- Energy stocks outpace the broad equity market

- Crude oil has fallen to its lowest price since January, now down year-on-year

- Possible long-term support on the chart, potential bullish fundamental catalysts

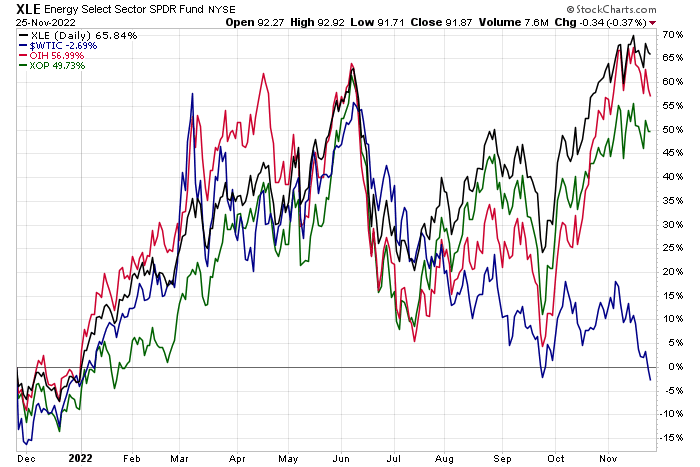

It has been a banner year for energy. The Energy Select Sector SPDR (XLE) is higher by 66% so far in 2022 while two other, more niche, funds are positive by handsome amounts, as well. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) has returned 50%, including dividends, while the VanEck Oil Services ETF (OIH) sports a 57% advance.

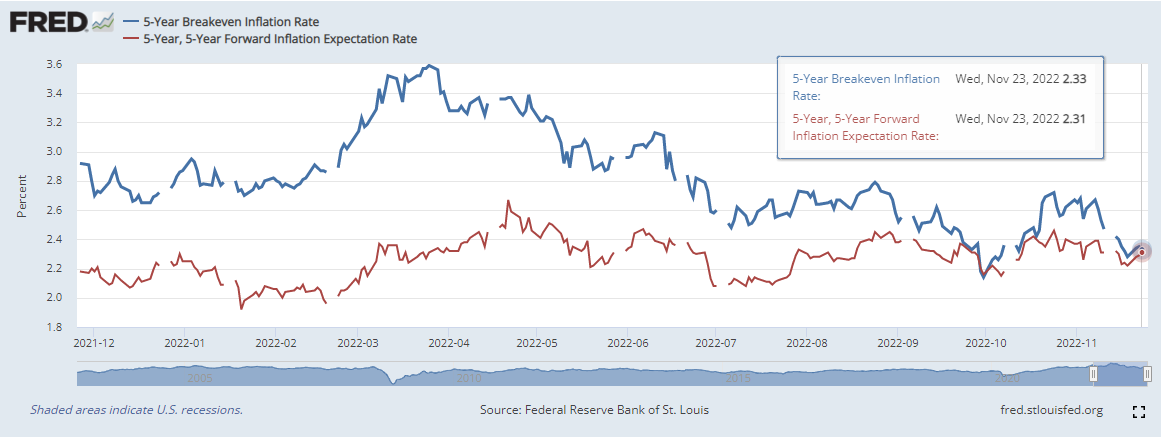

Not surprisingly, the recent plunge in oil prices has resulted in more sanguine inflation outlooks among traders.

Energy Equities Continue to Work Despite Lower Oil

Source: StockCharts.com

As of the close last Wednesday, both the 5-year forward breakeven inflation rate and the “5y5y” which measures expected inflation over the five-to-10-year horizon stood just above 2.3%—near the lowest figures in the last year. The rosier outlook for consumer prices comes after October’s better-than-expected CPI report that sent stocks soaring. But a new factor now comes into play that could keep a lid on rising costs across the economy and the world.

Inflation Expectations Cooling: Near 2.3% Next 10 Years

Source: St. Louis Federal Reserve

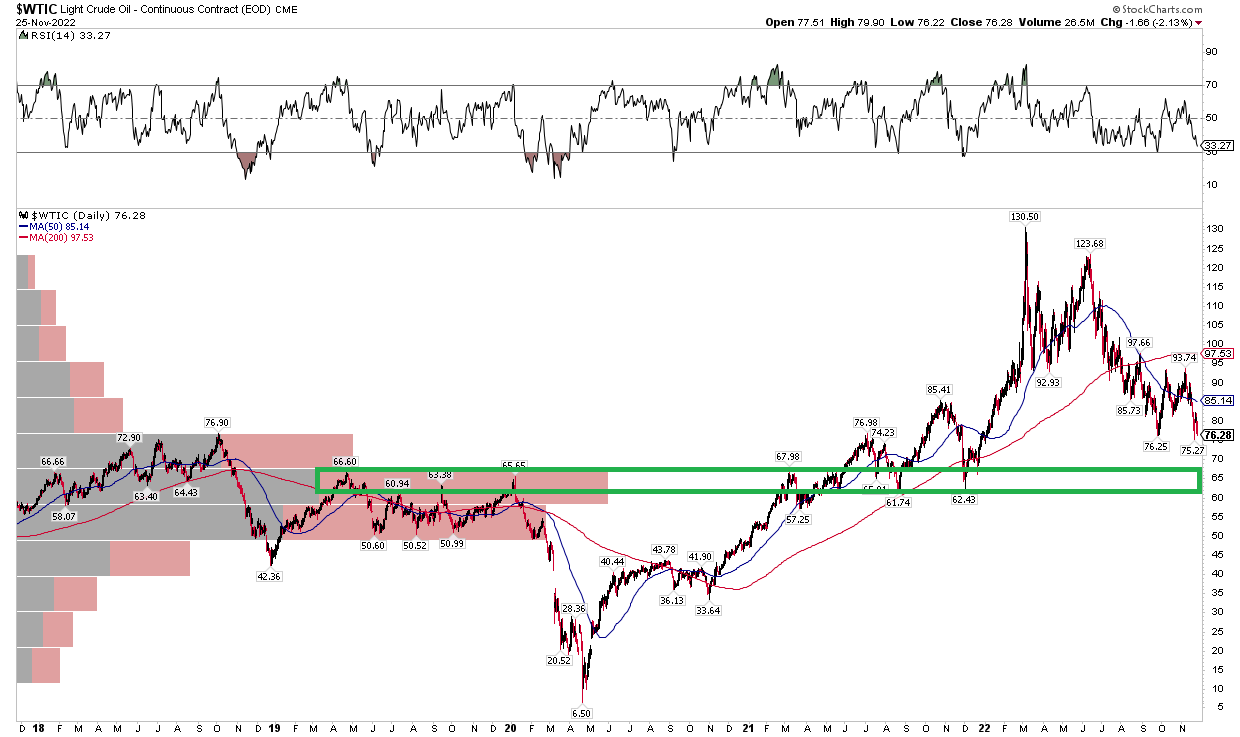

West Texas Intermediate crude oil ended last week at its lowest closing price since Jan. 3. Likewise, wholesale gasoline futures settled at the lowest weekly level dating back to the first month of 2022. Oil is now modestly negative from a year ago even with four-decade-high inflation rates and ongoing turmoil following Russia’s invasion of Ukraine.

Oil Futures: Down 3% Year-on-Year

Source: TradingView

Let’s home in on where oil might go from here. Is there much more room to the downside? If so, where’s a good spot to start nibbling long again?

I see important support in the $62 to $66 range. Notice in the chart that WTI has significant volume by price in that zone. That is also where the top end of WTI’s 2019 through early 2020 range highs were seen. Finally, there were a pair of pullbacks to the low $60s last year—the presumption is that that area attracted buyers then, and it will do so once more.

Eyeing WTI Support in the Low to Mid-$60s

Source: StockCharts.com

The bearish technical case for oil is that its long-term 200-day moving average is now rolling over and the shorter-term 50-day moving average is decidedly negatively sloped. After failing to notch a new high back in the second quarter, momentum has been on the side of the bears. A failure at climbing above the mid-$90s is another pain point. If we see a bounce in the low to mid-$60s, expect some resistance near $76.

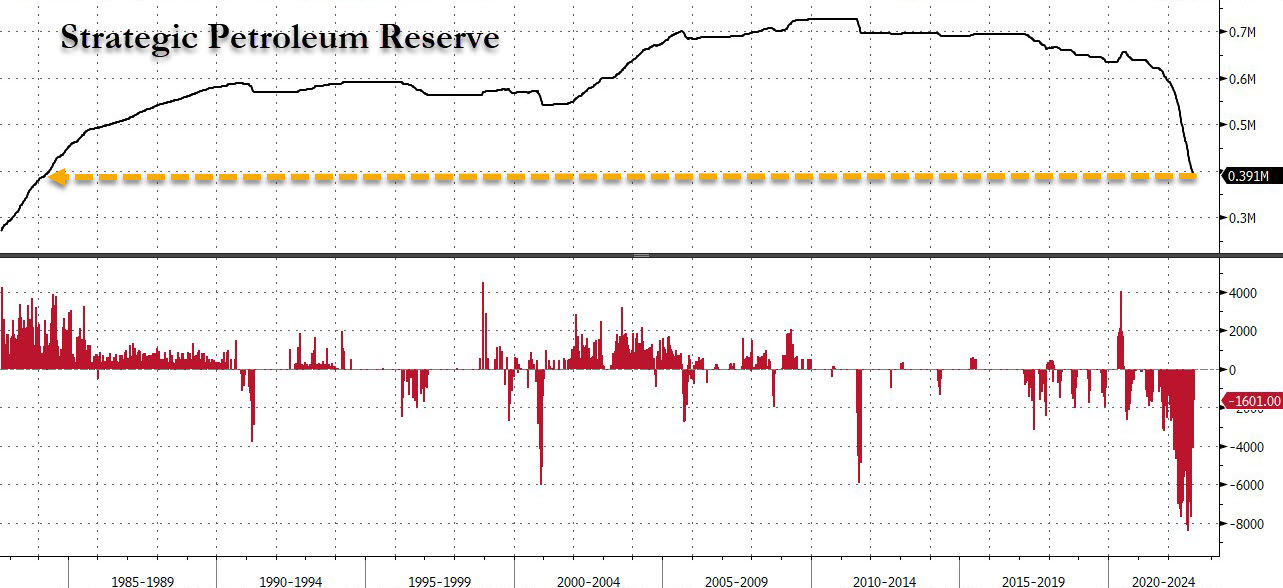

Fundamental support could come from a reopening in China or even the U.S. administration seeking to take advantage of lower prices by refilling the Strategic Petroleum Reserve which is the most depleted since March of 1984.

Bullish Catalyst: Refilling the SPR

Source: ZeroHedge, Bloomberg

The Bottom Line

I see further downside ahead for WTI oil prices. The key commodity settled at a fresh weekly closing price dating back to January on Black Friday and is now negative on an annual basis. Look for support in the low to mid-$60s.

Disclaimer: Mike Zaccardi does not own any of the securities mentioned in this article.