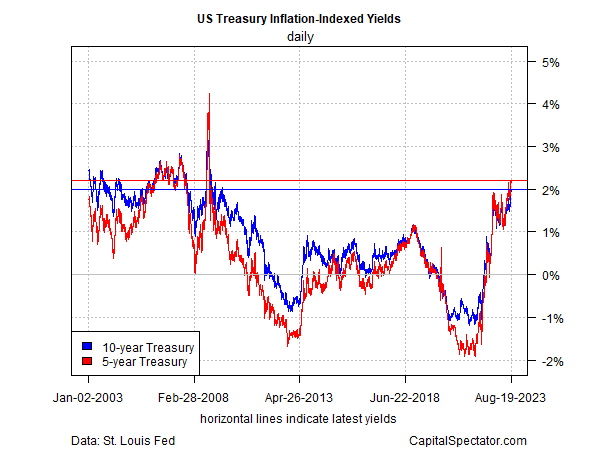

The last time you could lock in a real (inflation-adjusted) yield with inflation-adjusted Treasuries (TIPS), the world was still cleaning up the mess from the financial crisis. A lot has changed since then, but current yields for 5- and 10-year TIPS securities have come full circle.

The jump in real yields has various implications for the economy, financial markets, and investors. Here’s a quick look at where we stand and how some analysts are analyzing the recent increase in inflation-adjusted rates.

Let’s start by reviewing 5 and 10-year TIPS yields. The former edged up to 2.21% (Aug. 21), the highest since 2008. The 10-year equivalent is close behind and is currently 2.0%, a 14-year high.

The rise in real yields hasn’t gone unnoticed and for good reason. As Mark Rzepczynski, a veteran financial analyst, observes in his blog Disciplined Systematic Global Macro Views:

Higher real rates increase the true cost of capital Levered firms will lose. New investment project will be placed on hold. The housing market will further tighten. Economic activity will slow although the extent of this slowing is unclear. Stock market valuations will decline…

The core message is that real rate normalization will have spillover to the rest of the economy and asset prices. Fixed income repricing cannot be looked at in isolation.

Waddell & Associates CEO and chief investment strategist David Waddell tells Yahoo Finance advises that higher real yields will also influence policy decisions at the Federal Reserve:

Remember that while the Fed controls the policy rate, the real interest rate is what matters for the economy, and that’s going through the roof as inflation to come down and then the headline rates go up. So I’m not sure the Fed really does have to do a whole lot more [in terms of raising interest rates]. So I think Powell will recognize that the last time we were here, Silicon Valley Bank failed. So if he comes out super hawkish, he could break something.

Additionally, you’ve got real rates going up. You’ve got the 10-year going up, so the market’s doing a lot of tightening for him. I don’t think he has to do more. So I actually anticipate that he’ll end up being softer at Jackson Hole.

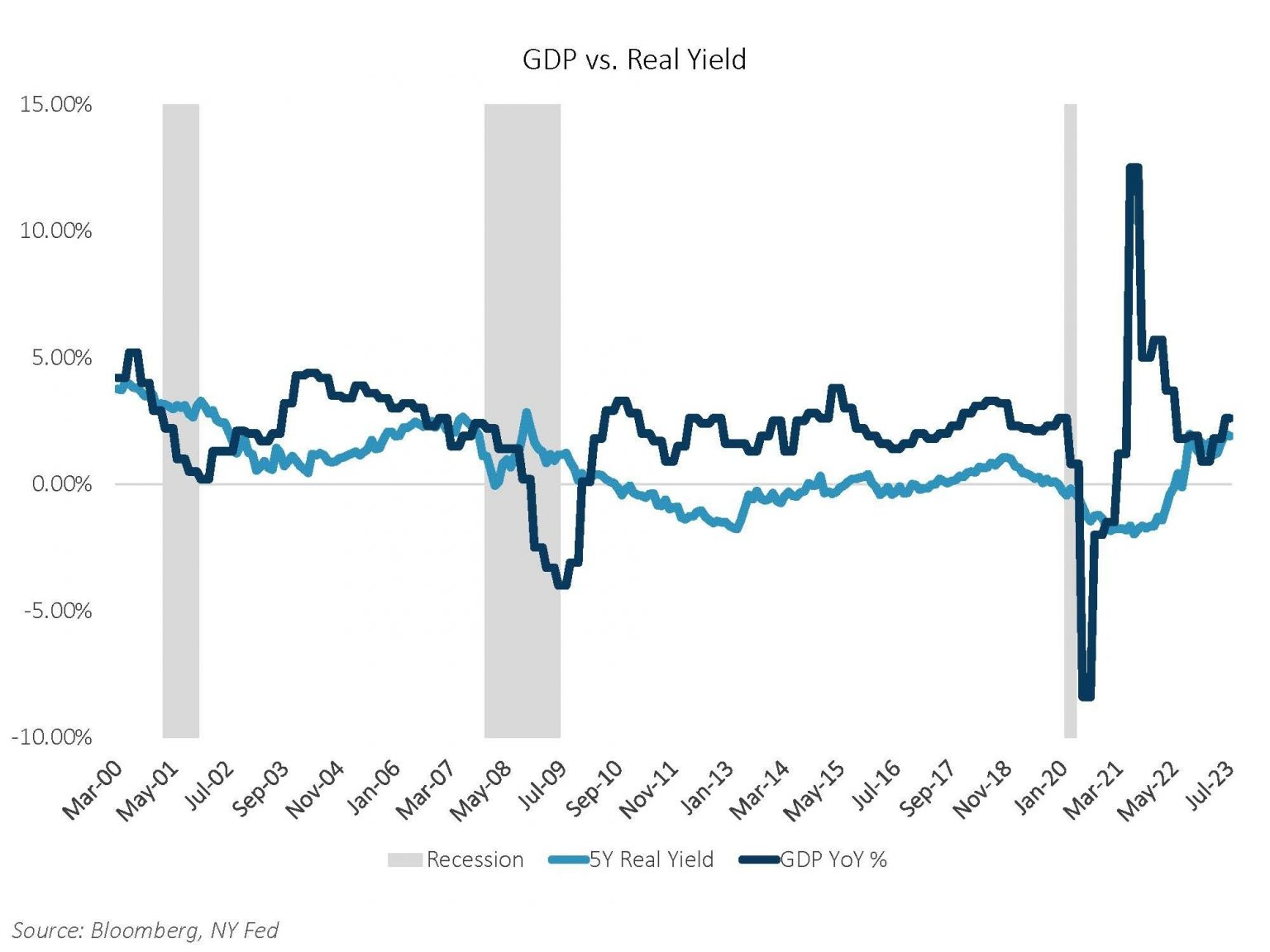

Sage Advisory noted earlier this month that “Real interest rates are the cost of capital for the US economy and have now closed the gap with US GDP. A negative GDP/Real Yield Gap has historically resulted in economic slowdowns — will this time be different?”

Rising real yields also have negative implications for the price of gold, notes Matthew Weller at Forex.com (via Investing.com):

Real interest rates simply represent the opportunity cost of holding gold. When real interest rates are low, investment alternatives like cash and bonds tend to provide a low or negative return, pushing investors to seek alternative ways to protect the value of their wealth.

On the other hand, when real interest rates are relatively high, strong returns are possible in cash and bonds, and the appeal of holding a yellow metal with few industrial uses diminishes. Beyond the opportunity cost of holding gold, interest rates also play a role in the cost of funds when buying gold on margin, as many traders do.

Finally, Zachary Griffiths, senior fixed-income strategist at CreditSights, explains:

“The move higher across the curve over the last few weeks has really been all on the real yield side,” a shift that’s linked “with a higher Fed policy rate or better growth expectations, with little shift in breakeven inflation expectations.”