- The BOJ’s policy shift continues to strengthen the yen, keeping USD/JPY under pressure.

- Rising Japanese bond yields signal further tightening ahead, reinforcing the bearish outlook.

- A break below 149 could accelerate declines, with 147 emerging as the next key target.

- Get the AI-powered list of stock picks that smashed the S&P 500 in 2024 for half price as part of our FLASH SALE.

The USD/JPY pair has been on a steady decline since the start of the year, driven by two key factors. First, the Bank of Japan (BOJ) raised its main interest rate by 25 basis points—the highest level since 2008. With inflation still rising and forecasts pointing to sustained pressure, the BOJ is unlikely to stop here.

Second, concerns over extreme US tariff policies under Donald Trump’s presidency have eased. Without aggressive trade restrictions, the US dollar has weakened, reducing pressure on the Federal Reserve to cut rates further. Meanwhile, the yen continues to push against strong support at 149 per dollar, keeping traders on edge.

Bond Yields Signal More Action (WA:ACT) from the BOJ

Before the BOJ scrapped its negative interest rate policy, it relied on United States 10-Year government bond yield control as its primary monetary tool. Keeping yields artificially low required large-scale bond buying, increasing the yen’s supply and weakening the currency. But as the BOJ tightens policy, it has widened the acceptable yield range and scaled back asset purchases, leading to medium-term yen strength.

Recent moves in 10-year Japanese bond yields reflect this shift, accelerating higher in recent months. BOJ officials have signaled they will continue reducing bond purchases, with government officials suggesting they are comfortable with a stronger yen.

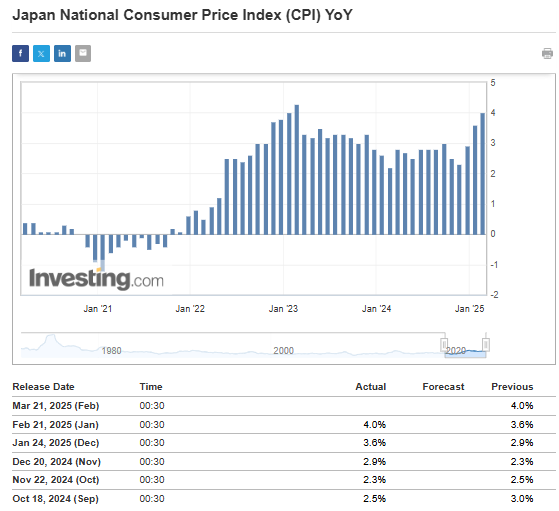

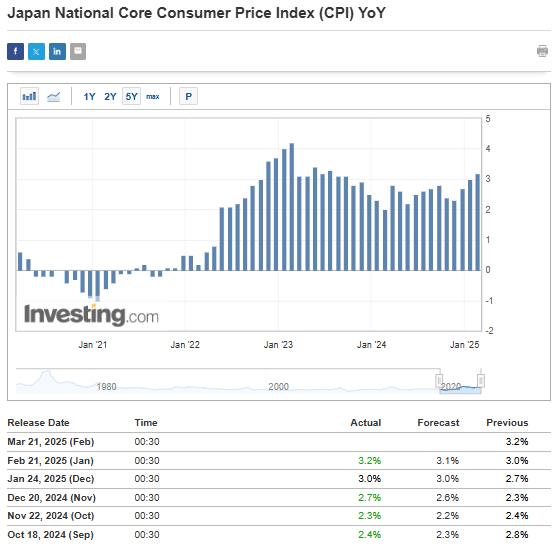

Japan’s Inflation Gains Momentum

Rising inflation adds another layer to the BOJ’s hawkish stance. Core and consumption-based inflation measures have accelerated, aligning with the BOJ’s latest forecasts.

The central bank now expects average annual inflation to rise from 1.9% to 2.4% this year, with a return to the 2% target unlikely before 2026. Any further rate hikes, however, may depend on how US tariff policies evolve and their impact on Japan’s economy.

Will USD/JPY Extend Its Decline?

USD/JPY recently bounced off strong support at 149, but price action suggests this may be a short-term rebound rather than a trend reversal.

Resistance near 151 triggered heavy selling, reinforcing bearish momentum. If support at 149 breaks, the pair could slide toward the next key level at 147, making further declines the base-case scenario.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.