GE Construction PMI 51.5 vs 50.0 Prior

- GE Trade Balance 16.5b vs 19.5b Expected

- GE Current Account Balance 15.3b vs 20.0b Expected

- GE Industrial Production -1.1% vs 0.2% Expected

- EZ GDP 0.4% vs 0.4% Expected

Data Preview

- ECB Rate Decision – No major changes in outlook. No plans to raise rates soon

- GE ZEW Survey - Potential for downside surprise as recent German data has been softer. Trade tensions could also dampen sentiment

- EZ Industrial Production - Potential for downside surprise given weaker GE IP, stronger French IP

- GE CPI - Revisions are difficult to predict but any changes can be market moving

- EZ Trade Balance - Weaker GE trade offset by stronger FR trade

Key Levels

- Support 1.1500

- Resistance 1.1700

There are two monetary policy meetings this week and between the BoE and ECB, we think the European Central Bank meeting will be the bigger market mover. EUR/USD ended last week near its 2-week lows on the back of risk aversion and softer German data. Italian yields fell every day last week so Italy is less of a problem but there’s very little reason for the ECB to change its neutral bias. The central bank made it clear at recent meetings that it has no plans to raise interest rates until late next year and data since the July meeting has been mixed. ECB President Draghi is worried about low inflation and given the lack of a significant increase in price pressures, his view that it is too early to call victory on inflation will remain unchanged. He will make this along with his concerns about global trade clear during his press conference this week. With US data improving and the Fed poised to raise interest rates later this month, neutral comments from the ECB could drive EUR/USD to 1.14.

British Pound

Data Review

- PMI Manufacturing 52.8 vs 53.9 Expected

- BRC Sales Like for Like (YoY) 0.2% vs 0.5% Prior

- Construction PMI 52.9 vs 54.9 Expected

- Services PMI 54.3 vs 53.9 Expected

- Composite PMI 54.1 vs 54.1 Expected

Data Preview

- Bank of England - No changes expected

- Visible Trade Balance, Industrial Production, Manufacturing Production and GDP - Potential for downside surprise given decline in UK PMI manufacturing index

- Labor Report - There was strong hiring in services and construction but weakness reported in manufacturing

Key Levels

- Support 1.2800

- Resistance 1.3050

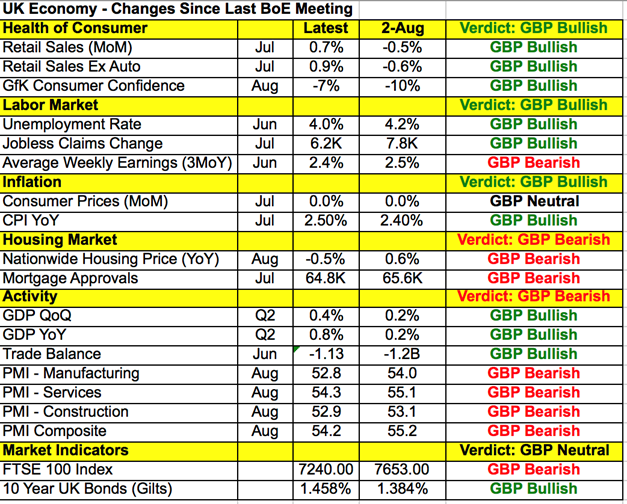

UK data and Brexit negotiations could have a greater impact on sterling than the Bank of England’s monetary policy announcement. Having just raised interest rates last month, the BoE is in no position to hike again. Brexit talks are going well with the European Union showing more willingness to facilitate an orderly withdrawal but a deal is not done and as we’ve learned from many of these trade negotiations, the talks could go south at anytime. So until a deal is officially announced, the Bank of England won’t be eager to raise rates again. Although we’ve seen some improvements in retail sales, inflation and the labor market, manufacturing-, service- and construction-sector activity slowed last month. The market is not pricing in another rate hike from the BoE until the middle of next year. With that in mind, sterling traders are not as patient as the BoE as there’s enough positive progression in the headlines for the shorts to be scared. Trade, industrial production and labor-market numbers are due for release this week and the jobs report could have a particularly significant impact on sterling ahead of BoE.