f the new global export restrictions on AI/GPU chips go into full effect, it is more likely that software stocks will gain a greater investor spotlight. After all, software-based companies don’t rely on delicate supply chains that overarching policies may disrupt.

However, some software stocks are better suited to receive investor attention, as they, too, are carried by the AI boom. Bank of America (NYSE:BAC) analysts’ latest note emphasized the aspect of “the unfolding Agentic AI wave, making the case that “inflecting enterprise IT spending and sustained migration to the cloud is unlikely to be fully priced in.”

And if stock prices are not fully priced in, they have the potential to give investors healthy returns. These three software stocks fit the bill.

Datadog

When we first covered this cloud-based analytics and monitoring platform in November 2023, Datadog Inc (NASDAQ:DDOG) stock was priced at $99.81 per share. A year later, in November 2024, it went up to $130.54, as it was recommended for value investors, and is now priced at $138.57 per share.

Datadog’s platform is all about unifying data observability so it can be “used by everyone, deployed everywhere.” Such integration includes traditional infrastructure monitoring and adds an AI-powered layer in the form of anomaly detection, proactive alerts, natural language querying, and root cause analysis.

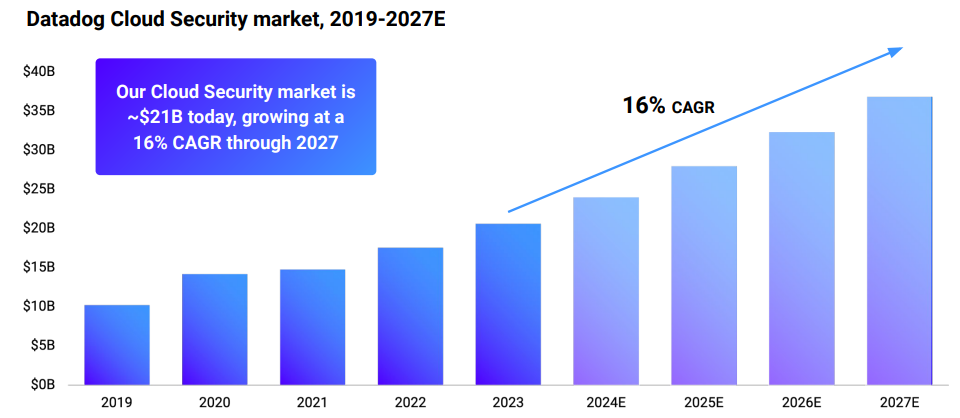

The company estimates enterprises are still in the early stages of spending for their network/cloud-spending needs. Although DDOG stock gained 236% since the end of January 2020, this leaves room for further shares appreciation.

In the latest reported earnings in November, for Q3 2024, Datadog reported a 26% revenue increase year-over-year to $690 million while operating cash flow turned $229 million. Datadog forecasted up to $2.66 billion revenue for full-year 2024, with a net income per share at $1.75 – $1.77 range.

On February 11th, Datadog scheduled its subsequent earnings, with an estimated earnings per share (EPS) at $0.1 vs the $0.17 EPS reported in the year-ago quarter. According to WSJ forecasting data, the average DDOG price target is $162.64 vs the current price of $138.57 per share.

HubSpot

Another software-as-a-service (SaaS) company, HubSpot Inc (NYSE:HUBS), uses AI to provide clients tools for marketing, sales, and customer service. This includes sales pipelines, automated marketing campaigns, and deploying a ready-to-go customer bot service.

Just like Datadog, the company counts on an easy-to-use and unified platform. Consisting of various “hubs,” from marketing and sales to content and commerce, makes pushing profitable ideas and products easier.

HUBS stock gained 24% value over the last year, now priced at $703.82 per share. In Q3 2024 investor presentation, HubSpot reported 23% year-over-year revenue growth to $2.5 billion. The company estimates its market penetration around 10%, going from TAM of $76 billion in 2024 to $128 billion by 2029.

For future growth, HubSpot is counting on its Breeze AI agents to further automate all aspects of business expansion for clients and their content relationship management (CRM).

Most recently, on January 6th, HubSpot completed the acquisition of Frame AI. The platform will integrate with Breeze to provide conversation in natural language. Compared to the current HUBS price of $704.25, the average price target from WSJ is $750.54 per share.

ServiceNow

ServiceNow Inc (NYSE:NOW) uses AI agents to automate business workflows on top of existing solutions to scale workflow management in the cloud. Using the ServiceNow platform, businesses can customize their own AI agents suitable for their niche and deploy them 24/7 to solve tasks.

In the latest Q3 2024 financial report, ServiceNow grew its SaaS subscription revenue by 23% year-over-year to $2.71 billion. This is consistent with quarterly yoy growths throughout 2023 and 2024.

Likewise, the company keeps its subscription renewal rate high, at 98% – 99%. Over the last year, NOW stock grew by 41% to the current price of $1,023.17 per share. ServiceNow is scheduled to release its following earnings report on January 29th, with an EPS forecast of $1.77 vs the EPS of $1.12 in the year-ago quarter.

Per the WSJ forecast, the average NOW price target is $1,118.63 per share. Considering that NOW stock is down 8.5% over the last month, this might be the correct exposure entry.

***

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.