Nvidia Corp. (NASDAQ:NVDA) has been leading the headlines after its first-quarter 2025 results surpassed the Street's expectations. The performance includes a massive 262% year-over-year revenue boost and 18% sequential growth. With that, the company exceeded its guidance by $1.50 billion. This is alongside a 462% jump in non-GAAP earnings per share. These numbers indicate Nvidia's lead in artificial intelligence-driven markets like data centers, reflecting 87% of its top line.

There has been a surge in demand for Nvidia's HGX platform, which powers AI applications like large language models. While there is a supply constraint for the company's Hopper GPU platform, it has been shown that partnerships with manufacturers such as Taiwan Semiconductor (NYSE:TSM) can push it to scale up production and continue beating analysts' expectations.

For the second quarter, management has guided for approximately $28 billion in revenue, continuing strong growth across all segments. This is most aggressively happening within AI and data centers. For Nvidia, market forecasts look conservative compared to its recent performance. This is due to the fast-paced adoption of AI technologies. Moreover, the operational leverage and improving margins hint at earnings per share increases and revenue growth boosts.

Lastly, Nvidia will benefit from increased AI spending. Research points to a 50% increase in data center capital expenditures for AI in 2025. Analysts have underappreciated the company's potential and remain surprised at its dominance in AI. One can expect it will beat earnings again in the second quarter, setting the stock up for further upside.

Oracle (NYSE:ORCL) Cloud leverages Nvidia's powerful GPUs to accelerate AI, LLMs and digital twins for enterprise innovationMoreover, Oracle Cloud Infrastructurealso known as OCIrecently expanded the availability of new compute instances accelerated by the newest Nvidia GPUs. These new compute instances include the latest Nvidia L40S GPU and a corresponding virtual machines that are set to be released soon. All these enhancements to Oracle's (NYSE:ORCL) offerings indicate or prove Nvidia's leading position in the computing power market in demand for generative AI, LLMs and digital twins. Hence, these technologies have become crucial for enterprises to target improvements in operational edge and product innovations.

Further, Nvidia's GPUs represent the apex in performance for a wide range of workload applications, from AI training and inference to advanced graphics and video processing. The L40S GPU derived multi-workload acceleration from bump into breakthrough, making it perfect for enterprises looking to use generative AI and other advanced technologies. Hence, sharp capabilities coupled with the Oracle infrastructure and Nvidia's GPUs become a strong value proposition.

Nvidia-powered OCI instances revolutionize enterprise AI with L40S GPUs, driving demand and boosting growthOCI's new instances accelerated by Nvidia GPUs are progressive within the enterprise market. These instances include the Nvidia L40S GPU, which excels in various workloads. The L40S offers significant improvements in AI training and inference that are vital for enterprises deploying large language models and generative AI. The L40S GPU also excels in graphics and media acceleration, which is ideal for digital twin applications.

Additionally, enterprises may leverage these capabilities to design, simulate and optimize products and processes before production. Further, OCI's bare-metal compute architecture, featuring the L40S, ensures high throughput and low latency for AI and machine learning workloads. The use of Nvidia BlueField-3 DPUs further enhances server efficiency. With that, OCI's supercluster delivers ultra-high performance with up to 3,840 GPUs.

Certainly, Nvidia's collaboration with OCI marks its strategic lead in the cloud computing space. This partnership will derive solid revenue growth from enterprises accessing powerful computing resources on demand. It also highlights Nvidia's focus on advancing AI and other transformative technologies.

Data Center revenue soarsIn the first quarter, Nvidia's Data Center revenue soared 23% sequentially to $22.6 billion. This massive growth indicates high demand for AI and cloud services in the data center segment. Companies increasingly adopt AI solutions with Nvidia's GPUs, which are essential for AI workloads. Cloud providers considerably rely on Nvidia's tech to expand cloud infrastructures. As a result, Data Center revenue surged 427% year over year, marking its market dominance.

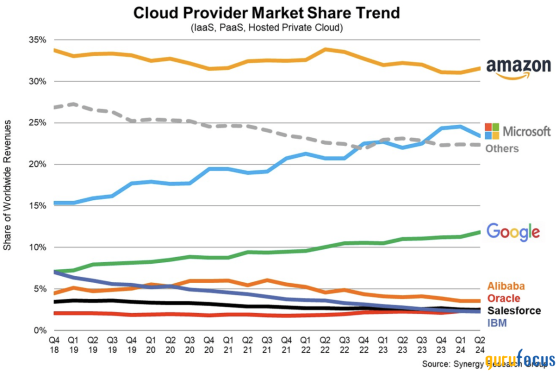

Moreover, the company leads in AI hardware with the CUDA platform. Nvidia is forging a competitive AI and deep learning software ecosystem, even as it collaborates deeply and sometimes opaquely with the major cloud providers, such as Amazon's (NASDAQ:AMZN) AWS, Microsoft (NASDAQ:MSFT) Azure and Alphabet (NASDAQ:GOOGL)'s (NASDAQ:GOOG) Google Cloud. These alliances enhance Nvidia's reach and further drive its data center revenue. The platform supports AI and deep learning, making the company's software ecosystem competitive.

According to tech expert Tharindu Fernando, Nvidia's leadership in AI hardware and strategic partnerships, particularly with major cloud providers like AWS and Azure, position it at the center of the AI revolution, with continuous innovation driving further growth. Nvidia's market share in data centers is also growing, outpacing competitors. Therefore, its technology is in high demand, and prospects for data centers are bright.

Source: Digital Information World

Massive growth potential despite future margin pressuresThe potential of Nvidia remains unmatched in the AI space, with it commanding a top position in supplying the basic technology needed for powering AI infrastructure. Any sophisticated AI models' training and deploymentthe OpenAI ChatGPT includedare now inseparable from the GPUs and APUs enhanced by CUDA software offered by the company.

This strategic lead is further backed by Nvidia's deep ecosystem, making it a large moat that will be hard to cross competitors. Its hold on the AI chip marketNvidia commands an estimated 70% to 95% market share for AI training chipsdemonstrates its products' importance to this fast-growing industry. In addition, Nvidia commands extreme pricing power, which is reflected in its impressive gross margins of about 78%.

While Nvidia's margins have been at all-time highs, there is evidence this degree of profitability cannot be sustained. Over time, competition could chip away at its pricing power and result in a steady downward trend for gross and net income margins. The well over 50% net income margin Nvidia has is extraordinary, but it may contract back down into the 40% to 45% range of more historical notes. While this reduction could hurt the stock price over the long term, this deflation is not likely to occur sharply.

Considering Nvidia's enormous lead and stronghold on the AI market, any decrease in profitability would likely happen gradually, allowing an investor to ride further gains for years to come. To that end, it does not demean the company's long-term potential, even with potential profitability erosion in the far future.

ConclusionNvidia's strategic partnership with Oracle Cloud Infrastructure extends its AI and advanced computing lead. With the GPU-accelerated instances being available on OCI, there is a growing demand for high-performance computing. Further, this collaboration points to the company's role in driving tech advancements across industries. With that, the stock represents a solid buy, given its strong market position and growth potential.

Finally, investors should watch for further developments in Nvidia's GPU offerings. The upcoming H200 and Blackwell GPUs will yield greater performance improvements. These advancements will likely derive continued demand for Nvidia's products within enterprises adopting AI, digital twins and advanced graphics.

This content was originally published on Gurufocus.com