By Kathy Lien, Managing Director of FX Strategy for BK Asset Management.

Taking a look at the day-to-day change in the U.S. dollar, it may seem that there was very little consistency in the performance of the greenback ahead of Wednesday’s monetary policy announcement. However if we isolate the price action to the U.S. session, the dollar moved higher against most of the major currencies. Tuesday morning’s U.S. economic reports were mostly better than expected with consumer confidence beating expectations and new-home sales rising sharply. Service-sector activity slowed according to Markit Economics and house prices dropped slightly but that was not enough to deter investors from buying dollars pre-FOMC. During a time when central banks around the world are actively talking about and planning for easing, the Federal Reserve’s hawkish bias will shine a bright light on the dollar. Many feared that the Fed would give up on the idea of tightening after Brexit but as we have seen, U.S. markets and the U.S. economy have proven to be fairly resilient.

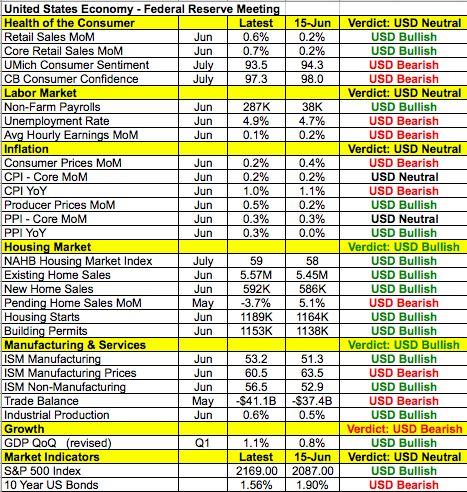

The following table shows more improvements than deterioration in the U.S. economy since the June Fed meeting. Retail sales increased, nonfarm payrolls rebounded strongly with job growth rising 287k in June, the housing market is chugging along, manufacturing- and service-sector activity are on the rise. U.S. stocks also hit record highs while plunging U.S. yields provide support to the economy. The currency has strengthened across the board but the strongest gains were against the British pound. We’ve also heard from a number of FOMC voters since Brexit and they still seemed to support the idea of tightening. The FOMC statement generally reflects the views of the Fed leadership (Yellen, Fischer and Dudley) and it is likely to recognize the improvements in the economy since June. Of course, there will still be notes of caution and everything will be “data dependent”, but we expect the main takeaway to be that a 2016 rate hike remains on the table. The Fed needs to move forward with policy normalization and it can’t wait around for the U.K. to invoke Article 50, which could take up to 2 years. So we expect the dollar to trade higher into and after FOMC. There won’t be fireworks but there could be some quick trading opportunities.

Meanwhile, the Japanese government continues to create confusion and division in the financial markets. Overnight, USD/JPY crumbled on reports that Japan’s fiscal stimulus package could be much smaller than expected. While the package could be 3 Trillion yen more than initially planned, it is believed that only 2 Trillion will be allocated to the supplementary budget. This spooked investors out of their USD/JPY trades and drove the currency below 104. Yet the currency pair recovered sharply during the U.S. session rising within arm's reach of 105.00. We don’t know how aggressive the Japanese government will be, but we strongly believe that it will combine fiscal with monetary stimulus on Friday. The prospect of easing makes the yen a sell on rallies pre-BoJ but trades should be squared ahead of the rate decision and only reestablished after the dust is clear.

Tuesday's best-performing currencies were the Australian and New Zealand dollars. There was no specific news to trigger to breakouts but both currencies have been quietly consolidating after last Tuesday’s breakdown. While the Reserve Banks of Australia and New Zealand recently signaled plans to ease, the massive yield advantage of AUD and NZD may be keeping these currencies bid. Their resilience is particularly surprising in the context of yen strength. New Zealand’s trade surplus shrank in June with export and import growth slowing; but the impact on the currency was nominal. Australian consumer prices were scheduled for release Tuesday evening and the recent increase in inflation expectations pointed to a hotter number. According to the RBA minutes, however, “inflation was still expected to remain low for some time.” USD/CAD raced to a 3-month high of 1.3244 but with oil prices beginning to stabilize and the rally in the currency pair becoming overextended, a correction seems likely. Eight days have past without a pullback in USD/CAD, the longest since January. No Canadian economic reports are scheduled for release on Wednesday but weekly oil inventories are on tap.

Sterling and euro ended the day virtually unchanged against the greenback. An increase in mortgage approvals in the U.K. failed to help the currency after MPC member Weale said policy action in August is unlikely to boost the economy before next year. Weale is typically one of the more hawkish members and his cautiousness worries investors. Second-quarter GDP numbers are scheduled for release Wednesday -- growth should have received a boost from stronger retail sales and trade activity between April and June, but investors may discount the report as it fails to capture life after Brexit. The euro on the other hand was unable to find a bid after Monday’s positive German IFO report. The currency pair pushed above 1.10 briefly only to end below that level for the third day in a row. The pair is currently stuck in a sideways range pattern between $1.1185 and $1.0910. Volume and price action have been somewhat muted as traders gear up for Wednesday's FOMC rate decision. There are no Eurozone economic reports Wednesday but action in the pair is expected to pick up at the end of the week as a slew of data is revealed for Germany and the Eurozone.