In an unexpected turn of events, the Utilities sector - which has been trailing behind in 2023's year-to-date performance - emerged as the week's top performing sector across the ETF universe.

Despite lackluster year-to-date returns of -8.69% (S&P Utilities Index), the sector registered a welcomed turn-around posting a gain of 2.67% over the week, making it the best performing sector within the S&P 500 last week.

The correlation between utilities and current interest rate trends could help explain this rebound. As previously discussed, a higher interest rate environment can have a more pronounced impact on the utility sector - utilities stocks are typically held as dividend yield plays but with current interest rates more favorable than dividend yields, investors have been turning to lower-risk Treasury yields over higher-risk utility stocks. The present one-year dividend yield for utility stocks stands at around 2.6%, considerably less than the one-year Treasury Bill which is currently pegged at 5.43%.

However, early indicators suggest better days could be on the horizon for utilities stocks. Investors anticipate a pause or slowdown in the Fed’s hawkish policy which may very well create a more conducive environment for utilities stockholders and prospective buyers alike.

While this week’s performance has indeed been encouraging for the sector, it remains to be seen how things will pan out in the coming months.

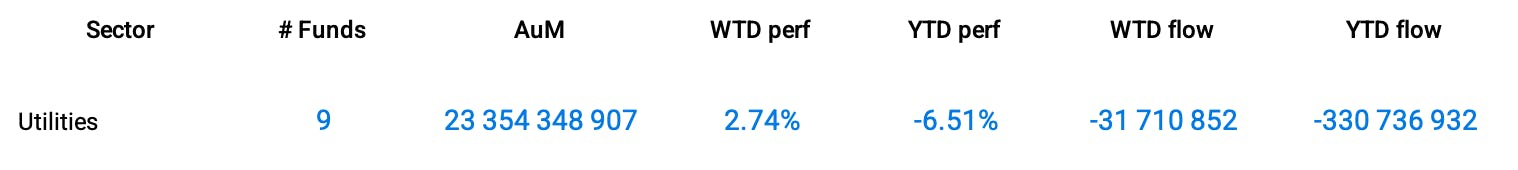

Group Data: Utilities

Funds Specific Data: XLU, VPU

This content was originally published by our partners at ETF Central.