Despite the brief quasi-stagnation of real GDP in 2019 Q4 caused by strikes in the transportation industry, our expectation of a muddling through economy for 2020 is supported by several factors.

First, the Bank of Canada's Business Outlook Survey released last week highlights the positive sentiment of companies.

Second, the economic momentum of the Canadian economy could be sustained by further expansionary measures in the federal budget, expected to be unveiled in February or March. With that in mind, and in addition to elevated household and corporate debt burdens, the BoC is less likely to start a new round of easing anytime soon, unless the outlook suddenly becomes gloomy because of an unexpected and severe negative shock.

Altogether, we do expect the BoC to repeat the cautious optimistic message of last December in the new statement to be released on Wednesday. We also see the overnight rate target to stay at 1.75% all year long, close to the market pricing of less than a 25bps policy rate cut. In our view, the bar is particularly high for the BoC to move away from the sidelines just a few months before Stephen Poloz ends his seven-year term in June 2020. Market participants will find out who the next governor is this spring.

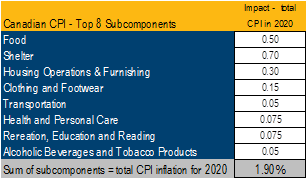

Also, our CPI inflation projections for 2020 do not make a strong case for easing. We forecast total CPI inflation to only edge down from an average of 2.0% in 2019 to 1.9% in 2020.

We also project the three core CPI metrics watched by the BoC to slip modestly by 0.2 percentage points to average 1.8%. Our 2020 total CPI inflation forecast is derived from multiple industry-specific developments (see table). More than half of our 1.9% forecast comes from the positive contribution of two sub-components: food and shelter.

First, the impact of climate change disrupting food production is unfortunately gaining ground.

Second, very tight conditions in the homeownership and rental housing markets are poised to accelerate the pace of increase in the shelter CPI sub-component.

Altogether, we do not think investors will be able to ride the “reflation trade” on a consistent basis in 2020 because of the small positive contributions to total CPI coming from other subcomponents. This being said, RRBs may have a good day on Wednesday if our expectation of a 0.2% m/m increase in total CPI for the month of December 2019 materializes when the CPI report is released on Wednesday at 8 a.m. (consensus is at 0.0% m/m). Our call of a 0.2% monthly gain brings total CPI inflation to a 16-month high of 2.5%. We forecast this 2.5% figure to remain unchanged for the January 2020 print before it gradually fades below 2% during the rest of the winter and spring seasons.