- Walmart is scheduled to release earnings tomorrow before the market opens.

- Stock price has consolidated in anticipation of financial data.

- However, the macroeconomic environment may favor further revenue expansion.

- Invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Despite a solid 13% year-to-date gain, Walmart (NYSE:WMT) has spent the past couple of months trading sideways within the $58-62 per share range.

The stock could break out of this consolidation in the coming days, driven by the company's first-quarter 2024 results, scheduled for release tomorrow before the opening bell.

Market consensus expects an improvement in earnings per share and revenue compared to the same period last year. However, the significantly higher number of downward revisions compared to upward revisions is a potential concern.

If numbers disappoint, we may be looking at the stock moving toward the mid-$55 range.

Will High Inflation Work in Walmart's Favor?

Consistently above-target inflation in the U.S. is a major concern not only for Federal Reserve officials but also for a wide range of lower-income consumers. Walmart, whose strategy centers on competitive pricing, benefits from inflation remaining above 3% as it attracts price-conscious customers.

Simultaneously, Walmart's management is targeting more affluent consumers by prominently displaying higher-quality, higher-priced items and launching its premium grocery brand, Bettergoods.

The company has ambitious plans for growth, including opening 150 new outlets and modernizing 1,400 stores over the next five years. It is also diversifying its business with the potential $2.3 billion acquisition of smart TV manufacturer Vizio, which could enhance advertising opportunities.

Walmart is also focusing on electronic sales, which are growing by 17% annually, by expanding its digital fulfillment centers and launching early morning delivery services. It faces significant competition from Target (NYSE:TGT) and Amazon.com (NASDAQ:AMZN) in this segment.

However, the higher-than-average inventory levels in recent months could generate upward pressure on costs, a point of concern for the market.

Consistently above-target inflation in the U.S. is a major concern not only for Federal Reserve officials but also for a wide range of lower-income consumers. Walmart, whose strategy centers on competitive pricing, benefits from inflation remaining above 3% as it attracts price-conscious customers.

Simultaneously, Walmart's management is targeting more affluent consumers by prominently displaying higher-quality, higher-priced items and launching its premium grocery brand, Bettergoods.

The company has ambitious plans for growth, including opening 150 new outlets and modernizing 1,400 stores over the next five years. It is also diversifying its business with the potential $2.3 billion acquisition of smart TV manufacturer Vizio, which could enhance advertising opportunities.

Walmart is also focusing on electronic sales, which are growing by 17% annually, by expanding its digital fulfillment centers and launching early morning delivery services. It faces significant competition from Target and Amazon (NASDAQ:AMZN) in this segment.

However, the higher-than-average inventory levels in recent months could generate upward pressure on costs, a point of concern for the market.

How to Trade the Results

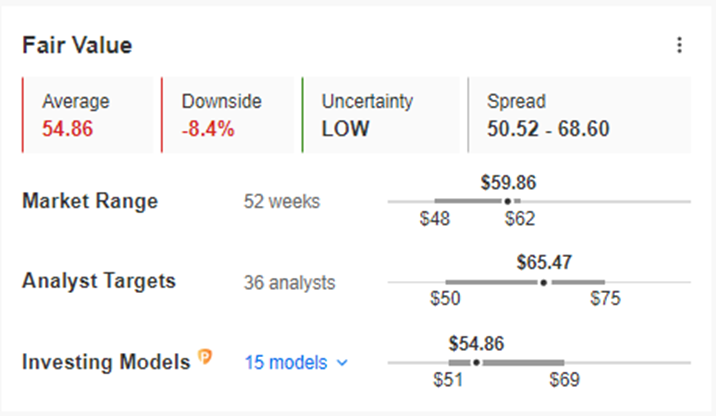

The current consolidation presents an intriguing investment opportunity, as a potential breakout could signal the stock's direction in the short and medium term. The InvestingPro fair value index currently indicates a possible overvaluation, which could become evident if the upcoming results disappoint.

Want to try the tools that maximize your portfolio? Take advantage HERE AND NOW of the opportunity to get the InvestingPro annual plan for less than $9 per month.

For readers of this article, now with the code: INWESTUJPRO1 as much as a 10% discount on annual and two-year InvestingPro subscriptions.ProPicks: AI-managed portfolios of stocks with proven performance.

- ProTips: digestible information to simplify a lot of complex financial data into a few words.

-

Advanced Stock Finder: Search for the best stocks based on your expectations, taking into account hundreds of financial metrics.

-

Historical financial data for thousands of stocks: So that fundamental analysis professionals can delve into all the details themselves.

-

And many other services, not to mention those we plan to add in the near future.

Act fast and join the investment revolution - claim your OFFER HERE!

Disclaimer: The author does not own any of these shares. This content, which is prepared for purely educational purposes, cannot be considered as investment advice.