Canada hits pause on tariff hike as Trump extends trade deadline - Politico

I write about Bitcoin, Crypto and finance and break down complex ideas so everyone can understand them. In this article, let’s look into something that might just be affecting your life — INFLATION.

Inflation is the increase in the price of goods or services over time. It usually refers to prices this year, compared to prices a year ago. It is also the gradual (or sudden) decrease in the value of money.

Officially, inflation in the US for April 2021 was 4.2%, meaning certain prices were 4.2% more expensive than April 2020, and this is the highest inflation has been since 2008.

Breaking Down Inflation

Courtesy of ft.com. ©FT.

- The cost of lumber is up 124%

- The cost of gasoline is up 49.6%

- The cost of copper is up 36%

- The cost of energy is up 25%

- The cost of used cars/trucks is up 21%

- The cost of housing is up 2.1%

If you run a business, drive a car, or are buying or renting, inflation is probably affecting your finances.

What is Inflation Caused By?

Inflation is generally caused by the balance or imbalance of two things. The first is money in circulation and the second is the availability of goods or services that we need or want.

Extreme shortages of supply and extreme spikes in demand can also send the prices of a good/service skyrocketing, which can affect inflation but is something else and not the subject of this article.

Inflation refers to the average of the price of all good/services.

If there is a ton of money in circulation compared to the goods/services that can be bought, their price tends to go up because the sellers think that their goods/services are more valuable than the money.

On the flip side, if there is very little money in circulation, the buyers think that their money is more valuable than the goods/services and so they are more likely to hold onto their money and the price of the goods/services goes down.

Central Banks

In the US, the Central Bank is the Federal Reserve. In the Eurozone, there is a European Central Bank. Other Central Banks you may have heard of include The Bank of England, The People’s Bank of China and The Bank of Japan.

Central banks generally set a target for what they consider to be ideal inflation. They call this an “inflation target”. Their stated job is to set monetary policy and monitor how much money is newly created to match this target. They think it is bad if it goes too far over or too far under the inflation target.

The thinking is that if an average worker’s wages goes up the same as or more than inflation, then that’s good for the worker. If inflation goes up too much compared to a worker’s wages, then workers are able to buy less things with their wages.

The Federal Reserve’s long-term inflation target is 2%. When this last inflation report came out, members of the Federal Reserve and many professional economists were surprised by how much it went up. They also claim that inflation is temporary, and this month’s report was higher based on an unusual crash in prices last April. They also claim that some of the rocketing prices in lumber, gasoline and cars are caused by increases in demand from economies re-opening post-COVID 19 combined with supply shortages that were generated last year when a lot of supply lines were closed down.

Some of these conditions validly affect prices and are partially responsible. And yes, there are also other supply/demand factors in this economy having to do with the subject of oil, gasoline and energy which I won’t get into now.

Are The Central Banks Printing Too Much Money?

YES! The current popular monetary policy of central bankers is to solve big problems — such as a sluggish economy or an upcoming financial crash — by creating a lot more money. This is not always bad and certainly has its place. But when the amount of money being created over a long period of time is a lot more than the increase in goods or services, this creates inflation. I believe that the US economy is so strong that this could continue for a long period of time before a disaster occurs. Things never looked so good as they did before any major crash — 1929 or 2007 for example.

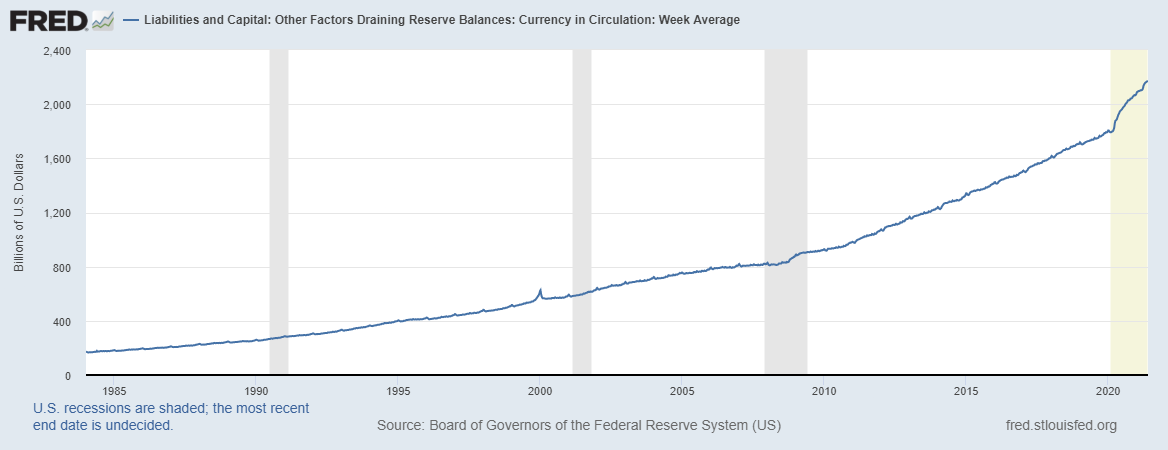

US Dollars in Circulation. Courtesy of Board of Governors of the Federal Reserve System (US)

Over the past 10 years, the money in circulation in the US has increased by an average of 11% per year. The total amount of good/services produced has increased by an average of 2% in that same time period.

In the past 16 months, this has ramped up. The money in circulation has increased by 21%. Due to COVID-19 and lockdowns, the GDP decreased by 3%.

This makes the dollar less valuable over time. Much of this money has been created to stimulate the economy or support those experiencing poverty. Some of this was necessary, but taken to extremes, it risks creating hyperinflation, or very high inflation.

It can get out of control where actions by the central bank to lower inflation do not work. Sadly, those that will suffer the most from this are those already currently experiencing poverty, followed by the working class who are living paycheck to paycheck or who have less than 6 months of savings. Of course, runaway hyperinflation effects everybody negatively.

Outside of the US, there are places where generating money out of thin air to solve problems has created hyperinflation that is out of control right now:

Venezuela 2,941%

Zimbabwe 162%

Lebanon 122%

Argentina 55%

Iran 49.5%

How Exactly do we Measure Inflation?

In the US, we get measurements on inflation from a part of the government called the The Bureau of Labor Statistics (BLS). They provide two specific reports on inflation. Economists and analysts read these over for more insight.

What Is the Bureau of Labor Statistics (BLS)?

The Bureau of Labor Statistics (BLS) is a federal agency based in Washington, DC and is part of the Department of Labor. It was started in 1884 and currently has about 2,500 employees.

The BLS collects, processes, analyzes and distributes various data about the U.S. economy and labor market. Their role is to report this to the US Congress, other US government departments and the American people.

Its reports include the Consumer Price Index (CPI) and the Producer Price Index (PPI), both of which are considered to be important measures of inflation. In addition, the BLS produces national and regional figures on employment, labor force participation, productivity, and wages.

They have an online publication called the Monthly Labor Review, with articles about these subjects.

What is the Consumer Price Index (CPI)?

The Consumer Price Index measures the average change in prices over time that consumers pay for a variety of goods and services. They just include people who live in cities, not those who live in rural areas or are in prison or the military.

This includes such items as: cereal, milk, coffee, housing costs, bedroom furniture, apparel, transportation expenses, medical care costs, recreational expenses, toys, the cost of admissions to museums, tobacco, haircuts and funerals.

What Is the Producer Price Index (PPI)?

The producer price index (PPI) is different from the CPI in that it measures costs from the viewpoint of industries that make the products, whereas the CPI measure prices from the perspective of consumers.

What Can I Do to Protect Myself Against Inflation?

One answer is to call, email or write to your local Congressman or Congresswoman.

But in this article, I am assuming monetary policy is not going to change tomorrow. I am suggesting an investment plan that protects against inflation. Past success is no guarantee of future results, and I am not your financial advisor. However, I will end with this:

- In the current market where interest rates are very low, borrowing is rewarded and saving is penalized.

- To learn how to invest if one has little extra money, read my article on Dollar Cost Averaging (DCA).

- Pay your bills and save enough cash to have an emergency fund. After that, invest in those things which appreciate in value over time. 5 years ago, if you invested $1,000 into the following, here is what it would be worth today:

2% Savings Account: $1,104

Real Estate Investment Trust (REITs): $1,288

Gold: $1,410

S&P 500 Index: $2,000

Bitcoin: $69,390

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.