The last month of the year kicked off with a bang but not in the way that many of us would have hoped.

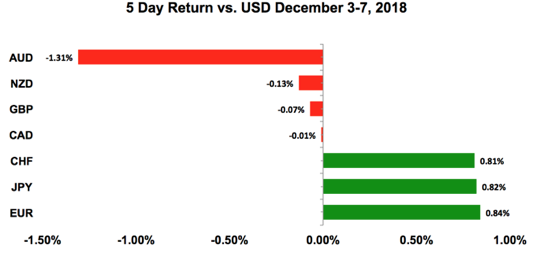

Equity markets sold off across the globe and in the world of currencies, the US and Australian dollars were the worst performers. A convergence of negative news pressed both currencies lower but most of the concerns centered on China, which is why AUD fell the hardest. The week started with optimism after President Trump and President Xi reached a trade truce, but things went south quickly when the US arrested Huawei’s CFO. Stocks crashed and President Trump tried to stem the slide by saying he had no knowledge of the arrest and that trade talks with China are going very well. Investors are sceptical and in a headline-driven trading environment, they are taking everything at face value. As we muddle through the conflicting headlines, what is clear is that uncertainty will remain in the weeks ahead as investors wait to see if the Huawei arrest really affects US-China trade talks. There’s also a big Brexit vote next week and the ECB meeting. Between these events and a continued focus on China, December will remain a jittery month for currencies.

US Dollar

Data Review

- US ISM Manufacturing 59.3 vs 57.5 Expected

- Construction Spending -0.1% vs 0.4% Expected

- ADP Employment Change 179K vs 195k Expected

- Challenger Job Cuts 51.5% vs 153.6% Previous

- Non-manufacturing ISM 60.7 vs 59 Expected

- Factory Orders -2.1% vs 2% Expected

- Durable Goods Orders -4.3% vs -2.4% Expected

- Nonfarm Payrolls 155k vs 198K Expected

- Unemployment Rate 3.7% vs 3.7% Expected

- Average Hourly Earnings 0.2% vs 0.3% Expected

- University of Michigan Consumer Sentiment Index 97.5 vs 97

Data Preview

- US Producer Price Index – Potential for downside surprise because oil prices fell sharply in Nov, but forecasts are already low

- US Consumer Price Index – Potential for downside surprise given sharply lower gas prices but will have to see PPI fares

- US Retail Sales – Potential for upside surprise as gas prices declined but Redbook reported an increase in spending in Nov

Key Levels

- Support 112.00

- Resistance 113.50

US Dollar is in Trouble

The primary theme in the FX market right now is risk aversion, which can be both positive and negative for the US dollar. When markets sell off globally, money usually flows into the US dollar and the Japanese Yen. With stocks poised for further losses, demand for the yen has been and should remain strong. However, demand for the US dollar depends on what is happening in the other currency’s home country.

The latest US jobs report is proof that despite the pickup in manufacturing and service sector activity the momentum in the US economy is slowing. Only 155K jobs were created in November versus a forecast for a 198K increase. Payroll growth in October was also revised slightly lower but the concern is wages. Not only did average hourly earnings growth fall short of expectations, rising only 0.2% compared to a forecast of 0.3% but the prior month’s reading was also revised lower to 0.1%.

This means that companies are hiring fewer workers, paying them less than expected and allowing them to bill fewer houses. Considering that the labour market has been the main engine for US growth, this month’s report has some major red flags. Another big problem is that hiring intentions will suffer from the past 2 months of market volatility. Fearing the possibility of further losses in share values, businesses will become more conservative about hiring which could lead to a downward spiral for the US economy and the rest of the world.

While the new date for Fed Chair Powell’s Congressional testimony has not been set, the jobs report, the sell-off in US stocks and decline in Treasury yields tell us that investors expect the Fed to be less hawkish and USDJPY to fall further. In the lead up to the last FOMC meeting of 2018, next week’s inflation and retail sales report will be just as important as NFP but keep an eye on US-China headlines as they will also influence risk appetite. USDJPY is at risk of testing 112 and possibly moving down to 111.50 if CPI or retail sales surprise to the downside.

Euro

Data Review

- EZ PMI Manufacturing Index revised up to 51.8 from 51.5

- EZ PPI 0.8% vs 0.5% Expected

- EZ PMI Services Index revised up to 53.4 from 53.1

- EZ PMI Composite index revised up to 52.7 from 52.4

- EZ Retail Sales 0.3% vs 0.2% Expected

- German Factory Orders 0.3% vs -0.4% Expected

- German industrial Production -0.5% vs 0.3% Expected

Data Preview

- German Trade Balance – Potential for downside surprise given lower business confidence and manufacturing PMI

- German ZEW Survey - Market stability and positive Italian headlines could bolster confidence

- Eurozone Industrial Production?

- Final German CPI – Revisions are hard to predict but changes can be market moving

- EZ December PMI – Will have to see how the ZEW survey and industrial production reports

Key Levels

- Support 1.1300

- Resistance 1.1450

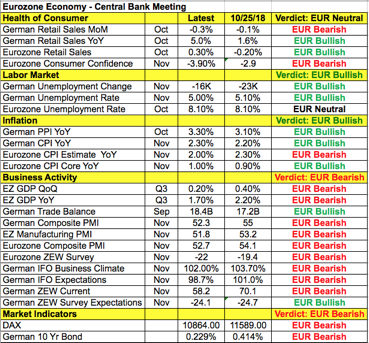

ECB Could Threaten EURO Recovery

Euro is prime for a breakout and this week’s European Central Bank monetary policy announcement could trigger just that. Euro has held up well in the face of risk aversion because for the most part, no news is good news for the currency. The ECB is widely expected to end asset purchases this month but between weaker global growth, trade uncertainty and lower oil prices, the central bank could lower their growth and inflation forecasts. Taking a look at the table below, spending and labor market activity has recovered slightly but there’s also been widespread deterioration in business activity. ECB officials have been mostly dovish, stressing the need keep policy accommodative. So if they combine this view with lower economic forecasts, EURUSD could find its way back below 1.13. However if no changes are made, EURUSD which has already been trending higher will break to the upside for a move above 1.15.

British Pound

Data Review

- UK PMI Manufacturing 53.1 vs 51.7 Expected

- UK PMI Construction 53.4 vs 52.5 Expected

- UK PMI Services 50.4 vs 52.5 Expected

- UK PMI Composite 50.7 vs 52.1 Expected

Data Preview

- UK Trade Balance, Industrial Production and Monthly GDP – Potential for upside surprise given Stronger UK PMI Manufacturing activity

- UK Employment report - Mild rebound in manufacturing employment

Key Levels

- Support 1.2700

- Resistance 1.3000

3 Ways UK Parliament Deal Could Play Out for GBP

The focus will turn to European currencies this week with what could be the most important Brexit vote this year happening on Tuesday. We’ll start with sterling because it will have the biggest move next week. Prime Minister May has suggested that Brexit lives or dies by the Parliament’s vote on December 11th. She said the choices are her deal, no deal or no Brexit (though the first step to the latter will be a rejection of her proposal). The European Union who went along with the UK’s plans to exit the EU begrudgingly said this is the only deal on the table. Many feel that the vote will fail because the DUP and a group of Euroskeptic Tory members oppose the agreement. The question then becomes the margin. If they lose by 100 or more votes, it will be an all-out defeat that will cause chaos for sterling, the UK economy and could cost PM May her job. Almost immediately there will be calls for an election and/or a second Brexit referendum. The risk of either happening will send GBP tumbling lower in a move that could take it below 1.25. If the vote is rejected by 50 or less members May could use this as an excuse to go back to the EU for changes and return to Parliament for another vote. This scenario would still be negative for GBP but could limit losses to 1.26. In the unlikely scenario that she manages to win over Parliament and push her deal through, short covering will take GBPUSD above 1.30 easily. On the eve of this key vote, the European Court of Justice will decide whether Britain could reverse Brexit. If they rule yes, it would be a blow to May’s Brexit push and more importantly add fuel to the call for a second referendum. Although Brexit will dominate sterling flows, UK trade and labour market

AUD, NZD, CAD

Data Review

Australia

- RBA leaves rates unchanged, removed reference to weak wage growth

- PMI Manufacturing 51.3 vs 58.3 Previous

- ANZ Job Ads -0.3% vs 0.3% Previous

- Building Approvals -1.5% vs -1.5% Expected

- Current Account Balance -10.7b vs -10.2b Expected

- PMI Services 55.1 vs 51.1 Previous

- Q3 GDP QoQ 0.3% vs 0.6% Expected

- Trade Balance A$2316m vs A$3000m Expected

- Retail Sales 0.3% vs 0.3% Expected

- PMI Construction 44.5 vs 46.4

New Zealand

- Terms of Trade Q3 -0.3% vs 0% Expected

- ANZ Jobs Ads 0.5% vs 1.4% Previous

Canada

- Bank of Canada leaves rates unchanged but says there’s room for non-inflationary growth

- Trade Balance -1.17B vs -0.73B Expected

- IVEY PMI 57.2 vs 61.8 Previous

- Employment Change 94.1K vs 10K Expected

- Unemployment Rate 5.6% vs 5.8% Expected

Data Preview

Australia

- Chinese Retail Sales, Industrial Production – Chinese data can be very market moving but difficult to predict

New Zealand

- Half Year Fiscal Update – Potentially market moving but hard to predict

Canada

- No Data

Key Levels

- Support AUD .7150 NZD .6800 CAD 1.3100

- Resistance AUD .7300 NZD .6900 CAD 1.3400

AUD Hit from All Slides – Data & Risk Aversion

The Australian dollar was hit from all sides last week in a move that turned A$ into the worst performing currency. Aside from the obvious impact of US-China trade tensions on Australia, data has been mixed. Although service sector activity and retail sales improved, manufacturing activity, building approvals, the trade balance and Q3 GDP deteriorated significantly. Third quarter growth was apparently the weakest in 2.5 years. The Reserve Bank of Australia was unfazed as they left interest rates unchanged at 1.5% and reiterated their steady and neutral policy stance. According to Deputy Governor Debelle, the next move in interest rates should be up though a change is some ways off. With no major economic reports this upcoming week, risk appetite will be the main driver of AUD flows. There’s been a recent rebound in iron ore, gold and copper prices that could help stem the slide in the currency. The New Zealand dollar also fell last week but its losses were moderate in comparison to AUD, which is why AUDNZD dropped to its lowest level since July 2017. New Zealand data wasn’t great either as the terms of trade, job ads, house prices and commodity prices weakened. With only a business PMI report on the calendar, we continue to expect more exaggerated moves in AUD vs NZD.

CAD Bottom Alert after Strong Jobs Report and OPEC Deal

While the Bank of Canada was less hawkish at the latest monetary policy meeting, Canada’s economy is on fire with a record-breaking 94.1K jobs created in the month of November. This is the strongest single month of job growth since Statistics Canada started keeping records in 1976. As a result of this blockbuster increase, the unemployment rate dropped to 5.6%, a record as well. Almost all the jobs were full time with Alberta – the oil-producing hub adding 23,700 workers despite falling oil prices. Bank of Canada Governor Stephen Poloz said there’s more room for non-inflationary growth and rates hikes will be data dependent, but this employment report screams of the need for more tightening. OPEC also reached an agreement to cut production by 1.2 million barrels a day which should be enough to halt the slide and shift the momentum in crude prices. $50 was really the uncle point for OPEC nations who pressed Russia to come onboard despite earlier resistance. With no major Canadian economic reports scheduled for release next week, between the OPEC deal, the prospect of a further recovery in oil, weaker US jobs data and stronger Canadian employment, we have strong reasons to believe that the Canadian dollar hit a bottom.