- U.S. Treasury market ETF capped off last week with big gains

- Sub-50 ISM manufacturing index suggests the economic backdrop not so rosy

- Focus shifting from inflation worries to recession fears

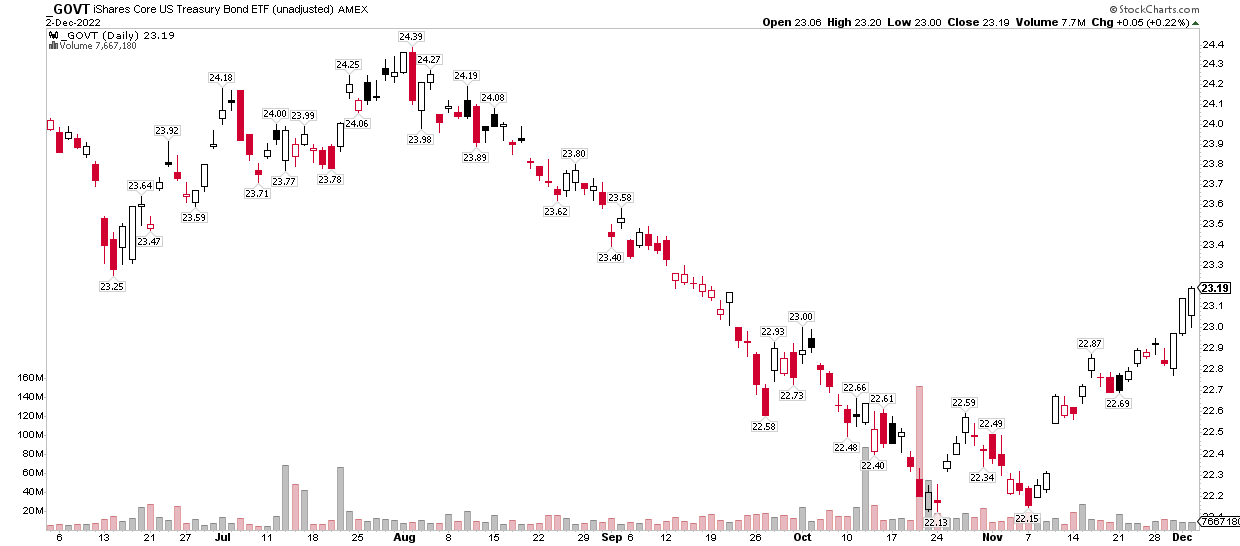

The bond market might finally be telling us that inflation concerns are a thing of the past and that the primary macro risk is a global recession. Consider that last week, the iShares U.S. Treasury Bond ETF (NYSE:GOVT) rallied big on Wednesday, Thursday, and Friday. As a technician, I always pay attention to intraday price action, too. Notice in the chart below that GOVT opened near the low of the day and finished at session highs during each of those days.

GOVT: Treasury ETF Climbed to its Highest Level Since September

Source: StockCharts.com

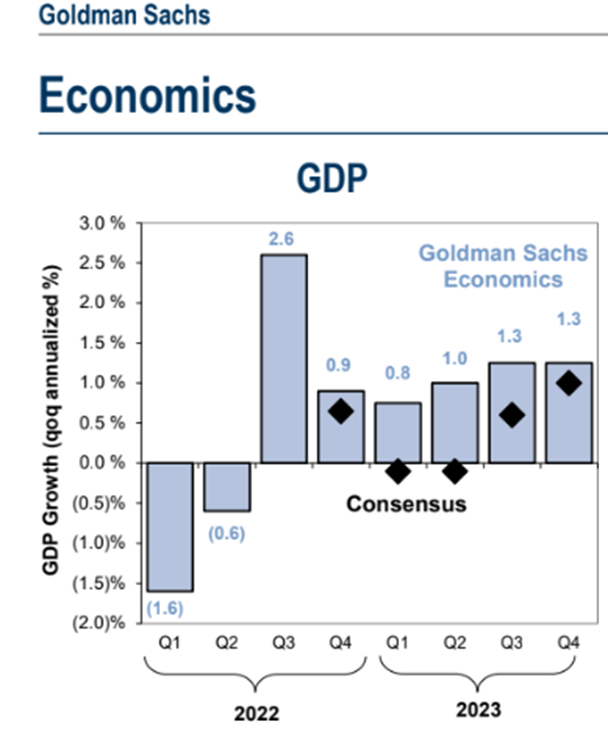

Three days do not make a trend or mark a significant market inflection, but this move comes amid some strong jobs data. It's as if the inflation bulls are being overwhelmed by those concerned about lower interest rates ahead. As it stands, the consensus expectation is for two consecutive quarters of negative real GDP growth in the U.S. in the first half of 2022.

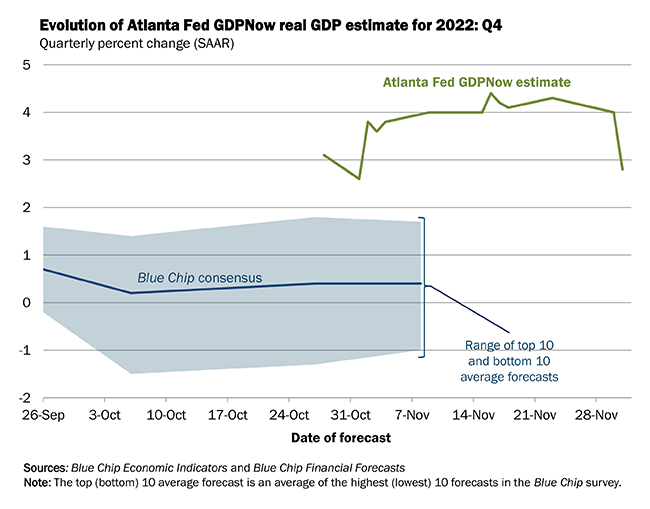

That bleak outlook contrasts last week's stronger-than-expected revised third quarter GDP number of +2.9% (q/q SAAR) and with an Atlanta Fed GDPNow model pointing to still above-trend growth of +2.8% in Q4. To be fair, most economists expect this period's expansion percentage to be more modest, under 2%.

Consensus GDP Growth Calls for (Another) Technical Recession

Source: Goldman Sachs Investment Research

The Atlanta Fed's GDPNow Shows Impressive Q4 Growth (For Now)

Source: Federal Reserve Bank of Atlanta

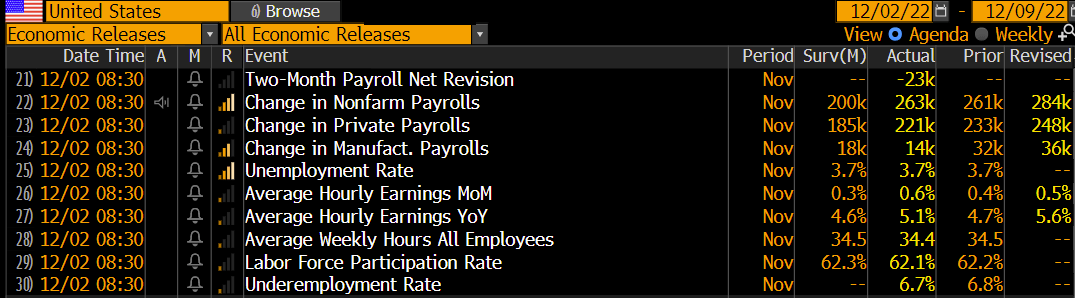

Higher Treasury prices last week and lower bond yields were perhaps driven by a sub-50 ISM Manufacturing print. As a reminder, 50 is the demarcation line between growth and contraction in the domestic economy. Once again, though, the two-faced economic landscape shows a still-strong labor market as evidenced by Friday's seventh consecutive hotter-than-forecast monthly jobs report.

The November reading indeed revealed a solid 263,000 net new jobs created, but the more startling figure was a large 0.6% increase in average hourly earnings from the month prior. To be fair, total hours worked came in light, which is actually a significantly cooler-than-expected number.

A Still-Strong Labor Market

Source: Bloomberg

Couple strong annual gains at +5.1% with Core PCE that verified at 5.0% and the numbers can be twisted to show positive real wage growth from this time in 2021. Still, in my view, the weight of the evidence is borne out in the price action of Treasury securities. With a yield curve that is inverted by almost 80 basis points and a Fed Funds Terminal rate still seen near 5% following the May FOMC meeting next year, future economic data will likely be responded to differently; the focus will soon turn to how bad the economy will be in the first half of next year.

The Bottom Line

I suggest investors continue to watch how GOVT trades. Last week's bullish price action might not be such a sanguine sign for the stock market as we've seen in the last two months. We will get more clues on the state of the economy following next week's CPI report and Fed meeting.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.