US recession risk appeared to ease in the wake of last week’s encouraging updates for retail sales and jobless claims.

Will the better-than-expected numbers delay the widely expected rate cut that markets are pricing in for the Federal Reserve’s Sep. 18 policy meeting?

Judging by current market conditions, along with CapitalSpectator.com’s proprietary modeling, there’s a persuasive case that the start of a softer policy regime is still on track to begin next month. Let’s start with Fed funds futures, which are pricing in a virtual certainty that the central bank will reduce its target rate on Sep. 18.

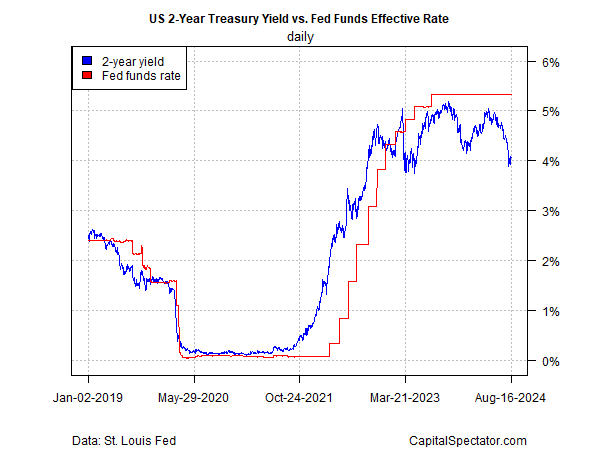

The policy-sensitive 2-year Treasury yield is also firmly in the camp of projecting a rate cut. At Friday’s close, the 2-year yield traded down to 4.06% (Aug. 16).

That level is more than one percentage point below the current 5.25%-to-5.50% Fed funds target rate – the biggest spread in more than a year that’s a defacto rate-cut forecast via the crowd’s collective wisdom.

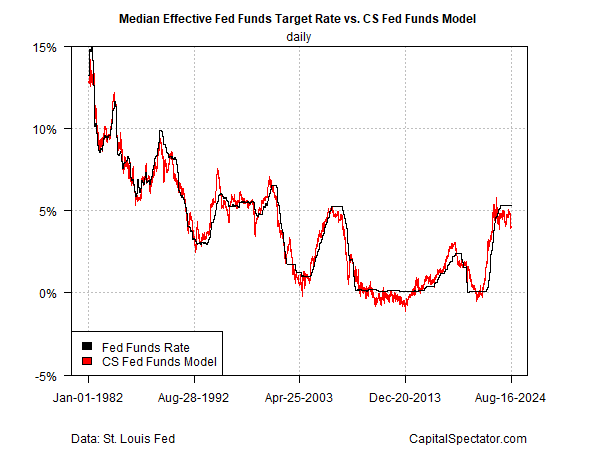

For another perspective, consider a model monitored by CapitalSpectator.com that uses inflation, the Treasury yield curve, the US economy and other factors to estimate the optimal Fed funds rate in real-time. The key takeaway: the policy rate continues to look overdue for a cut, as shown in the chart below.

Nothing’s certain, of course, and so it’s prudent to consider what might persuade the Fed to postpone a cut at next month’s meeting. Robust incoming economic data and/or hotter-than-expected inflation numbers are on the shortlist.

Recent history downplays the odds that the economic reports over the next four weeks will paint a materially different profile than the one we’ve seen in recent months. Modest but slowing growth, along with ongoing disinflation, in sum, remains the baseline forecast.

Meanwhile, markets will be keenly focused on commentary flowing from the Fed’s Jackson Hole Symposium that starts on Thursday (Aug. 22). The highlight: Fed Chairman Jerome Powell’s speech on Friday (Aug. 23) at 10:00 am Eastern.

“The Fed, we think, is likely to signal at Jackson Hole that a cut is likely at the next meeting, assuming that inflation progress holds,” predicts Mark Cabana, who heads US rates strategy at Bank of America (NYSE:BAC). Ultimately, the incoming economic data will be a crucial factor, he notes. “So we don’t think that the Fed will close the door on the possibility of doing larger cuts if it seems necessary — but it likely won’t do much to signal that that’s going to happen.”