- The NASDAQ scores another record week, but momentum on the tech-heavy index slowed relative to the broader market

- Stocks have been rising alongside spiking cases of coronavirus

Even as the US continues to hit new daily records for the still-escalating number of coronavirus cases across the country, and with a growing number of states considering lockdowns, markets blithely move higher, powered by improving economic data and robust stimulus funding. That is, until, something reaches a breaking point.

On the one hand, technology shares and growth stocks are leading the market acceleration, as economic data remains better-than-expected. Last week, ISM non-manufacturing PMI, a measure of business conditions, registered its largest monthly gain since data was recorded in 1997. And Initial Jobless and Continuing Claims both surprised to the upside.

Still, the number of confirmed COVID-19 cases in the US has crossed the 3.2 million threshold unabated, with close to 135,000 deaths and the figure keeps growing.

V-Shaped Recovery Or Rising Economic Risks?

Nonetheless, some see a string of economic data beats and even record results, as further evidence of a V-shaped economic recovery. Others remain dubious that any real recovery can be at hand when the number of global coronavirus cases continues to escalate, currently at 12.8 million and rising. Count us in the second category.

This current recession wasn’t caused by a bubble that burst. Rather, it's the result of a force majeure—the ongoing coronavirus pandemic that keeps spreading across the globe—pressuring countries, their workforces and economies into lockdown, shuttering businesses and creating massive layoffs and firings.

Without a vaccine or cure for COVID-19, and with many US states remaining open despite the health hazards, we expect that rising outbreak levels will continue hitting new records. As such, hospitals in hot spot locations will remain overwhelmed, forcing states to weigh new restrictions—including lockdowns—that would slow down the current rebound in economic data. We also expect that so much uncertainty ahead of this Fall's US elections will add an additional level of uncertainty to already erratic markets.

For now, it appears that rates near zero and the Fed’s “infinite QE” will continue to support near-record prices. Federal Reserve Bank of Dallas President Robert Kaplan, speaking on Fox Business, said he sees the need for more fiscal outlays. This, just two days after Cleveland Federal Reserve President Loretta Mester warned economic activity is slowing in her area.

Both the IMF and Goldman Sachs recently cut their forecasts for US economic growth this year. The IMF is now forecasting a global contraction of -4.9%; Goldman analysts lowered their full year growth projection to -4.6% from -4.2%

Still, on Friday investors were optimistic enough to lock themselves into rising positions ahead of the weekend and four major US indices—the Dow Jones, S&P 500, Russell 2000 and NASDAQ—gained. Some of the positive sentiment was driven by renewed hopes of progress in finding a treatment for COVID-19.

Gilead Sciences (NASDAQ:GILD) announced that its coronavirus drug remdesivir can reduce deaths by 62%. Though shares of the biotech added more than 2% on the final day of trade, these claims must still be put to larger and more rigorous testing. It may still be a long road ahead before this company or any others are able to supply it to the public.

While the NASDAQ underperformed on Friday for the first time in nearly two weeks, the tech-heavy index still notched yet another all-time high along with its fifth record close in six days. Friday's finish was its 26th record for the year.

From a technical perspective, the NASDAQs rising gap on Monday, which was intuitively bullish, puts it in a precarious state, as extremely thin volume and negative divergences for both the Rate of Change (ROC) and Advance Decline (AD) line provide a setup for an Island Reversal.

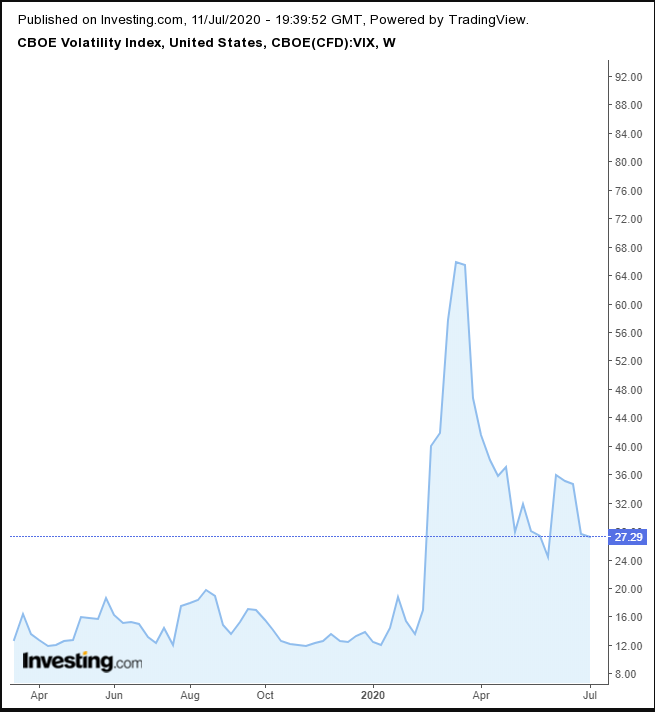

Despite US markets experiencing their most vociferous rally in years—including the best quarter for the S&P 500 in 22 years, and the strongest quarterly performance for the Dow Jones since 1987—the VIX is still more than three times higher than it was before COVID-19.

Conversely, yields, including for the 10-year Treasury note, are far below their pre-coronavirus, 1.5% levels, hovering now at near historical lows.

Technically, they may have completed a H&S continuation pattern, suggesting they could be revisiting the all time lows recorded on March 9.

The dollar retested the completed flag and retreated, confirming the pattern’s bearishness.

The 50 DMA crossed below the 200 DMA, triggering a Death Cross, before the downside breakout. Both the RSI and the MACD provided bearish signals.

Gold moved higher for a fifth straight week, its longest streak of weekly gains since 2011.

We have been bullish on gold for some time now, since at least March 2, but certainly since the yellow metal completed a H&S continuation pattern on April 7.

However, the precious metal closed well off its weekly high on Friday, producing a weekly shooting star—a pattern demonstrating that after bulls gave it a run, the bears pushed them back. As we predicted on Thursday, gold retreated. It might deepen the dip in the week ahead, as both momentum indicators and price averages weakened, showing signs of reversals.

Crude oil prices rebounded on Friday. They're now back above $40 but off the trend line we’ve drawn since May 22 that we intended as a top.

The price of WTI has found resistance by the falling gap March 9 that wiped out almost a quarter of crude’s value. The 200 DMA is falling toward the same level. Both the MACD and the RSI are bearish.

These technicals might reflect growing investor fears of a return to lockdowns. Should that occur, planes would once again be grounded as travel decreased and cars would return to driveways as workers once again were authorized to shelter-in-place.

The Week Ahead

All times listed are EDT

Tuesday

2:00: UK – Claimant Count Change: seen to drop to 400.0K from 528.9K.

2:00: UK – GDP: anticipated to rise to 5.0% QoQ from -20.4% previously.

2:00: UK – Manufacturing Production: expected to surge to 8.0% from -24.3%.

5:00: Germany – ZEW Economic Sentiment: probably edged lower, to 60.0 from 63.4.

8:30: US – Core CPI: forecast to rise to 0.1% for June from -0.1%.

8:52: China – Exports: predicted to have dropped to -1.5% YoY in June, from -3.3% in May.

Wednesday

2:00: UK – CPI: expected to remain flat at 0.5%.

8:30: US – NY Empire State Manufacturing Index: foreseen to 9.25 from -0.20.

10:00: Canada – BoC Interest Rate Decision: forecast to remain steady at 0.25%.

10:30: US – Crude Oil Inventories: seen to show a drawdown of -3.114M bbs, from a gain of 5.654M.

21:30: Australia – Employment Change: predicted to surge to 112.5K from -227.7K.

22:00: China – GDP: seen to soar to 2.1% YoY from -6.8%.

22:00: China – Industrial Production: expected to edge higher to 4.7% from 4.4%

Thursday

7:45: Eurozone – ECB Interest Rate Decision: predicted to remain flat at 0.00%.

8:30: US – Core Retail Sales: seen to fall to 5.0% from 12.4%.

8:30: US – Initial Jobless Claims: anticipated to shrink to 1,250K from last week's 1,314K.

8:30: US – Philadelphia Fed Manufacturing Index: expected to decline to 20.0 from 27.5.

8:30: US – Retail Sales: seen to plunge to 5.0% from 17.7%.

8:30: Eurozone – ECB Press Conference

Friday

5:00: Eurozone – CPI: probably remained stead at 0.3% YoY and rose to 0.3% from -0.1% MoM

8:30: US – Building Permits: expected to have risen to 1.280M from 1.216M.