Shares of Nu Holdings Ltd. (NYSE:NU) have been on fire over the past year. The stock has consistently posted higher highs, racing ahead of its exponential moving averages across multiple timeframes. However, with the the company's meteoric rise, stellar fundamentals, promising outlook and strong technical indicators suggest otherwise.

Nu Bank, through its parent company, has quickly become one of the fastest-growing digital banking platforms, serving north of 100 million customers. It generates most of its business from Brazil, with significant contributions from Colombia and Mexico. The company already controls roughly 50% of the Brazilian market, but still has an extraordinary runway ahead. Moreover, its foray into the fast-growing markets of Colombia and Mexico is poised to significantly boost its revenue in the coming years.

Additionally, it delivers a comprehensive suite of financial products, covering everything from credit cards to personal loans and insurance, accessible through its mobile-first interface. Adding to its appeal are low costs, transparency and a customer-first strategy. Unsurprisingly, Nu Holdings has caught the eye of legendary investors like Warren Buffett (Trades, Portfolio). The stock currently comprises around 0.50% of his massive $280 billion equity portfolio.

Hence, there's a lot to like about the company as we delve further into its compelling growth story. Based on my analysis, the stock has double-digit upside potential from its current price before it enters correction territory.

Remarkable growth in operations and platform expansionAs mentioned previously, Nu Bank has grown significantly over the past several years. Its total revenue has surged from $327.20 million in 2019 to a whopping $3.70 billion last year. The impact is perhaps more pronounced in its net income, which swung from a $92.50 million loss to an impressive $1.03 billion profit last year. These remarkable results stem from a robust increase in customer numbers and substantial improvements across key performance indicators.

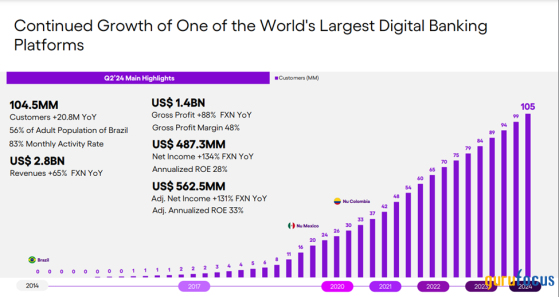

Source: Nu Holdings' second-quarter earnings deck

The snapshot from NU Holding's second-quarter earnings deck underscores its stellar expansion, reaching 104.50 million customers, up by 20.80 million on a year-over-year basis. Moreover, the platform serves 56% of Brazil's adult population, with a remarkable 83% monthly activity rate. Since 2014, its customer base has grown continuously, solidifying its market positioning while rapidly scaling across crucial Latin American markets.

Recently, operating results have been exceptionally promising, with the company consistently surpassing top-line expectations over the past five quarters. Though the same cannot be said about its bottom-line performance, with just two beats, the latest results were notably encouraging as it posted a one-cent earnings beat.

Zooming in closer, Nu posted revenue of $2.85 billion for the quarter, blowing past consensus estimates of $2.81 billion. Additionally, the company reported $563 million in adjusted net income while adding 5.20 million new customers. One of the highlights from the quarter was its net interest income, which surged upwards of 77%, reaching a record high of $1.70 billion due to healthy growth in its credit card and lending portfolios. Gross profit reached a new quarterly high of $1.40 billion, with 88% year-over-year growth translating into a stellar 48% profit margin.

Further, if we look at Nu's financial breakdown for 2020 and 2023, we see a stark increase in the bank's net interest income, which grew from $167.80 million (46.60% of revenue) to $4.40 billion (78.20% of revenue).

This rapid increase is linked to the heightened interest rates in Brazil, which added significantly to the profitability of its credit and lending operations. The chart below shows a sharp increase in interest rates over the past three years, which added immensely to the bank's top and bottom-line expansion.

Source: Focus Economics

Moreover, as we look ahead, interest rates in Brazil are likely to remain elevated, with the benchmark Selic rate expected to hit the 10% mark by December of next year, a 25 basis point increase from the previously expected 9.75%.

Technical indicators point to further gains aheadNu Holdings' stock, as discussed earlier, has gained ground over the past 12 months. Further, shares have jumped over 73% year to date, dwarfing the S&P 500's 18% gain.

The chart below illustrates the stock's momentum over the past year through exponential moving averages and closing prices. EMAs are a variation of moving averages that give more weight to recent prices. As we can see, the 12-day EMA has hovered above the longer-term EMAs (26-day, 50-day and 200-day) for most of the period, pointing to bullish momentum. On top of that, the stock has consistently closed above its short- and long-term EMAs, signaling robust upward momentum.

Source: Author created based on historical data

The Moving Average Convergence Divergence and Signal Line chart for Nu confirm the bullishness. The MACD line helps identify short-term momentum in a particular stock, while the Signal Line helps identify buying opportunities.

Source: Author created based on historical data

The chart shows a downward movement where the MACD fell below the Signal line. However, we've recently seen the MACD's sharp upward recovery, crossing above the Signal line by a sizeable margin, indicating a bullish reversal. As expected, the relative strength index surpassed the overbought threshold of 70, pointing to limited upside potential.

Also, the stock appears to be moderately undervalued with GF Value pegged at $16.82.

TakeawayNu Holdings has been a juggernaut in the fintech realm, establishing itself as a dominant force in the digital banking landscape. Its rapid expansion across Brazil, Mexico and Colombia has driven a stellar increase in its customer base and fundamentals. Moreover, recent results have shown that the bank will continue to grow rapidly, with multiple catalysts in motion.

Looking ahead, a key focus will be on expanding its presence in high-growth markets while continuing to capitalize on the sustained high interestrate environment in Brazil. Technically, the stock's strong momentum, underscored by its consistent performance above key EMAs and a bullish MACD reversal, suggests some upside remains in its stock.

Despite the recent surge, however, the stock is moderately undervalued with a GF Value of $16.82 indicating further upside potential. Given these factors, Nu Holdings is well positioned to continue its upward ascent, offering a compelling investment opportunity for those seeking exposure to the rapidly evolving space.

This content was originally published on Gurufocus.com