by Chaim Siegel of Elazar Advisors, LLC

S&P 500: Bullish

Economic Calendar This Week

- Tuesday: PCE Price Index

- Thursday: ADP Employment

- Friday: Nonfarm Payrolls

We only list three events this week because this is all that matters to us, as we’ll explain. There is typically a ton of noise and commentary on many economic numbers. Inflation and jobs is all the US Fed really looks at. It just so happens that jobs and inflation are the core drivers to stocks and bonds. That’s why we sift through the rest and focus on what really matters (to us anyway).

PCE Price: Tuesday

The US Federal Reserve’s main inflation index reports on Tuesday morning. It's the PCE Price Index and its last reading was negative.

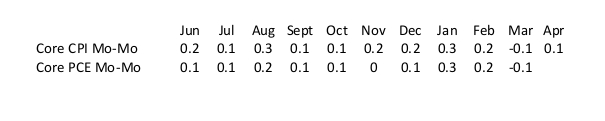

CPI reports ahead of PCE Price and tends to predict PCE Price. The last CPI reading was released on May 12. It was light and April PCE may not be much better.

You had two Fed officials comment recently that the Fed is in fact ahead of the curve because inflation is below their forecasts. That may be a hint that Tuesday’s number could come in low once again.

St. Louis Fed President James Bullard said last week that the low inflation is “worrisome.”

Chicago Fed President Charles Evans echoed the need to keep rates low by saying the Fed is at risk for “a serious policy outcome miss” by tightening too fast.

Clearly, Tuesday’s inflation number matters.

Even if it comes in low we’d still expect the Fed to hike at their June 14th decision. They are trying to get rates back to 3% which they consider “neutral.” As long as markets give them the pass to raise rates, they'll likely raise.

Currently the markets are giving them that pass with Fed Funds futures currently giving a hike a roughly 80% chance for June.

As long as the markets are comfortable with hikes, markets still have upside.

As long as inflation stays low, markets still have upside. Low readings on PCE Price on Tuesday should be a bullish event for the S&P 500.

Jobs Thursday And Friday

ADP tends to preview the Nonfarm Payrolls (“NFP”) the next day. Still, stock markets move with NFP.

Jobless claims are averaging lower than they were in April. Since jobless claims and NFP are inversely related, the NFP number could be bigger than April.

Estimates for Friday’s NFP however are only expecting 211,000, an equal number to April. Looking at jobless claims much better than a month ago you can envision May’s NFP to be higher.

Upside to the NFP number on Friday should be a bullish stock market event.

Debt Ceiling Coming

News is leaking that the US debt ceiling could be reached by June or July of this year. Treasury Secretary Steven Mnuchin has recently impressed upon Congress that they must pass a ceiling raise before they go on vacation in August.

The markets had to deal with the debt ceiling in July 2011 and May 2013. Both times saw market volatility. July 2011 also saw the S&P downgrade the US's credit rating which also caused market volatility.

We need to track how this develops this month.

Individual Investors Not Too Bullish

The American Association of Individual Investors, (AAII), said that overall bullishness was no greater than historical averages.

While there are a ton of press reports trying to get people to believe a top is in, sentiment isn’t showing a top.

Comey Losing Credibility

The former head of the FBI, James Comey has lost some credibility and his testimony has been pushed out to sometime after the Memorial Day holiday, though no date has yet been set.

Mr. Comey's memos of President Trump apparently asking the former FBI chief not to go after Michael Flynn helped cause the market to take a tumble two weeks ago.

His testimony is one risk to the stock market. If Mr. Comey does have evidence against President Trump, it could navigate the market into political distractions.

Last week however, Mr. Comey lost some credibility when it was reported that he brought Clinton news to the public during the elections knowing that he was basing his decision on “fake” information.

Discrediting Mr. Comey boosts President Trump’s position and should be seen as a stock market positive.

Last Week's FOMC Minutes

The Fed confirmed that they would slowly end their historic bond buying by the end of this year. They also confirmed the desire to raise rates in June.

Both pieces of news did not budge markets which we see as “good action” on potentially bad news. Not going down on such news confirms further potential upside.

OIL: Bullish

Even with the “sell-the-news” reaction to OPEC last week, we still see oil in an uptrend. There are a few positives for oil medium-term.

Memorial Day Monday marks the start of the summer driving season. Add to that, the economy is picking up from Q1 to Q2.

After a report of 1.2% GDP in Q1, The Atlanta Fed is predicting Q2 at 3.7%. That would be the strongest quarter of GDP since Q3 2014. Oil then was in the $90s and $100s.

Taking the two events in combination, a stronger economy along with peak driving season, you could continue to see a draw of crude inventories. Crude inventories have dropped in EIA Wednesday releases now for seven weeks.

Combine that with OPEC cuts and there is some visibility that prices can hold and start to move higher.

GOLD: Neutral

Tuesday’s PCE Price index will matter for gold.

Our comments above, that Fed officials are starting to worry about inflation not being high enough, could be read two ways. Inflation is dead despite all their efforts which is a negative for gold.

Or, if you believe that the Fed will hold off rate hikes because of low inflation, that would be bullish for gold.

We do not think the Fed will hold off rate hikes because they are about 200bp behind their own “neutral rate” as we explained above. They appear dead-set on getting rates back to that number unless the economy were to slow.

With GDP and jobs decent, we don’t expect the Fed to hold off rate hikes which is a negative fundamental story for gold.

But with gold’s price breaking out above resistance as of Friday, technicals are looking bullish. Strong technicals against a negative fundamental backdrop have us neutral.

BONDS: Bearish

With growth picking up we are bearish on bonds. We’d expect this downtrend on the chart, (above, iShares 20+ Year Treasury Bond (NASDAQ:TLT), to hold bonds back.

That said, they have been surprisingly strong even with the economic backdrop picking up.

Bonds staying strong are saying that bond investors are expecting growth to slow. One other reason that bonds may be strong is that despite growth picking up, investors are still risk averse and not ready to take the risk plunge into equities.

If that’s the reason, then that is a very bullish story for equities. Like AAII above, it tells you that everybody is not all in, which leaves stock market upside as investors continue to drip into stocks.

DOLLAR: Neutral

The PCE Price report on Tuesday will also matter for the dollar. If inflation is low again, that gives extra support to the dollar.

If what we wrote above about James Comey proves correct and he loses credibility, that could strengthen the political picture in the US. That could also force traders to cover shorts.

Disclaimer: Securities reported by Elazar Advisors, LLC are guided by our daily, weekly and monthly methodologies. We have a daily overlay which changes more frequently which is reported to our premium members and could differ from the above report.

Portions of this report may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.